[ad_1]

We believe that we continue to sit within a transition period for the global economy on multiple fronts, and that the low levels of implied volatility seen in Q4 2023 are unlikely to last through 2024.

1. Introduction

The fourth quarter of 2023 capped a strange year for traditional assets. Despite lingering economic concerns, increasing corporate defaults and a squeezed consumer, equity markets finished the year strongly. The incrementally dovish rhetoric from central banks, particularly the Federal Reserve, buoyed risk assets into year-end and drove down bond yields on the expectation of multiple rate cuts over the next year. This was generally a headwind for hedge fund alpha, since market volatility remained low, dislocations were small and infrequent, and trends in markets have been short-lived. However, as elaborated at length below, we believe that we continue to sit within a transition period for the global economy on multiple fronts, and that the low levels of implied volatility seen in Q4 2023 are unlikely to last through 2024.

2. Our Outlook

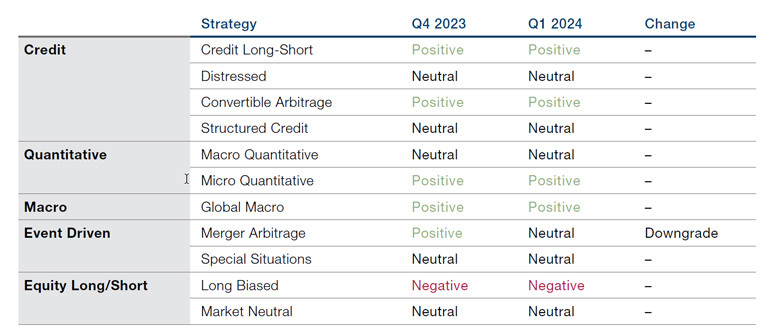

We have maintained a broadly positive outlook for hedge fund alpha, with a positive stance in Credit Long-Short, Convertible Arbitrage, Micro Quantitative strategies, and Global Macro. Our optimism in relative value credit strategies comes from the uncertainty and internal dispersion in credit markets caused by higher rates and refinancing needs. Capital structure arbitrage opportunities are more plentiful in periods of higher rates and may become even more attractive if we see equity market volatility increase in 2024. Convertible Bond primary markets are expected to remain active as issuers move into the asset class to address forthcoming debt maturities in the face of higher rates. Our stance in Micro Quant and Global Macro is predicated on expectations of a more volatile landscape next year, as both top-down and bottom-up approaches to capitalise on dislocations and dispersion may be successful.

We have downgraded our outlook in Merger Arbitrage following a good run for the strategy after the wider spreads seen in Q2 and Q3 of 2023. We feel that we were correct to increase our conviction here in the face of growing regulatory concerns around six to nine months ago, as these concerns ultimately were resolved, and several large deals closed. We now see less of an anomaly in the price of mergers and therefore have reduced our outlook. We maintain a negative outlook for Long-Biased Equity Long-Short given the overvaluation of equity markets (relative to history) and the downside risks present in the current economic climate.

Figure 1. Q1 2024 Outlook Versus Q4 2023 Outlook

We continue to maintain a positive view on Credit Long-Short and our Neutral view on Distressed, as the prolonged period of relatively benign market conditions has meant that there is still more to do in relative value trades in Credit as opposed to restructuring opportunities.

3. The Details

3.1 Credit

We continue to maintain a positive view on Credit Long-Short and our Neutral view on Distressed, as the prolonged period of relatively benign market conditions has meant that there is still more to do in relative value trades in Credit as opposed to restructuring opportunities.

US High Yield spreads closed the year near to their tightest levels seen since pre-2020, and below historical median levels. This market positioning continues to feel at odds with the growing level of defaults and generally poor recovery rates seen in the asset class over the last year (through November 2023 there were $76bn of defaults in 2023 vs $48bn for the whole of 2022). One explanation may be the increased appetite of investors to allocate to higher quality credits given the optical appeal of yields in the high single-digits for low default risk bonds, after over a decade of low single-digit yields. Indeed, within the high yield market there is increasing dispersion between higher rated credits (i.e., BB) and lower rated credits (i.e., CCC), such that while the broad market is trading on tighter spreads, the CCC portion of the market has significantly lagged. At the end of the year, around 60% of US High Yield CCC rated bonds had spreads more than 400bps wider than the broad index, a level seldom seen outside of crisis periods (for comparison, this proportion was closer to 20% at the start of 2022).

