[ad_1]

A version of this post first appeared on TKer.co

Stocks hit a new all-time high last week, with the S&P 500 rising 1.2% to close at 4,839.81. The index has increased 1.5% since the beginning of the year and is up 35.3% from its closing low of 3,577.03 on October 12, 2022.

Stock markets often fall while rising. This is the fundamental truth his longtime TKer readers will remember from his October 2021 debut publication.

The last time the S&P hit a record high was in January 2022. Wall Street was bullish heading into 2022, with most strategists confident the S&P would end the year above $5,000. But high inflation, widely believed to be temporary, persisted and continued to heat up in early 2022 as hot demand and tight supply chains remained unbalanced.

As a result, the Federal Reserve has tightened monetary policy much more aggressively than initially expected. Federal Reserve Chairman Jerome Powell even warned that economic “pain” may be necessary to win the fight against inflation.

Hawkish monetary policy meant tighter financial conditions, which meant higher interest rates, tighter lending standards and pressure on stock market valuations, all of which were a challenge for stock markets. . It has become clear that the market will continue to be hit by the Federal Reserve until the inflation rate improves.

Fortunately, inflation peaked in mid-2022 and began to subside, and has continued to ease ever since. The stock market bottomed in October 2022, months before the Fed stopped raising rates and even before it clearly signaled a dovish turn in policy rates. Approach to Monetary Policy — This makes sense if you remember that the stock market is a discounting mechanism.

For the remainder of 2022 and throughout 2023, inflation continued to decline as a result of tight monetary policy. Impressively, during this period there was increasing evidence suggesting the emergence of a bullish “Goldilocks” soft-landing scenario in which economic growth is sustained and inflation cools to manageable levels without the economy slipping into recession.

Meanwhile, the stock market soared in 2023, with the S&P 500 up an impressive 24%.

Wall Street had a relatively positive outlook for 2024, with most expecting the S&P to rise in the mid-to-high single digits this year. But the market again followed many people. Goldman Sachs strategist red blood cellsand UBS We have already revised our year-end targets upward, and January is not over yet.

As I wrote on Friday, the simplest explanation for why stocks are rising is that the outlook for earnings growth, the most important long-term driver of stock prices, is positive.

zoom out

Will the rally continue? In the short term, no one can predict that.

The experience of the past two years reminds us that TKer Stock Market Truth #2: The short term may be smokey, but TKer Stock Market Truth #1: The long game is undefeated. ”

[T]”The S&P 500 Index has recorded 1,176 new highs since its inception in 1957,” Invesco’s Brian Levitt said Friday. “This equates to a new all-time high every two weeks, or every 14.3 days. History suggests that investors are sensitive to how markets move over their lifetimes, even if the path is not always straight. We should expect it to reach new highs again.”

The situation will probably become unstable again in the coming days, weeks, or months. But history continues to show that the stock market rewards investors who can put in the time.

There were some notable data points and macroeconomic trends to consider last week.

