[ad_1]

To tell paypal (NASDAQ:PYPL) To say the stock has been depressed over the past three years is a bit of an understatement. Heading into 2024, the stock has recorded negative returns over the past three years, with the stock declining nearly -75% during that period.

New CEO Alex Criss said at a press conference that he wants to spark interest in the stock. CNBC He said in an interview that PayPal will “shock the world” at an innovation event it held at the end of January.

But the event focused on PayPal’s artificial intelligence (AI) ambitions, so it didn’t exactly awe investors. In 2024, AI-powered product improvements won’t necessarily be cutting edge. Meanwhile, the stock sold off a few weeks after the company announced its fourth quarter results.

The question now is, can investors bargain hunt for this beaten-down name?

Over-promise and under-deliver

The narrative around PayPal over the past few years has been that it is a declining business facing competitive pressures. Arguably, these are the biggest risks facing the company.

However, the company’s numbers don’t necessarily reflect this story. Despite the share price drop, the company’s key metrics have consistently grown over the past three years.

Gross payments, the amount of money flowing through the company’s payment processing system, has increased quarterly for the past several years, and growth in this metric accelerated in 2023. Similar to sales, the number of payment transactions is also steadily increasing. All is not perfect, as the company’s number of active accounts has currently stopped growing.

Most recently, PayPal came under pressure due to its 2024 guidance. The company expected first-quarter sales growth of 6.5%, but did not provide a full-year sales outlook, but said it expects adjusted EPS to be in line with its 2023 forecast of $5.10.

So why didn’t investors like this? Because analysts were expecting 2024 adjusted EPS to be $5.53. Stock performance is often tied to future expectations and how a company’s performance compares to expectations, so if a company’s earnings forecast falls short of analysts’ expectations, the stock price will decline. Fall.

Innovation that leads the way

Well, PayPal didn’t shock the world with its innovation event, but it did introduce some promising AI-powered products. One of the company’s areas of focus is speeding up the checkout process and removing friction for consumers. To this end, the company has introduced his two new services: PayPal Checkout and Fastlane. The former eliminates the need to enter a password and uses biometric authentication such as facial or fingerprint recognition, while the latter allows purchases with a single tap.

Improving customer engagement and personalization are two other areas PayPal is targeting. PayPal uses its Smart Receipts service to provide customers with receipts and personalized product recommendations from the same merchant.

Similarly, PayPal’s advanced offers platform analyzes transaction data through AI to provide personalized offers to customers. It is primarily an advertising tool, and sellers only pay if a customer buys the recommended product. PayPal CashPass, on the other hand, allows consumers to earn not only perks but also cash back on purchases.

These innovations are not entirely groundbreaking in and of themselves. However, these are reliable services that drive engagement and transactional growth.

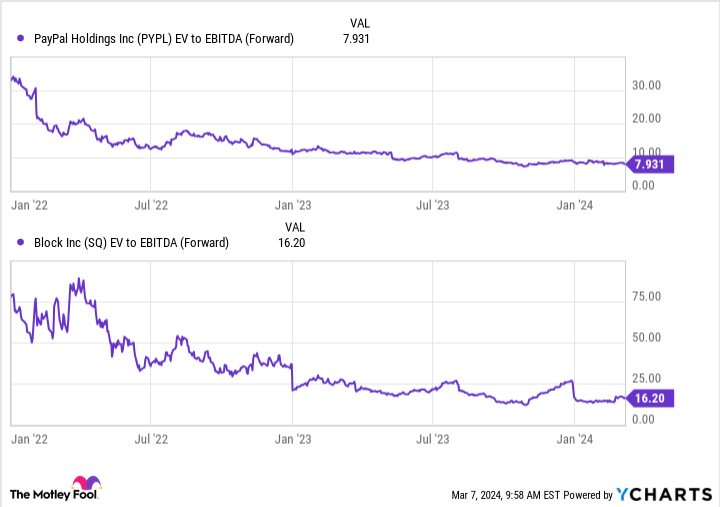

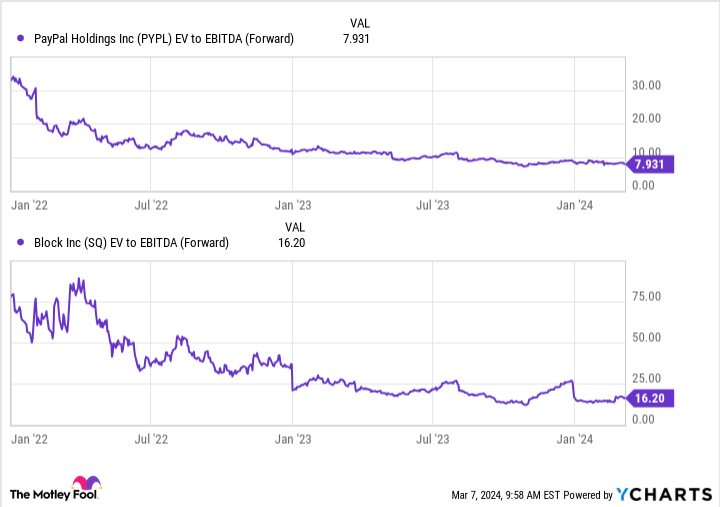

PayPal’s valuation has fallen significantly as its stock price has declined over the past few years. The company also trades at about half the EV/EBITDA multiple of rival and peer payment processors. block (NYSE:SQ). Given PayPal’s strong cash position, I prefer this common valuation metric because Enterprise Value (EV) considers a company’s balance sheet, whereas EBITDA excludes non-cash impacts. prefer to use.

PYPL EV to EBITDA (Forward) data by YCharts

Given its historically cheap relative valuation, what investors should be looking for in the company is innovation and growth. These new products didn’t shock the world, but they look like they have exactly what they need to offer.

What about PayPal’s disappointing guidance?

Ahead of the innovation event, CEO Chris over-promised but under-delivered, which is never good for a stock as investors are always looking for companies to exceed expectations. Meanwhile, a few weeks later, management provided rather tepid guidance for 2024.

That may seem like a bad thing, but Chris quickly learned his lesson and when the company released its 2024 guidance, the plan could have been under-promised and over-delivered. There is enough. The guidance appears to be conservative given all the new and promising services PayPal plans to introduce.

One of the best settings for stocks is cheap valuations and low expectations. If PayPal can clear what appears to be a low bar, 2024 could mark the beginning of a turnaround for the stock.

Where you can invest $1,000 now

When our analyst team has a stock tip, it’s worth listening. After all, the newsletter they’ve been running for 20 years is Motley Fool Stock Advisorhas more than tripled its market. *

they just made it clear what they believe Best 10 stocks PayPal made the list of stocks that investors should buy right now. But there are nine other stocks he has that you may have overlooked.

See 10 stocks

*Stock Advisor returns as of March 8, 2024

Jeffrey Seiler has a position on the block. The Motley Fool has a position in and recommends Block and PayPal. The Motley Fool recommends this option: His March 2024 $67.50 Short Calls on PayPal. The Motley Fool has a disclosure policy.

PayPal didn’t shock the world.What’s next for investors? Originally published by The Motley Fool

[ad_2]

Source link