[ad_1]

Many electric vehicle (EV) manufacturers performed well in 2023, even as high interest rates and macro pressures weighed on demand and EV affordability. In addition, market leader Tesla (NASDAQ:TSLA) fought fierce competition and created price wars to increase sales volume. Demand for EVs could increase in 2024 as interest rates are expected to fall. With that in mind, we used TipRanks’ stock comparison tool to place his Nio (New York Stock Exchange:Nio), Tesla, Li Auto (NASDAQ:LI) against each other to find the EV stocks that have the potential to generate the highest returns in 2024, according to Wall Street analysts.

Nio (NYSE:NIO)

Chinese EV maker Nio’s first quarter 2023 results failed to impress investors. Uncertainty surrounding the company’s deliveries, low profit margins, continued cash burn, and continued losses are affecting investor sentiment toward Nio. Intense competition and macro challenges in China’s EV market weighed on the company’s performance in 2023.

On January 1, Nio reported that the number of EV deliveries in December increased by 13.9% year-on-year to 18,012 units. As a result, the company’s vehicle deliveries in the fourth quarter of 2023 reached 50,045 vehicles, an increase of 25% compared to the same period last year.

Going forward, Nio is expected to benefit from a $2.2 billion strategic equity investment from CYVN Holdings, an Abu Dhabi-based investment vehicle. Nio bulls are also optimistic about the company’s upcoming models, including the ET9, which is expected to begin deliveries in the first quarter of 2025.

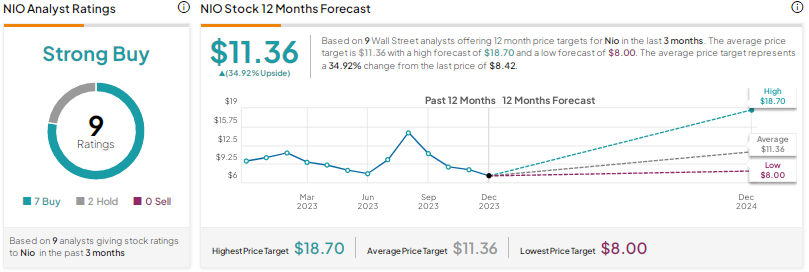

What is the future price of Nio stock?

Morgan Stanley analyst Tim Hsiao said Tuesday that Nio’s better-than-expected monthly and quarterly shipments are a sign of solid demand and business execution. He believes the year-over-year increase in deliveries reflects the company’s growing market presence and customer acceptance.

Although the analyst acknowledges short-term challenges, he expects Nio’s financial investments and product development, particularly battery replacement and advanced driver assistance systems (ADAS), to strengthen its competitive position. Additionally, he expects the upcoming launch of Nio’s sub-brand ALPS to strengthen its growth trajectory.

Nio received a “Strong Buy” consensus rating with 7 buys and 2 holds. Nio’s average price target of $11.36 suggests nearly 35% upside potential. NIO ADRs (American Depositary Receipts) have declined by about 14% over the past year.

Tesla (NASDAQ:TSLA)

Tesla shares have risen 102% over the past year, despite growing concerns about the impact of CEO Elon Musk’s aggressive price cuts on the company’s profits. Additionally, investors are concerned about the high costs associated with the Cybertruck and the uncertainty surrounding the product’s long-delayed acceptance.

Additionally, Tesla faces intense competition from several emerging EV players. The company delivered 484,507 vehicles in the fourth quarter, bringing total deliveries in 2023 to approximately 1.81 million vehicles, exceeding the company’s target of 1.8 million EVs. However, deliveries in the fourth quarter were not strong enough, as Tesla lost the top spot as the top EV manufacturer in the quarter to Chinese automaker BYD (Biddy) (Hong Kong:1211), delivered 526,409 fully electric vehicles during the same period.

Despite this, Tesla maintained its leadership in the battery-powered EV space, surpassing BYD in deliveries for the year.