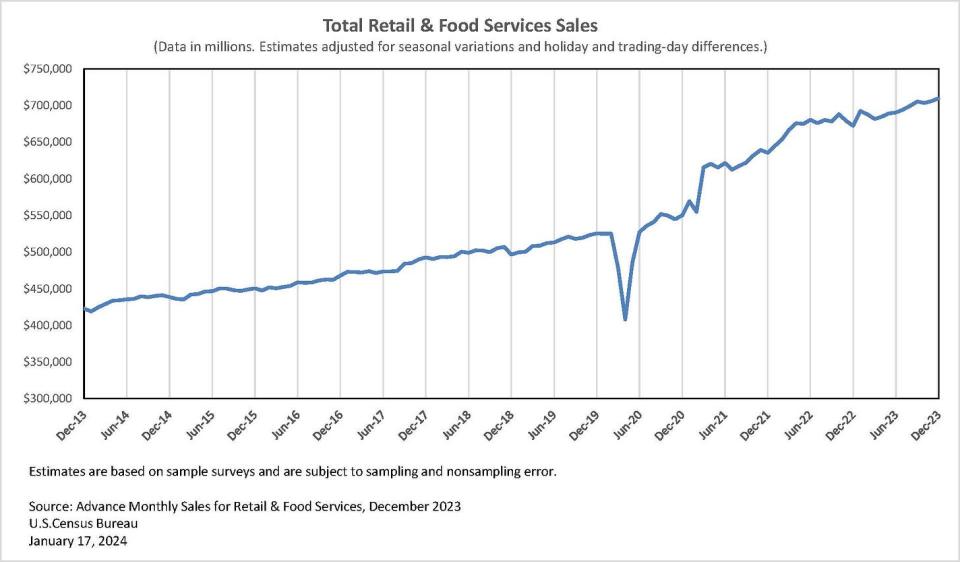

🛍️ consumers are spending. Retail sales rose 0.6% in December to a record $709.9 billion.

Categories driving growth Includes department stores, online, clothing, automobiles and parts, and building materials. Sales of gas stations, furniture, and electrical appliances decreased.

Consumer sentiment soars. The University of Michigan’s Consumer Confidence Index rose in January. From the survey: “Consumer sentiment rose 13% in January, reaching its highest level since July 2021, showing that the sharp rise in December was no fluke. Consumer views were supported by confidence that inflation has turned a corner and stronger income expectations.Sentiment has risen a cumulative 29% in the past two months, the highest since the end of the recession in 1991. This was the largest increase ever.”

The number of unemployment insurance applications has decreased. The number of new applications for unemployment benefits for the week ending January 13 was 187,000, down from 203,000 the previous week. This is just above the September 2022 low of 182,000 and remains at a level historically associated with economic growth.

Gasoline prices soar. From AAA: “The national average for a gallon of gasoline is $3.09, up 2 cents from last week. The likely cause is winter weather that disrupts refining operations and gasoline distribution. Pump prices are skyrocketing in the region’s frigid regions.

Mortgage interest rates fall. The average interest rate on a 30-year fixed-rate mortgage fell to 6.60% from 6.66% the previous week, according to Freddie Mac. From Freddie Mac: “Mortgage rates fell this week, hitting their lowest levels since May 2023, which is encouraging for first-time homebuyers who are sensitive to changes in the housing market, especially home affordability. However, as purchasing demand continues to cool, already depleted inventories for sale will be under further pressure.”

Homebuilder sentiment improves. From NAHB’s Alicia Huey: “Lower interest rates have improved the housing affordability situation over the last month, bringing some buyers back to the market after leaving due to higher borrowing costs in the fall. …The number of single-family home starts is expected to increase in 2024, adding much needed inventory to the market. However, builders are concerned about the cost and availability of building materials and even the supply of lots. In this respect, we will face increasing challenges.”

New home construction data varies. According to the Census Bureau, housing starts fell 4.3% in December to an annual rate of 1.46 million units. The number of building permits increased by 1.9% to 1.49 million units per year.

