[ad_1]

A new scientific poll underwritten by the North Dakota News Cooperative is finally shedding light on citizens’ opinions about this $10 billion legacy fund, filled primarily with oil and gas money.

This money does not come from the support of “hard-working citizens,” as is often used in political rhetoric, but money that belongs to everyone in North Dakota. Therefore, everyone has a stake in the use of the fund.

Having taught polling at the University of North Dakota, I offer some careful advice. The reliability of public opinion polls, even if scientifically structured, can be influenced to some extent by the nature of the poll’s subjects.

In a talk by NDNC’s Michael Standaert, he points out that three-quarters of the public admits some level of ignorance about the activities of state investment boards. Of course, the Board is not doing much to bridge the information gap between the Investment Committee and the public.

Others are also reading…

Because people were in the dark, their judgment on some issues must be taken with a little cognitive salt.

North Dakota’s bigotry is exposed as 60% say they want legacy funds to invest in North Dakota development projects, rather than outside the state or hemisphere, where they can get the best returns. Only 18% supported the investment. .

political issues

Putting this on a biennial merry-go-round would allow political outriders to exploit the revenue loss that comes from investing only in North Dakota, since it is a critical campaign fund.

The poll found that 84% want greater transparency in investments, primarily the publication of investment lists. “This is an important steering committee, but it’s a mystery to most voters,” said Trevor Smith, chief pollster at WPA Intelligence.

NDNC co-chairman Steve Andrist said, “The results of the ND poll raise the question of what the State Investment Commission is doing and what voters want from them.” It shows that there is.”

NDNC Co-Chair Jill Denning Gackle pointed out that people are not making connections between Legacy Funds and their lives and communities.

investing is complicated

When I chaired an investment committee in the mid-1980s, I found that investing was more complex than it appeared on the surface, and that boards relied heavily on the expert advice of experienced consultants.

For years, lawmakers have added confusion to investment management by putting themselves on the board, no doubt believing that their royal status posed a threat to the board’s non-legislative members.

At present, Congress has welcomed two members to its Board of Directors to expand its footprint in future Congresses. Congress has a greedy desire to take over the executive branch.

In our three-party government, we forget that the legislature makes policy decisions and the executive branch executes them. Having a member of this administrative committee violates the separation of powers.

With so little information flowing through the state about the functioning of the Investment Board, there is little political accountability for violations in the undergrowth. Lawmakers can and do violate the fundamental tenets of the republic.

Hopefully, this poll will lead to a larger discussion at a national level about this wealth that has humiliated us into inaction.

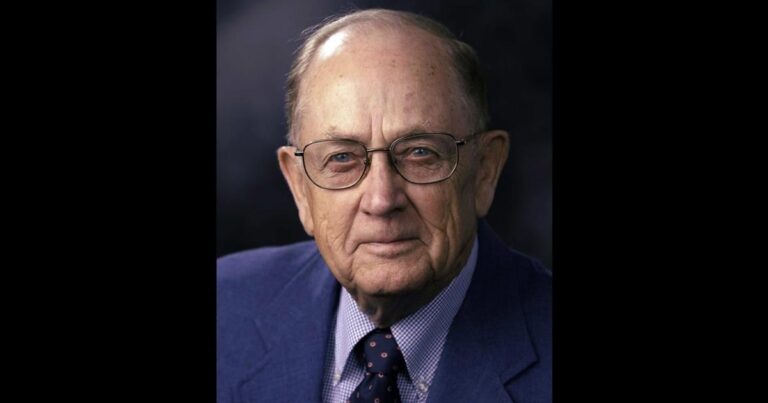

Lloyd Omdahl is a political scientist and former North Dakota Democratic lieutenant governor.

[ad_2]

Source link