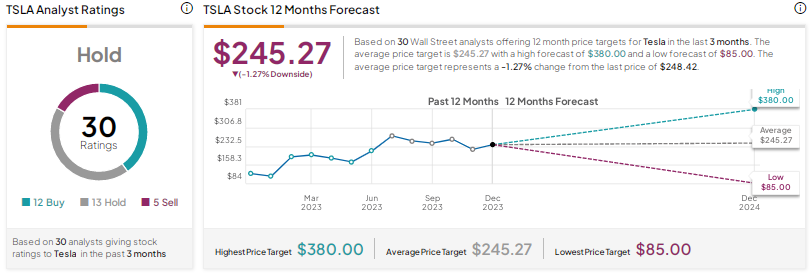

What is the future price of Tesla stock?

Following Tesla’s fourth-quarter delivery report, Goldman Sachs analyst Mark Delaney said that while deliveries reached a record high, they were only slightly ahead of consensus. He said the main discussion is about Tesla’s auto adjustment, as the company offered discounts and incentives in some regions in the fourth quarter to increase sales while raising the price of the Model Y in China. I think it will be about gross profit.

Analysts say investors will also be watching to see how subsidy cuts for certain models in the U.S. and Europe affect sales.

Delaney gave TSLA a Hold rating and reiterated his price target of $235. The analyst remains on the sidelines, believing the stock is well valued at current levels. Additionally, he expects the company to announce additional price cuts.

Overall, Wall Street is on the sidelines on Tesla stock, with a Hold consensus rating based on 12 Buys, 13 Holds, and 5 Sells. TSLA’s average price target of $245.27 suggests the stock is well valued at current levels.

Lee Auto (NASDAQ:LI)

Chinese EV maker Li Auto delivered solid performance in 2023 despite macro pressures and a slower-than-expected recovery in China. The company delivered 50,353 vehicles in December, marking the first time that monthly deliveries exceeded 50,000 vehicles. Furthermore, the company delivered 131,805 vehicles in the fourth quarter, an increase of 185% year-on-year, exceeding its own guidance of 125,000 to 128,000 vehicles.

Despite strong deliveries in the fourth quarter, the launch of MEGA, the company’s first fully battery-powered EV, was slightly postponed to March 1, 2024, with deliveries scheduled to begin in early March. , investors were disappointed. The company had previously indicated that deliveries would begin in late February, after a planned launch in December 2023.

Nevertheless, the company is confident that the Li MEGA will emerge as the preferred model in the above-mentioned 50,000 yuan range of vehicles.

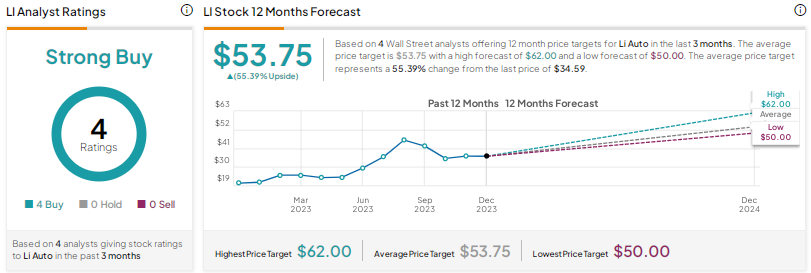

Should you buy, sell or hold Li Automobile stock?

Wall Street is extremely bullish on Li Automobile stock, with a consensus rating of Strong Buy based on 4 unanimous buys. The average price target of $53.75 means there is 55.4% upside potential. Li Auto’s stock price has risen about 70% over the past year.

conclusion

Wall Street is very optimistic about Chinese EV makers Li Auto and Nio, but cautious about Tesla. Li Auto’s strong execution and continued innovation have impressed investors and analysts alike. Even after a solid rally in 2023, analysts expect LI stock to have more upside potential than the other two EV stocks.

disclosure

[ad_2]

Source link