[ad_1]

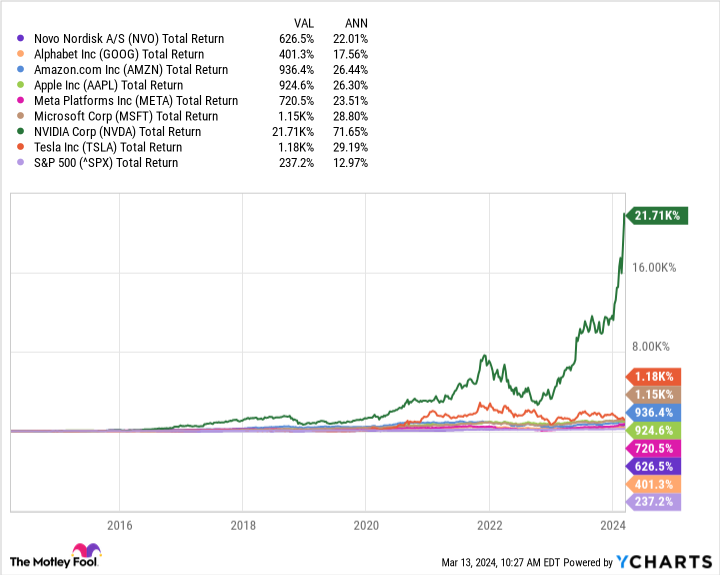

The Magnificent Seven has helped push major U.S. indexes to record highs. This highly regarded group of stocks is one of the most heavily weighted stocks in the world. S&P500 – consists of alphabet, Amazon, apple, meta platform, microsoft, Nvidiaand tesla. He has good reason to invest in all seven companies, which is why they have performed so well in recent years.

But there are some companies outside of this faction that are just as impressive and deserve to be considered on par with the Magnificent Seven. He is one of these companies, but novo nordisk (NYSE:NVO), a pharmaceutical giant based in Denmark. Here’s why this pharmaceutical company is being considered for inclusion in the so-called “Magnificent Eight.”

Long-time leader in diabetes care

Novo Nordisk has been around for decades. Throughout its history, the company has been a leader in the important therapeutic area of diabetes care.

Novo Nordisk has been helping to stop this serious global health crisis through the development of a range of new insulin products and other medicines for people with diabetes. The company’s ability to maintain its lead in this market despite intense competition from various other players is impressive.

As of November 2023, Novo Nordisk held a 33.8% share of the global diabetes market, increasing by approximately 2% year-on-year. The company is still innovating in this area as well. Last year, the company filed regulatory applications for icodec, a potential once-weekly insulin product, in the U.S., Europe and China.

Here’s why this is important: Diabetics who require insulin usually take it daily. The once-a-week option is more convenient and eligible patients will be happy to switch.

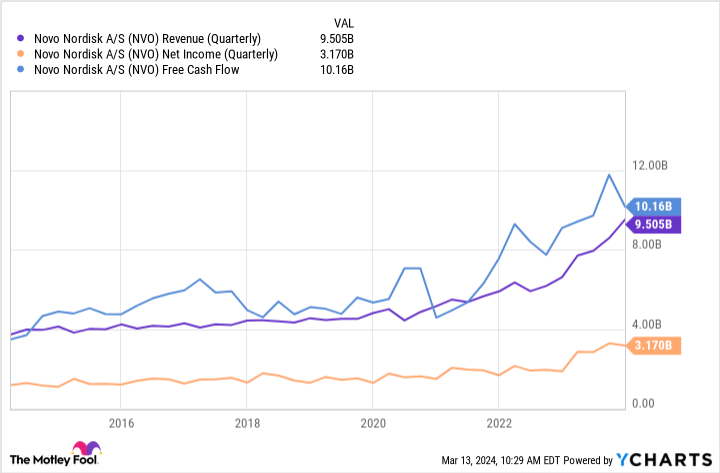

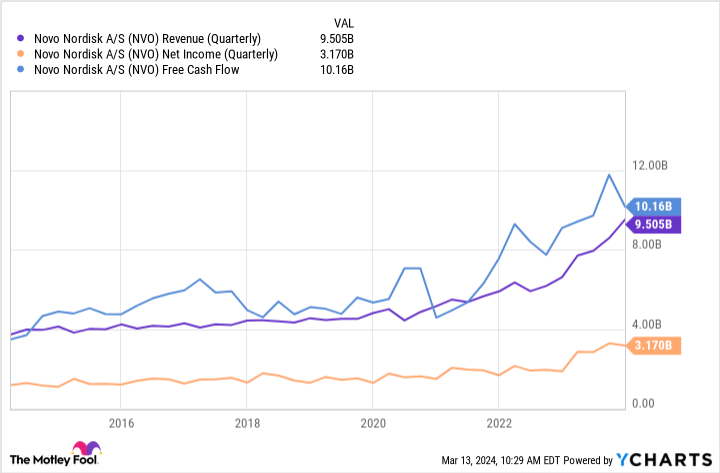

If all goes according to plan, Icodec should receive approval this year. Novo Nordisk’s leadership in diabetes treatment has resulted in generally strong financial results.

The company’s stock has also performed well, with returns far outpacing the overall market over the past 10 years. Part of the Magnificent Seven’s name lies in its ability to deliver outsize profits, and this is clearly an advantage for Nordisk.

Expect more of the same

Novo Nordisk is also making waves in another related treatment area: obesity care. The company’s weight loss drug Wegovy was so popular that demand outstripped supply. The anti-obesity drug market is expected to soar toward the end of 2010, and the company is grappling with shortages.

The pharmaceutical giant has a lot of competition, including longtime rivals in the diabetes market. Eli Lilly.and amgen, pfizerand Viking Therapeutics Some pharmaceutical companies are considering launching their own weight-loss drugs.

However, investors need not worry. As Novo Nordisk has previously shown, it can handle competition. The company’s Wegovy should remain one of the best-selling obesity drugs for some time.

We are also working on new targets. Novo Nordisk recently reported very promising Phase 1 results for a potential oral diabetes drug called amicletin.

The company has built a culture around innovation, especially in its core areas of expertise. This is the main reason why leaders in a particular therapeutic area generally remain near the top of their field.

Novo Nordisk is also aiming to diversify its lineup. Its pipeline includes medicines across rare diseases, cardiovascular diseases, neurological diseases, and more.

Novo Nordisk checks all the same boxes as the existing Magnificent Seven. All of these companies are innovative leaders in their respective industries and have had strong financial performance and stock market returns for some time, and will continue to do so. The shoe fits – that’s why Novo Nordisk has earned its place here.

It doesn’t matter if someone creates a new Magnificent Eight that includes Novo Nordisk. Investors should consider adding the company’s stock to their portfolios.

Should you invest $1,000 in Novo Nordisk right now?

Before buying Novo Nordisk stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Novo Nordisk wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 11, 2024

John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of the Motley Fool’s board of directors. Randi Zuckerberg is a former head of market development and spokesperson at Facebook, sister of Meta Platforms CEO Mark Zuckerberg, and a member of the Motley Fool’s board of directors. Alphabet executive Suzanne Frye is a member of The Motley Fool’s board of directors. Prosper Junior Bakiny has positions on Amazon and Metahis platforms. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Pfizer, and Tesla. The Motley Fool recommends Amgen and Novo Nordisk and recommends the following options: His long January 2026 $395 call on Microsoft and his short January 2026 $405 call on Microsoft. The Motley Fool has a disclosure policy.

Novo Nordisk isn’t featured in The Magnificent Seven, but why I think it should be Originally published by The Motley Fool

[ad_2]

Source link