Capital Structure Arbitrage opportunities are expected to continue to emerge as issuers see varying impacts from the higher cost of capital and tougher capital market access. Managers are seeing good opportunities to buy stressed credits from issuers that are proactively addressing maturity issues, and there remain fertile opportunities in debt vs equity dislocations, particularly for companies that are raising capital.

We retain a favorable view of Convertible Arbitrage, despite broad markets trading close to estimates of fair value. There is still a reasonably large universe of convertible bonds trading below 80% of par value (more than 20% of the global Convertible Bonds [CBs] market), and of these, more than 40% have no other debt, making CBs a lucrative source of alpha for idiosyncratic opportunities. Unlike the traditional credit markets, spreads in high yield convertible bonds remain wide, therefore the additional yield pick-up is a useful tailwind for managers with good stock selection skills. Primary market activity in CBs is expected to remain active as issuers seek to proactively address an expected high level of bond maturities arriving in 2025 and 2026. Furthermore, the expansion of convertible bond markets and increase in issuer diversity are positive tailwinds for the strategy in the long run.

We have maintained a neutral stance in Structured Credit due to the variation in the attractiveness of opportunities across the space. Loss-adjusted yields remain historically attractive in many sectors due to the higher risk-free rate, although they have rallied somewhat from the wider levels seen in early 2023. The fundamentals in the consumer and residential/housing markets remain generally solid, with low household debt balances and debt service ratios, but many managers are modelling a softening of these fundamentals going forward, given the higher rate regime. Concerns remain focused on a significant and broad-based increase in delinquencies and defaults in residential and consumer asset-backed securities (ABS) due to an economic downturn, which would likely be presaged by a material increase in unemployment.

3.2 Quantitative Strategies

We remain positive in our outlook for Micro Quantitative strategies. We expect equity market dispersion and volatility to increase in 2024, which should generally provide a better backdrop for Micro Quantitative strategies. For some time now we have transitioned away from the more fundamental Equity Market Neutral approaches, as these have become increasingly commoditised through Alternative Risk Premia strategies, therefore we have fewer concerns around the risk of factor moves (or the needs for a factor tailwind) on the profitability of the best managers in this space. In addition, we have seen a broader pool of high-quality managers in this strategy over the last year or so, as managers spin out from platforms or reach a level of development where they can be genuinely competitive with the best practitioners in the strategy. As is also the case with Equity Long-Short below, we still have some concerns over the saturation of highly levered strategies at the largest hedge fund platforms and the risks that platform destabilisation may pose on the wider industry.

In Macro Quantitative strategies, we maintain our neutral stance. We continue to prefer alternative trend strategies to simple trend following given the volume of assets allocated to trend risk premia over recent years and the ability of alternative trend strategies to generate alpha from capacity-constrained markets. Performance in non-trend systematic macro strategies has been generally weak in 2023, with traditional lead/lag effects failing to gain traction in the somewhat unusual ‘post-Covid, higher inflation, higher rates, but resilient economy’ regime. We continue to watch this space and expect that the best practitioners will revert to their previous strength, although given that there is no explicit reason for a mean reversion impulse (besides high-water marks on performance fees), discretion is the better part of valour here.

3.3 Macro

We maintain our positive outlook for Global Macro strategies, anticipating greater risk-taking in end-of-cycle trades. We are entering an unusual period for global economic policy, with predictions of multiple rate cuts in the short term despite none of the usual reasons for looser monetary policy, namely forecasts of inflation undershooting policy targets, excessive unemployment, or significant market shocks. For this reason, we are more positive about the ability of discretionary strategies to navigate and profit from any market uncertainty or policy missteps than we are about quantitative strategies, where the focus is more on pattern recognition from previous market episodes.

As we move through this tightening cycle and potentially weaker economic backdrop, we expect that there will be opportunities to differentiate between the different growth trajectories in different regions and the associated impacts on relative value trades between, for example, the shape of yield curves in different countries. Policy error remains a significant risk in our view, and while this can lead to volatility of hedge fund returns in the first instance, there are seldom fewer better environments for discretionary macro practitioners than when policy makers are caught behind the curve and forced to react.

