[ad_1]

On average, stock markets tend to rise over time. This makes the investment attractive. But if you choose that path, you’ll end up buying some stocks that don’t reach the market. Unfortunately for shareholders, Ponce Financial Group, Inc. (NASDAQ:PDLB) stock has increased 14% over the past year, which is below the market return. However, the long-term returns have been less impressive, with the stock gaining just 2.9% over the past three years.

So let’s do some research and see if the company’s long-term performance is in line with the progress of its underlying business.

Check out our latest analysis for Ponce Financial Group.

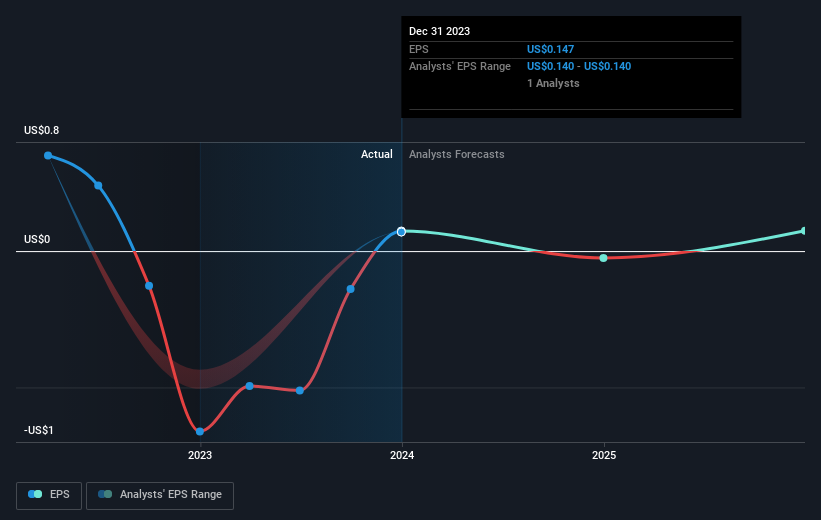

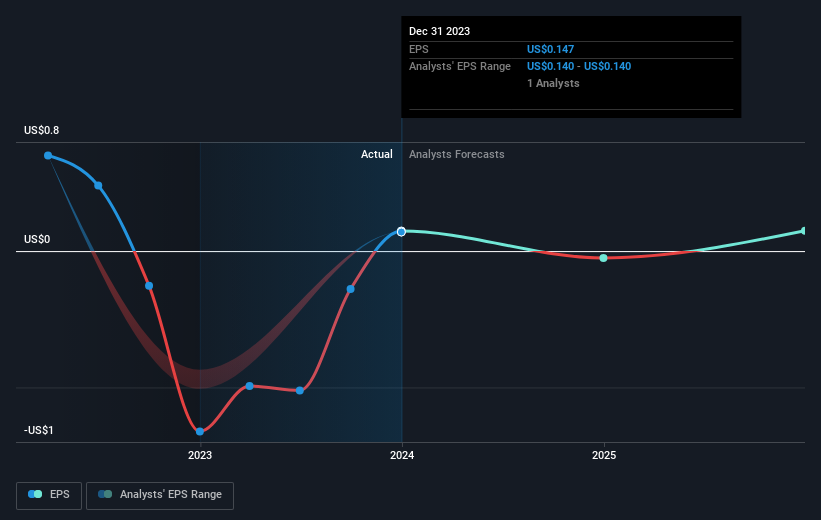

Markets are powerful pricing mechanisms, but stock prices reflect not only underlying business performance but also investor sentiment. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Ponce Financial Group went from a loss to a profit last year.

We think this growth is very promising, and it’s no wonder the market likes it. Inflection points like this can be a great opportunity to take a closer look at a company.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Ponce Financial Group has been improving its earnings lately, but will its earnings grow? Why not check this out? free A report showing analyst revenue forecasts.

different perspective

Ponce Financial Group shareholders received a total return of 14% for the year. However, its returns are below the market. On the bright side, this is still a profit, and certainly better than the annual loss of around 1.8% it endured over five years. Maybe business is stabilizing. I think it’s very interesting to look at stock price over the long term as an indicator of business performance. But to really gain insight, you need to consider other information as well.Case in point: we discovered 2 warning signs for Ponce Financial Group It should be noted that one of them can be serious.

For people who like searching succeed in investing this free This list of growing companies with recent insider purchasing may be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.

[ad_2]

Source link