[ad_1]

It may not be the first thing that comes to mind when you think of Nvidia (NASDAQ:NVDA)but the chip giant’s healthcare business is substantial.

Driven by growing computational demands for AI in drug discovery, genomics, patient diagnostics, medical devices, robotics, and more, Nvidia’s healthcare space is now a $1 billion-plus business, reaching that milestone two to three years earlier than expected. has been reached.

According to JPMorgan’s Harlan Soule, a five-star analyst ranked in the top 1% of Street Stock Pros, NVIDIA’s healthcare sector is in the top three of the company’s data center business.

“NVIDIA’s ability to drive high-speed computing solutions through HPC and AI/DL platforms continues to provide significant revenue opportunities for the company,” said Harlan. “Additionally, the team continues to see the potential for significant market expansion with opportunities in wearables, medical/imaging/robotics, and computer-aided drug discovery.”

These insights are based on a presentation by Kimberly Powell, VP of Healthcare at Nvidia, at JPMorgan’s 42nd Annual Healthcare Conference. At Nvidia, we feel the healthcare sector is currently “at a tipping point,” driven by expanding opportunities in generative AI and computer-aided drug discovery.

The software frameworks used in computer-aided chip design are the powerhouse of the multitrillion-dollar electronics industry, and Nvidia sees a similar trend emerging in drug discovery. We expect the drug to be significantly accelerated. Given that $250 billion is spent annually on medical research and development, there is a huge opportunity.

Generative AI is poised to have a significant impact on the healthcare industry, with companies in pharmaceutical/biotech, healthcare/clinical, and academia leveraging large-scale language models (LLMs) or transformer-based models to address a variety of challenges. I’m giving. Nvidia has a presence here through its BioNeMo, a generative AI platform that provides services for the creation and deployment of customized AI-based models designed specifically for drug discovery. The platform is currently in the beta stage.

The software stack/ecosystem has also been strengthened by three announcements that Sur believes will “further strengthen our competitiveness.” First, the team is expanding its collaboration with Amgen, aiming to develop generative AI models to gain insights from human data and enhance drug discovery, all of which will be integrated into his Nvidia’s DGX Powered by SuperPOD. Second, the company revealed his Recursion as its first partner to utilize his Phenom Beta, a base model within the BioNeMo framework. Finally, Nvidia also announced its own base model, MoIMIM.

That’s good news for Nvidia, but what does it mean for investors? Sur reiterated his Overweight (i.e. Buy) rating on Nvidia shares, along with a $650 price target. If the target price is met, investors could earn a 22% return in one year. (Click here to see Sur’s track record)

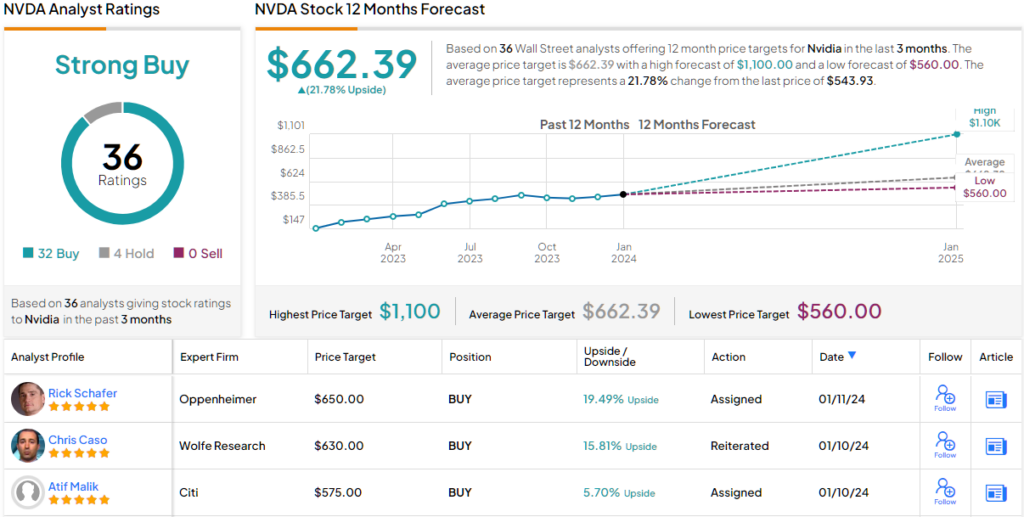

On Wall Street, Suhr was joined by 31 other analysts as bulls, well outnumbering the four skeptics, giving the consensus rating a Strong Buy. The average price target is $662.39, implying a 12-month upside of 23%. (look Nvidia stock price prediction)

To find good ideas for trading stocks at attractive valuations, visit TipRanks’ Best Stocks to Buy, the tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. Content is for informational purposes only. It is very important to perform your own analysis before making any investment.

[ad_2]

Source link