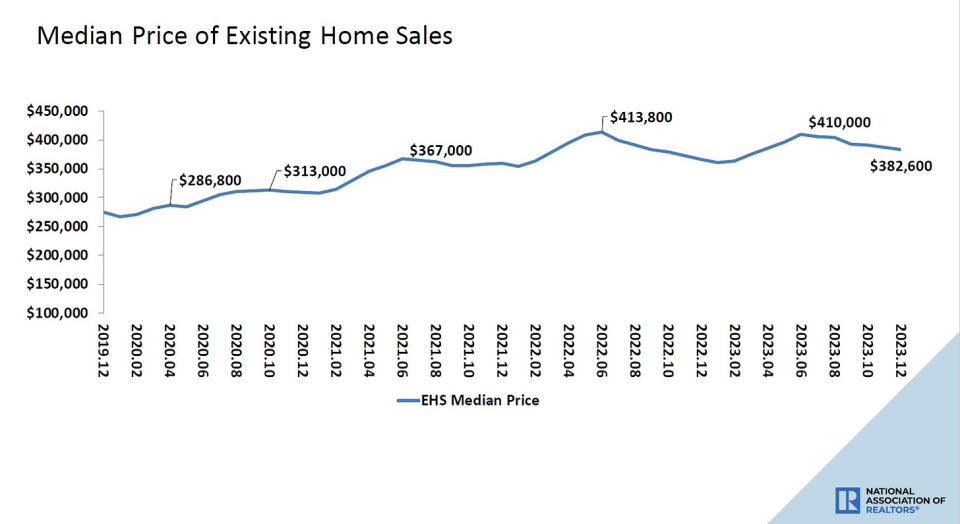

home sales are cool. Existing home sales in December decreased by 1.0% to an annual rate of 3.78 million units. NAR Chief Economist Lawrence Yun said: Mortgage rates are significantly lower than they were just two months ago, and more inventory is expected to hit the market in the coming months. ”

house prices fall. Prices of existing homes fell month-on-month, but rose from the previous year’s level.from NAR: “The median existing home price for all home types in December was $382,600, up 4.4% from December 2022 ($366,500).”

Regional business research continues to look gloomy. The New York Fed’s Empire State Manufacturing Survey index of general business conditions in January fell to its lowest level since May 2020.

According to the Philadelphia Fed’s Manufacturing Outlook Survey, recent activity picked up in January but still suggests contraction. Meanwhile, the future activity index sank to its lowest level since May.

Remember that during times of stress, soft data tends to be more exaggerated than actual hard data.

Industrial activity will increase. Industrial production activity rose 0.1% in December from November’s level, and manufacturing production also rose 0.1%.

Professionals worry about many things.. According to BofA’s January Global Fund Manager Survey, fund managers identify “geopolitical deterioration” as their “biggest tail risk.”

The truth is, we are always worried about something. That’s just the nature of investing.

Short-term GDP growth forecasts look good. The Atlanta Fed’s GDPNow model projects real GDP growth of 2.4% in the fourth quarter.

All together 🤔

We continue to receive evidence that we are experiencing a bullish “Goldilocks” soft landing scenario in which the economy falls to a manageable level without going into recession.

This comes as the Federal Reserve continues to adopt highly austere monetary policy in its ongoing efforts to control inflation. It’s true that the Fed took a less hawkish tone in 2023 than it did in 2022, and most economists believe the last rate hike of the cycle has either already happened or is close. agree, but inflation still needs to subside further and central banks need to remain calm for some time to come before they are satisfied with price stability.

Therefore, we should expect central banks to continue tightening monetary policy. This means you need to prepare for a prolonged period of tight financial conditions (e.g., rising interest rates, stricter lending standards, and lower stock valuations). All of this means that monetary policy will be unfriendly to markets for some time to come, increasing the relative risk that the economy will fall into recession.

At the same time, we know that stock prices have a discount mechanism. That means prices will bottom out before the Fed signals a major dovish shift in monetary policy.

It’s also important to remember that while the risk of a recession may be increasing, consumers are coming from a very strong financial position. Unemployed people can get jobs, and people with jobs can get raises.

Similarly, many companies have fixed their debt at low interest rates in recent years, so their corporate finances are healthy. Despite the looming threat of higher debt servicing costs, rising profit margins are giving companies room to absorb higher costs.

At this point, any recession is unlikely to turn into an economic disaster, given that the financial health of consumers and businesses remains very strong.

And as always, long-term investors should remember that recessions and bear markets are just part of the trade when entering the stock market with the aim of generating long-term profits. The market has been pretty tough over the past few years, but the long-term outlook for stocks remains positive.

A version of this post first appeared on TKer.co

[ad_2]

Source link