[ad_1]

Technology companies are driving the stock market higher than ever before, with a few widely held stocks responsible for most of the gains, making Microsoft the most valuable company in the United States.

Technology companies are driving the stock market higher than ever before, with a few widely held stocks responsible for most of the gains, making Microsoft the most valuable company in the United States.

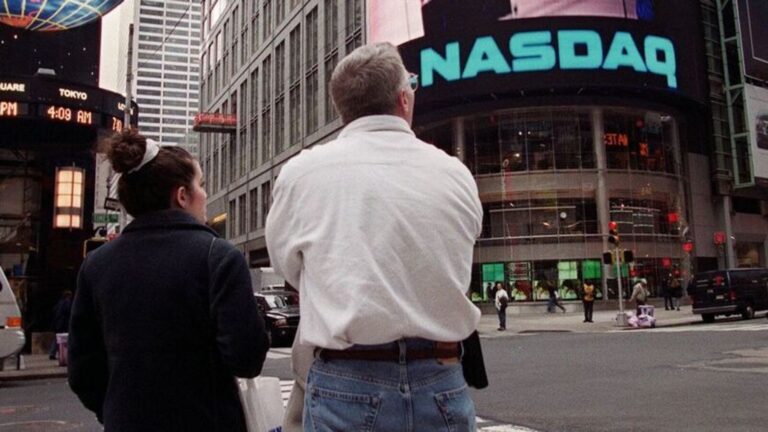

The year is 1999, which is also the day the Invesco QQQ Trust exchange-traded fund, known as QQQ, debuted. Its launch transformed the world of investing in some ways. But 25 years later, tech investors still face the same fundamental questions and market trends.

Hello!Reading premium articles

The year is 1999, which is also the day the Invesco QQQ Trust exchange-traded fund, known as QQQ, debuted. Its launch transformed the world of investing in some ways. But 25 years later, tech investors still face the same fundamental questions and market trends.

The fund, once synonymous with the dot-com boom and bust, has now grown into a $250 billion behemoth. This is the main tool used by large and small investors to gain broad exposure to big tech stocks.

QQQ, which invests in 100 of the largest non-financial companies listed on the Nasdaq stock exchange, will celebrate its 25th anniversary next month. It has experienced major ups and downs during this time, but it has been a winner for buy-and-hold investors. If you invested $1,000 in the fund’s debut on March 10, 1999, it would have been worth $9,394 at the end of 2023, almost doubling, with dividends reinvested. A similar investment in a fund that tracks the S&P 500.

Microsoft, currently valued at just over $3 trillion, is QQQ’s largest holding today, just as it was in 1999. Apple also participated in the fund at its launch, as did Amazon.com. These companies have dramatically transformed their core businesses over the past 25 years while maintaining dominant stock market performance.

“People forget that Amazon became famous because they were trying to put Barnes & Noble out of business,” said Ryan McCormack, Invesco’s senior ETF strategist who covers QQQ. “And then they made the iPod. Microsoft sold the software on CD-ROM.” . ”

Nasdaq launched QQQ near the peak of the dot-com bubble. This fund occurred shortly after its establishment, from early 2000 to late 2002, when its stock price plummeted by more than 80%. The investor who bought in 1999 and 2000 said he was submerged in the investment for more than a decade, highlighting the boom-and-bust nature of the investment. Technology investment.

Few investors expect a repeat of 2000, but some say there are eerie similarities to today’s market. The Nasdaq 100 index soared 54% last year. Enthusiasm about artificial intelligence and a handful of big tech stocks are repeatedly pushing major stock indexes to new records.

The AI frenzy has extended beyond traditional bets like Nvidia and Microsoft to stocks like British chipmaker Arm Holdings, whose stock price soared nearly 50% in a single trade last week. Other risky investments, such as Bitcoin, are also surging. The token recently crossed $50,000 for the first time since late 2021, when near-zero interest rates had investors chasing all kinds of speculative assets.

Investors and analysts tend to get nervous when a handful of large-cap stocks are responsible for most of the market’s rally. That’s because I worry that if a few companies stumble, a broader decline awaits. Current prices reflect expectations for significant growth and adoption of AI in the coming years, but this nascent technology has little track record.

However, throughout the ups and downs of the tech industry, capital inflows to QQQ have been consistently strong. By the end of 2000, QQQ had nearly $24 billion in assets, according to Morningstar. It currently has approximately $250 billion in assets, making it the fifth largest U.S. ETF behind the four broad-based stock market funds.

ETFs, which allow investors to buy and sell hundreds of shares through a single publicly traded stock, have become ubiquitous in the decades since QQQ’s creation. They popularized the idea of simply following the market, a strategy known as passive investing, which Nasdaq promoted as part of its QQQ advertising campaign after its launch.

Investors now take for granted the ability to buy a broad basket of stocks cheaply and quickly. In 1999, it was suddenly revolutionary to be able to invest in all Nasdaq 100 companies at once. No other funds tracked the index.

The fund became a huge hit almost overnight, as Nasdaq pumped millions of dollars into advertising QQQ, and the fund continued to rise.

“The Nasdaq was going up every day and people were asking, ‘How can I get in on this?’ The answer was Qs,” said John Jacobs, a former Nasdaq executive who led the launch of QQQ. .

“There was a tech bubble, new companies going public everywhere, people learning to day trade for the first time. QQQ was a symbol of what was happening, and it made ETFs known to retail investors,” he added. .

Nasdaq eventually reached a revenue-sharing and licensing agreement with PowerShares, which took over the fund in 2007, shortly after Invesco acquired PowerShares.

Today, QQQ is Invesco’s largest fund and has a significant ecosystem around it, allowing investors to gain long, short, inverse or leveraged exposure. Asset managers are now also offering cheaper versions of QQQM aimed at retail investors who don’t need the liquidity that large institutions crave.

Email Jack Pitcher at jack.pitcher@wsj.com.

[ad_2]

Source link