[ad_1]

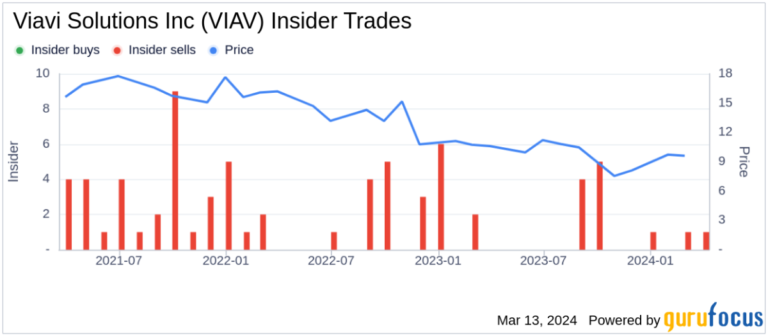

According to a recent SEC filing, Viavi Solutions Inc (NASDAQ:VIAV) reported insider sales. On March 12, 2024, EVP and Chief Marketing Strategy Officer Paul Mcnab sold 15,004 shares of the company’s stock. This transaction has attracted the attention of investors as it may provide an insider’s view of the company’s current valuation and future prospects. Viavi Solutions Inc is a global provider of network testing, monitoring and assurance solutions to communications service providers, enterprises and their ecosystems. . The company also provides optical security and performance products to customers in the anti-counterfeit, consumer electronics, government and industrial sectors. Viavi focuses on developing and applying technology to help customers optimize and maintain many of the world’s largest and most complex networks. Paul Mcnab has a history of selling shares in companies. Over the past year, insiders have sold a total of 28,781 shares, but bought no shares. Viavi Solutions Inc’s insider trading history shows a pattern of insider sales over the past year, with 12 of his insider sales and no insider sales. On the day of the recent sale, Viavi Solutions Inc stock was trading at $10.62, giving the company a market cap of $2.271 billion. The price-to-earnings ratio is 510.25, significantly higher than both the industry median of 23.51 and the company’s historical median price-to-earnings ratio.

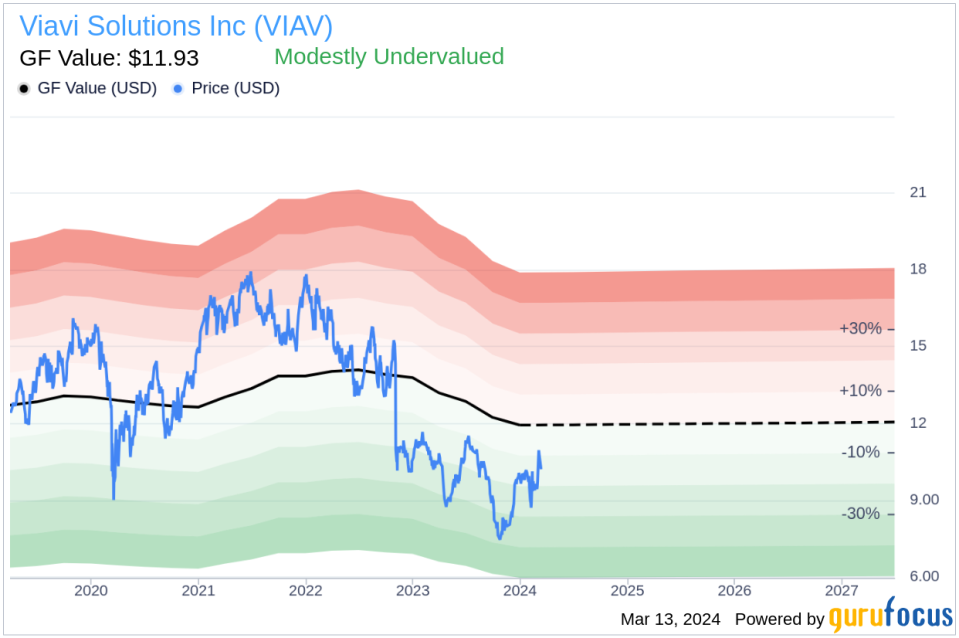

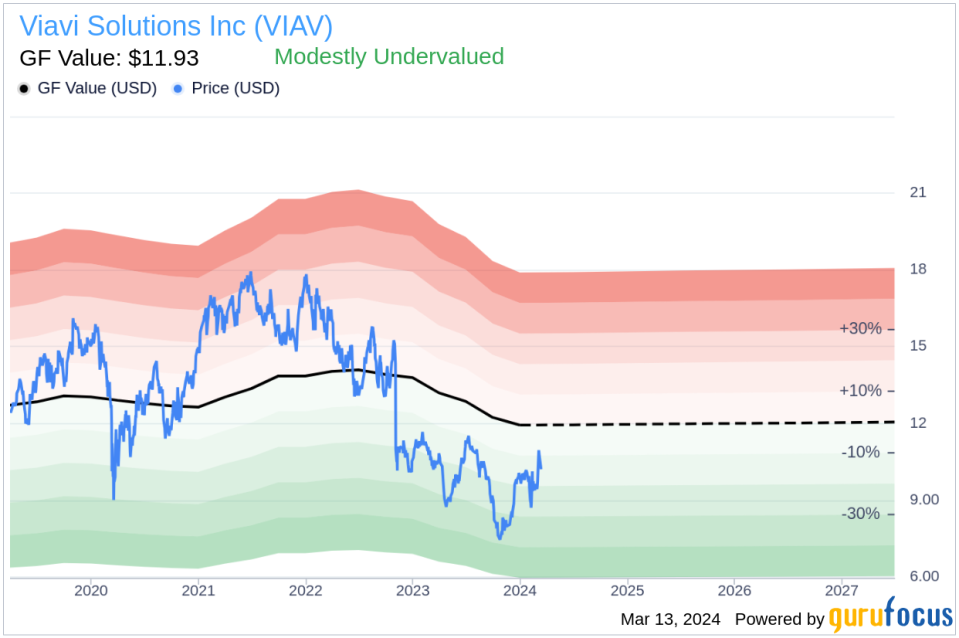

Considering the stock price is $10.62 and the GuruFocus Value is $11.93, Viavi Solutions Inc.’s Price to GF Value ratio is 0.89, indicating that the stock is slightly undervalued according to the GF Value metric. I am.

GF Value is calculated based on historical trading multiples, GuruFocus adjustment factors, and future performance estimates provided by Morningstar analysts. This intrinsic value estimate provides investors with an additional reference point for evaluating the potential fair value of a company’s stock. Investors often monitor insider transactions as it can give them insight into how insiders view a stock’s value and future performance. However, it is important to consider a wide range of factors when assessing the impact of insider trading activity.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

[ad_2]

Source link