[ad_1]

Investment banks are relying more than ever on hedge funds for revenue. But what happens when hedge fund business reaches its peak?

Hedge funds’ poor performance has caused a degree of schadenfreude among industry watchers. Hedge funds’ HFR index rose just 6% in 2023, well below most stock markets.

In fact, hedge fund returns have lagged for the past decade due to poor capital inflows from the industry, and that’s not stopping investment banks from growing their hedge fund client base. This is especially true given the recent trading drought and constant pressure on traditional active fund manager clients.

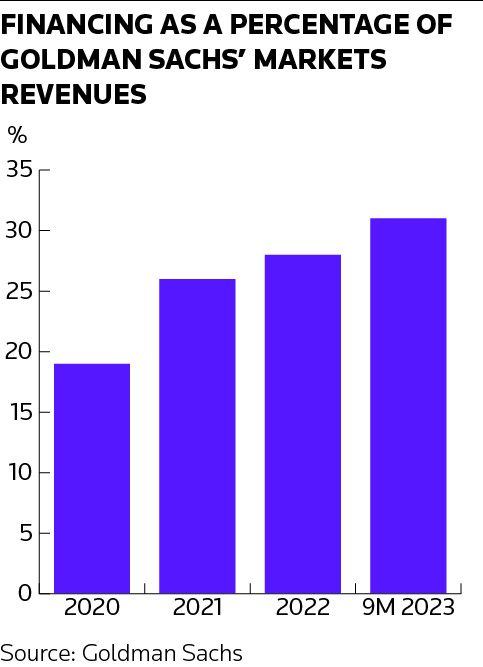

Investment banks’ prime brokerage revenues have doubled over the past decade to about $30 billion. This is still only his 15% of market revenue, but it is disproportionately biased towards certain players. Market leader Goldman Sachs has seen its loan income (most, but not all, hedge funds) nearly triple in the past decade. In his first nine months of 2023, this represented more than 30% of his market revenue. For Morgan Stanley, this was 28% during the same period.

Some smaller prime brokerage franchises are also increasingly reliant on this revenue stream. Barclays’ market finance revenue in the first nine months of 2023 was less than half of Goldman’s, but it accounted for 38% of total market revenue.

Even at companies such as Bank of America, which traditionally have had little exposure to hedge funds, financing has become increasingly important to their markets operations.

Hedge funds also represent a very large customer base on the trading side of the business, especially for banks with strong prime brokerage franchises.

The key to the growth of sell-side hedge fund wallets is not the industry assets under management, but the rapid growth of regularly traded, highly leveraged multi-strategy firms, particularly “pod shops,” a subset of multi-strategy firms. It was a great growth. To make investments, it operates many individual “pods”, or small groups of traders.

Podshops have decisively outperformed other industries over the past five years in a depressed market. However, the returns are highly concentrated around the Citadel and, to a much lesser extent, the Millennium. Fast-growing pod shops such as Baryasny and Schoenfeld struggled in 2023. Other large multi-strategy firms, such as Brevan Howard, also had weak earnings.

Unlike top private equity firms, the best hedge funds tend to be closed to new capital. Citadel recently returned his 7 billion USD to customers, similar to the previous year.

Jain Capital, a new multi-strategy fund run by former Millennium co-CIO Bob Jain, will be the largest hedge fund founded in 2024, surpassing the 2017 founding of Exodus Point by other former Millennium CIOs. The goal is to exceed the record. Bloomberg reported that Jain Capital is offering potential large clients significantly discounted rates than expected. This is an ominous sign of the industry’s current funding environment.

The problem of limited alpha has always been a constraint for hedge funds. Major pod retailers have tried to address this problem by limiting the size of individual pods, but headcount and cost increases have far outpaced new asset growth in recent years. Paul Marshall, one of Britain’s best-known hedge fund managers, recently said: What’s happening now is that everyone is getting paid the same as Cristiano Ronaldo.”

Hedge funds naturally hedge, and are supposed to focus on risk-adjusted returns. However, in an environment where overnight interest rates have recovered, can hedge funds really survive with a track record of 5% annual returns over five years?

One could also question the extent to which the industry’s performance is underperforming due to hedging rather than insufficient alpha generation.

For years, the tiger cubs that dominated the industry hunted in packs. Even more diversification is expected today. Nevertheless, Goldman announced late last year that crowding, or funds making nearly identical trades, had reached the highest level since it began tracking funds 22 years ago.

In line with broader stock market trends, the hedge fund industry’s long-term U.S. stock portfolios are expected to increase in 2023 to the “Magnificent 7” tech stocks, including Alphabet, Amazon, Apple, Metaplatform, Microsoft, Nvidia, and Tesla. significantly increased exposure. Therefore, it will be exposed to a pullback in momentum trading. Another example of crowded hedge fund positioning is highly leveraged bets between spot and futures on U.S. government bonds, which is currently being watched by regulators around the world. It is likely that there will be some intervention from the authorities regarding hedge fund leverage in 2024.

All of this suggests that 2023 may have been a peak year for investment banks’ market business from hedge funds. Unless revenues improve significantly, reductions in client assets, leverage, and investment professional headcount are likely to be seen across the hedge fund industry.

If there is a silver lining for banks, it may take time for it to sink in, but it could result in less competition for top traders.

Rupak Ghose is a former financial research analyst

[ad_2]

Source link