Furthermore (as has been discussed to death across various commentators’ annual outlooks), 2024 is the year of elections. Geopolitics and fiscal dynamics should present plenty of sources of catalysts for large changes in market behaviour across the globe throughout the year. Once again, the opportunity set for Macro managers lies less in predicting these events than the market volatility and reallocation of capital than can occur after them.

A more stable and benign period for markets more generally should prove beneficial for deal volumes, although it is likely to be accompanied by tighter spreads, therefore the alpha opportunity for hedge funds remains contained.

3.4 Event Driven

We have reduced our outlook on Merger Arbitrage to neutral following a broadly correct call to increase for the past two quarters. Annualised spreads have tightened over the last quarter as less regulatory risk is now priced in to deals. In addition, several high-profile deals closed in the second half of 2023, and managers have been rotating their books into new opportunities. Deal volumes remain close to average, in line with the post-Covid levels but below the higher volumes seen in the 2015-2019 market rally.

Managers are generally bullish around the potential for more deals in 2024 due to the greater certainty in the financing environment following the peak in interest rates and the resolution of banking sector issues seen in H1 2023, and many believe there is pent-up demand for corporate activity held over from 2022 and 2023 given the then uncertain economic outlook. A more stable and benign period for markets more generally should prove beneficial for deal volumes, although it is likely to be accompanied by tighter spreads, therefore the alpha opportunity for hedge funds remains contained.

The downside risks to the strategy right now focus on a deterioration in the broader economic picture. Weaker equity markets and higher levels of volatility could lead to more cautious corporate behaviour, especially if this is caused by inflation and/ or rates not coming down as quickly as currently expected. We also face the risk of changes to the regulatory landscape due to elections in 2024 or from heightened geopolitical tensions.

We remain neutral on Special Situations, as the opportunity set remains very idiosyncratic. For several quarters, we have looked closely at opportunities from increased activity in Japanese corporate governance trades, but we continue to struggle to find ways to effectively extract a stable source of alpha from this theme without taking a broader exposure to Japanese markets or the Value factor. There are other pockets of opportunity in Event Arbitrages, particularly in strategies focused on litigation and restructuring events, as these ‘alpha from complexity’ themes require deep knowledge and benefit from a more uncertain economic backdrop.

3.5 Equity Long/Short

Keeping a consistent stance over the past few quarters, we continue to hold a preference for low-net Equity Long-Short managers and have maintained our neutral rating for Market Neutral Equity Long-Short and a negative rating on Long-Biased Equity Long-Short. Patience is likely to be important in extracting value from equity markets in 2024, which looks to be a year of transition with divergent economic outlooks across countries and regions.

One area of growing but rather nebulous concern is the impact on alpha generation of any potential failure of the larger hedge fund multi-strategy platforms.

Alpha generation from stock picking is likely to be supported by higher equity volatility caused by the feed-through effects of higher rates (i.e. corporate defaults, a squeezed consumer) and by uncertainty around geopolitics and the crowded election calendar over the next 12 months. While these sources of volatility may be painful in the short term, particularly for managers holding crowded or consensus positions, they provide entry points for new trades and wider dislocations from which to generate alpha. While not trying to forecast factor performance, we maintain a slight preference for quality and profitability metrics, which should help to guide stock selection as companies with strong cash flow generation and stable balance sheets are generally best positioned to navigate a slower growth regime.

One area of growing but rather nebulous concern is the impact on alpha generation of any potential failure of the larger hedge fund multi-strategy platforms. There has been a significant and aggressive ‘war for talent’ across these platforms in recent years, sparked by higher-than-average alpha generation for the hedge fund industry in 2021 and 2022. The largest players have become larger, imposing more onerous liquidity and fee terms for investors to protect their business and to allow for greater largesse when attracting new employees. The risks of failure of these platforms are now being looked at by global regulators, given their large market footprint.

It seems sensible to monitor one’s exposure to crowded positing and common factors, and to hold exposure to managers who are generally smaller and investing in more liquid securities.

While it is impossible to predict if, how, or when any of these players could cause a systemic event in markets, it is likely that contagion from any such event would be material for all hedge fund strategies, not least those in the equity long-short sector. Our views on whether one should try to avoid such risks are still evolving, but it seems sensible to monitor one’s exposure to crowded positing and common factors, and to hold exposure to managers who are generally smaller and investing in more liquid securities, as this provides much-needed nimbleness to navigate any future contagion events.

[ad_2]

Source link