[ad_1]

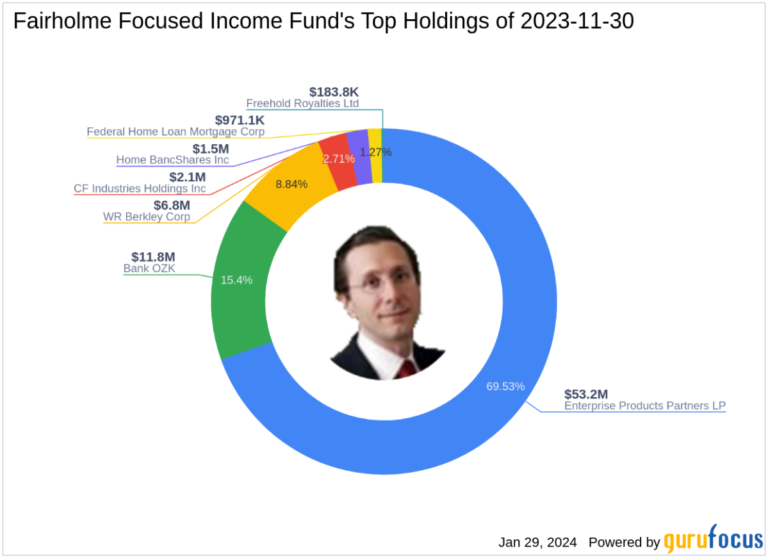

Fairholme Focused Income Fund (Trade, Portfolio), managed by renowned investor Bruce Berkowitz (Trade, Portfolio), has announced its N-PORT filing for the fourth quarter of 2023. The fund is known for its strategy of pursuing recurring income and capital preservation. Through a concentrated portfolio of cash distributing securities. Bruce Berkowitz (Trades, Portfolio)’s investment approach is closely monitored by GuruFocus based on two different profiles of him. “Bruce Berkowitz (Trades, Portfolio)” for his SEC filings with Fairholme Capital Management and “Fairholme Funds (Trades, Portfolio)” for Flagship. Fund holdings.

Summary of new purchases

Fairholme Focused Income Fund (Trade, Portfolio) expanded its portfolio with the addition of three new stocks last quarter.

-

OZK Bank (NASDAQ:OZK) emerged as a standout addition with 281,700 shares, representing 15.4% of the portfolio and a market capitalization of $11.79 million.

-

CF Industries Holdings Inc (NYSE:CF) was the second major acquisition for 27,600 shares, representing approximately 2.71% of the portfolio, valued at $2.07 million.

-

Home BancShares Inc (NYSE:HOMB) rounds out the top three with 69,600 shares representing 2.02% of the portfolio and a total value of $1.54 million.

Key position rises

The fund also strengthened its position in existing holdings.

-

Enterprise Products Partners LP (NYSE:EPD) increased by 187,300 shares for a total of 1,988,000 shares. This adjustment means the number of shares will increase by 10.4%, giving him a 6.55% impact on his current portfolio worth $53.24 million.

Reduction of key positions

Conversely, Fairholme Focused Income Fund (Trade, Portfolio) has reduced its holdings in 1 company:

-

The Fund reduced its investment in Freehold Royalties Limited (TSX:FRU) by 22,100 shares, resulting in a 55.25% decrease in stock and a portfolio impact of 0.43%. The stock traded at an average price of C$14.59 during the quarter, with a return of -1.58% over the past three months and a return of 2.41% year-to-date.

Portfolio overview

As of Q4 2023, the Fairholme Focused Income Fund (Trade, Portfolio) portfolio consists of seven stocks. The top holdings are Enterprise Products Partners LP (NYSE:EPD) with 69.53%, Bank OZK (NASDAQ:OZK) with 15.4%, WR Berkeley Corp. (NYSE:WRB) with 8.84%, and CF Industries Holdings (NYSE). :WRB) was 2.71%. CF) and 2.02% for Home Bancshares, Inc. (NYSE:HOMB). Investments are mainly concentrated in three industries: energy, financial services and basic materials.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

[ad_2]

Source link