[ad_1]

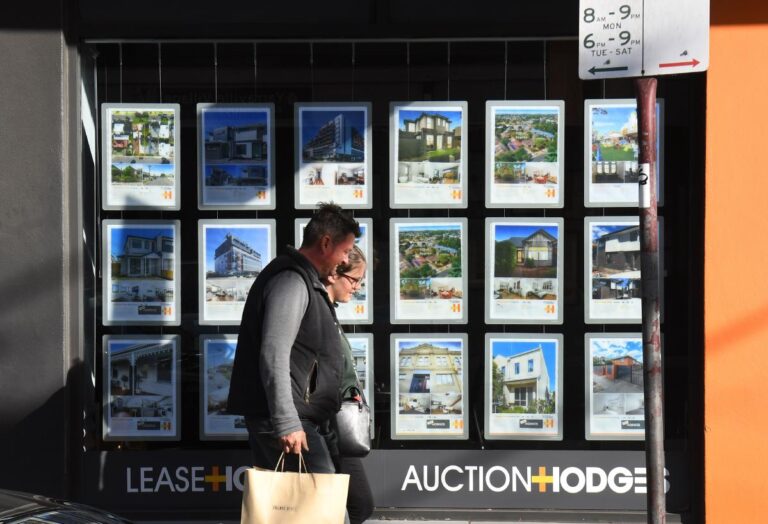

Americans haven’t been this optimistic about the housing market in nearly two years, but home sellers have something to celebrate.

Fannie Mae’s housing sentiment index rose slightly in February, marking the third straight month of improving confidence and hitting its highest level since March 2022. This boost was driven by increased optimism among home sellers as market conditions continued to tilt in their favor.

In fact, about 65% of consumers surveyed by Fannie Mae said now is a good time to sell, up from 60% in January. However, this was opposed by buyers who remained very pessimistic, with only 17% saying it was a good time to buy.

Potential buyers remain discouraged due to woefully low inventory levels and rising borrowing costs, but increased seller confidence could be a sign of more inventory heading into the spring.

Lawrence Yun, chief economist at the National Association of Realtors, told reporters last month that “as mortgage rates come down, some home sellers will start listing properties.” “But we’re not out of the woods yet.”

read more: With mortgage rates hovering around 7%, is it a good time to buy a home?

Rising interest rates reduce buyer confidence

Potential buyers have been unable to shake off the burden of rising borrowing costs, reducing confidence.

After falling more than a point from its October high, interest rates began the year at their lowest level of 6.62%, but the drop didn’t last long. The popular 30-year fixed rate had recovered to 6.94% by the end of February, according to Freddie Mac.

And it remains to be seen whether interest rates will rise further in the coming weeks.

The national median list price also rose seasonally, rising to $415,000 in February from $409,500 the previous month. According to Realtor.com, this increase, along with higher mortgage rates, increased the annual household income needed to buy the average home by $4,400, to $86,100 before taxes and insurance. That’s what it means.

“At the end of the day, it’s about affordability,” Jeff Reynolds, a real estate broker and founder of Urban Condo Spaces, told Yahoo Finance.

This was also evident in the latest survey of prospective buyers. According to Fannie Mae, about 83% of consumers think now is not a good time to buy, a trend that has not improved since December.

Still, both buyers and sellers expressed some optimism about the direction of mortgage rates, with 36% expecting rates to fall within the next year.

Fannie Mae had expected interest rates to be flat at around 6% by the end of the year. If that’s true, buyers may get much-needed relief.

“Lower mortgage rates and the associated increase in sentiment clearly bode well for next spring’s home buying season,” said Doug Duncan, senior vice president and chief economist at Fannie Mae. “However, affordability will remain a major challenge for buyers, at least until net supply increases significantly.”

Housing builders were also confident.

Domestic home builders also reported an improved optimistic outlook in February, raising expectations that mortgage rates would fall as spring approaches.

The possibility that the Federal Reserve will cut interest rates later this year and the low inventory of existing homes on the market were enough to boost the outlook, according to the National Association of Home Builders (NAHB).

But that optimism led to fewer incentives for homebuyers in February.

About 25% of builders said they offered price reductions in February, down from 31% in January and 36% in the last two months of 2023. Average price reductions remained at 6% for eight straight months, according to NAHB data.

Sales incentives also continued to shrink. The percentage of builders offering some kind of concession to close a contract was 58% last month, down from 62% in January and the lowest level since August.

read more: Should you pay mortgage discount points? 4 tips to help you decide.

NAHB President Alicia Huey also noted that lower mortgage rates later this year will encourage more buyers to return to purchasing plans.

“Mortgage rates remain too high for many prospective buyers, but if mortgage rates continue to fall this year, we expect pent-up demand to bring more buyers into the market,” Huey said. Ta.

Gabriela Cruz Martinez I’m a personal finance and housing reporter for Yahoo Finance. Follow her on X @__Gabriela Cruz.

Click here for real estate and housing market news, reports and analysis to help you make investment decisions.

[ad_2]

Source link