[ad_1]

(Bloomberg) – President Xi Jinping is scheduled to receive a briefing from China’s financial market regulator, according to a person familiar with the matter, underscoring the urgent need for Beijing to support the country’s plummeting stock prices. .

Most Read Articles on Bloomberg

Regulators led by the China Securities Regulatory Commission are scheduled to report to top leadership on market conditions and the latest policy initiatives as early as Tuesday, the people said, asking not to be identified as the matter is private. Ta. Officials say the timing is subject to change. It is unclear whether new support measures will be proposed at this meeting.

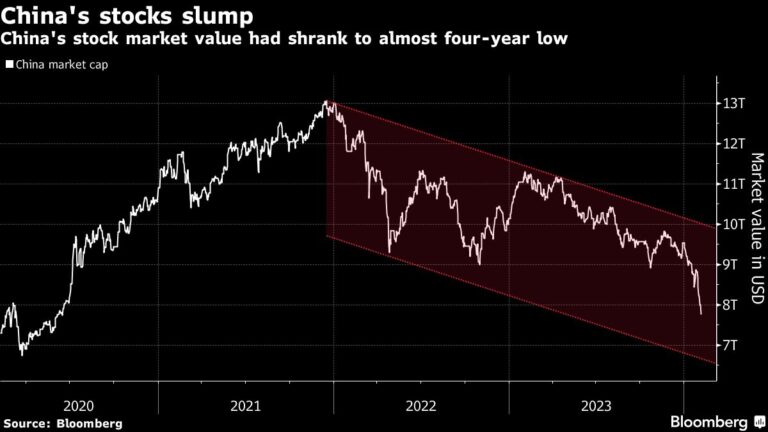

The move underscores growing pressure on Chinese authorities to stem the slump in stocks after gradual measures over the past few months failed to improve investor sentiment. About $7 trillion in value has disappeared from Chinese and Hong Kong stocks since their peak in 2021.

Authorities on Tuesday gave a flurry of support to Central Huijin Investment Co., which owns Chinese government stakes in major financial institutions, including a pledge to increase purchases of exchange-traded funds (ETFs) to keep capital markets running smoothly. made a presentation. In follow-up comments, the CSRC said all efforts will be made to maintain stable market operations.

The CSI 300 rose 1.8% at the midday break, capping a 20% decline over the past year.

Mr. Xi has shown signs of increasing his involvement in the country’s financial and economic policies, including an unprecedented visit to the People’s Bank at the end of last year.

Officials said authorities have been working around the clock for the past few months to come up with a market rescue plan. Securities regulators are working on weekends, and the National Financial Supervisory Authority has convened at least a dozen meetings in the past two months on stabilizing capital markets, the people said.

CSRC and NFRA did not immediately respond to Bloomberg’s requests for comment.

Regulators this week tightened trading limits to stem stock losses, banning some quantitative hedge funds from placing sell orders and forcing others to reduce equity positions in leveraged market-neutral funds. It was forbidden to do so. Securities regulators also announced Monday that they would adjust margin call levels to limit forced liquidations and guide brokerages to maintain “flexible” liquidation lines.

Efforts so far have included curbing short selling, a state buyout of the nation’s largest banks, and the creation of a $278 billion stock stabilization fund.

These measures have done little to restore investor confidence, damaged by the recent economic slowdown and President Xi Jinping’s tightening of control over private companies and crackdowns.

The country’s small-cap stocks fell more than 6% on Monday to their lowest since 2018, and the benchmark CSI300 index fell to a five-year low earlier this month. Traders have reduced positions amid concerns that risks such as geopolitical tensions and weak consumer spending could deepen the market’s free fall once trading resumes, and investors are preparing for the week-long Lunar New Year holiday. It is possible that they are preparing for further losses in the face of this.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link