[ad_1]

Bitcoin surpassed the $60,000 mark for the first time since the back end of 2021. This rally was fueled by the long-awaited approval of a Spot Bitcoin ETF, suggesting institutional adoption is coming.

While this has been one of the key drivers for rising asset values, another driver is coming. Approximately every four years, Bitcoin mining rewards are cut in half, resulting in fewer Bitcoins in circulation, which in turn increases demand as the asset becomes more scarce. The next similar event will be held in April.

While this is good news for investors, it makes it more difficult for Bitcoin miners to operate as they will be rewarded less for their mining activities. That said, assuming prices remain flat to high going forward, the price of BTC should exceed the total cash break-even point for public miners after the halving, according to Needham analyst John Todaro. thinking.

“We expect major publicly traded miners to mine Bitcoin at lower cash costs than the current Bitcoin price,” the 5-star analyst elaborated. “Theoretically, break-even costs would double at the halving, but we note that new rig efficiency gains and rising Bitcoin prices provide a healthy margin cushion.”

However, as with any sector, some trades are better than others, and Todaro is a big believer in two of the most prominent BTC miners, Riot Platforms (NASDAQ:RIOT) and Marathon Digital (NASDAQ:MARA). ) have been investigated in detail. One has an advantage over the other. So let’s find out which one it is. You can also see if the rest of the Street agrees with Needham’s analysis with the help of the TipRanks database.

riot platform

First up is Riot Platforms, a vertically integrated Bitcoin mining company headquartered in Castle Rock, Colorado. The company primarily focuses on Bitcoin mining to support the Bitcoin blockchain. Additionally, Riot provides comprehensive infrastructure for institutional-scale Bitcoin mining at facilities located in Rockdale, Texas (referred to as the Rockdale Facility) and Navarro County, Texas (Corsicana Facility). Masu. The company is touting its Rockdale facility as the largest single Bitcoin mining facility in North America based on developed capacity, with potential expansion plans underway. In addition, Riot is developing its Corsicana facility, which is expected to have approximately 1 gigawatt of capacity when completed.

The company’s business is divided into three segments: Bitcoin self-mining, data center hosting for miners, and manufacturing equipment for mining such as electrical components and immersion cooling technology.

As of the end of last year, there were 112,944 miners in circulation in the Bitcoin mining business, with a total hash rate capacity of 12.4 exahashes per second (EH/s), a 28% increase from 9.7 EH/s at the end of the year. doing. The company mined 6,626 Bitcoins during the year, an increase of 19.3% compared to 5,554 Bitcoins mined in 2022. By the end of 2024, the company expects the total hash rate to be around 28 EH/s.

As a result of the above, full-year revenue was $280.7 million, an increase of 8.3% year-over-year, but that number was $7.66 million below consensus estimates. However, FY GAAP EPS of -$0.28 beat expectations by $0.69.

Assessing the miner’s prospects, Todaro outlines three reasons to be bullish on RIOT. 1) Low cost provider: RIOT is one of the lowest cost Bitcoin miners on the public market today, estimating its electricity costs to be around 4 c/kWh. 2) Clean balance sheet : RIOT has no corporate bonds, maintains the largest cash position among its publicly traded mining peers, and also has the largest BTC position relative to its peers. 3) RIOT’s stock is Trading at a premium as the sector has been battered, RIOT is the lowest-cost provider to achieve its facility deployment goals while maintaining a clean balance sheet. This is in contrast to many of our peers who have expanded.”

Todaro quantifies his bullishness by rating Riot’s stock a “buy,” but his $18 price target suggests the stock could rise as much as 25% over the next year. ing. (Click here to see Todaro’s track record)

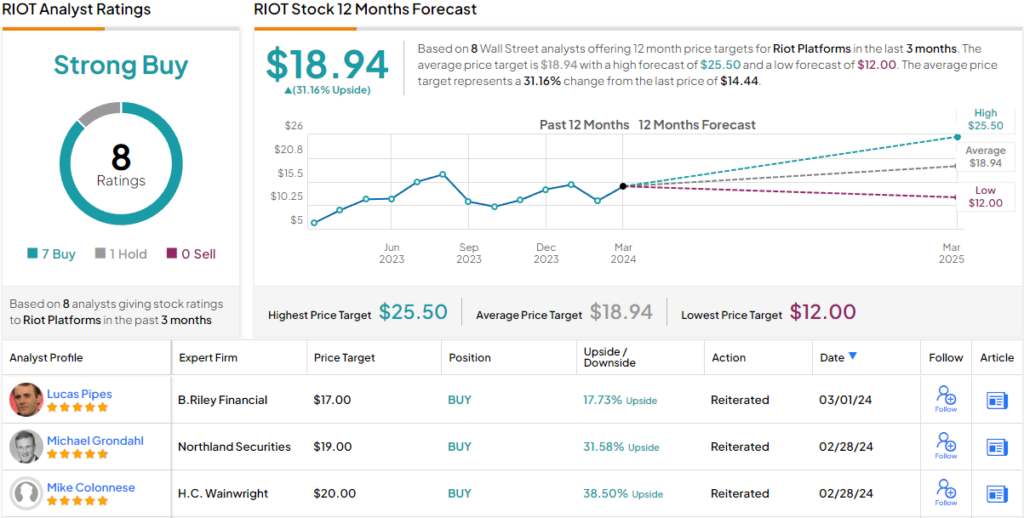

Most analysts agree. Apart from one skeptic, all of his other 6 reviews are positive, making the consensus view here a Strong Buy. At an average price target of $18.94, the stock will trade at a 31% premium in one year. (look RIOT stock price prediction)

marathon digital

Second, Marathon Digital is the largest Bitcoin miner in the US by hashrate and also the largest by market capitalization, which currently stands at around $6 billion. The company started mining crypto assets in Canada in 2017 and moved to the United States in 2020. Since then, he has operated primarily on an asset-light model utilizing third-party data center hosts, and his mining rigs are located at 11 sites around the world. 3 continents.

As of the end of 2023, Marathon operated approximately 210,000 mining rigs with installed and energized hash rates of approximately 25.2 EH/s and 24.7 EH/s. The company expects the hash rate to reach 35-37 exahashes this year, and 50 exahashes by the end of next year, roughly double its current capacity.

Marathon also holds the most Bitcoin among miners, with a total of 15,741 unrestricted BTC as of the end of January. However, the company has no qualms about selling its holdings to cover operating costs. To do just that, in the fourth quarter it sold 56% of the Bitcoin it produced during the same period.

Total mining volume for the quarter reached 4,242 Bitcoins, higher than the 3,490 Bitcoins mined in the third quarter and a 172% increase compared to the 1,562 Bitcoins generated in the same period last year. For the full year, the company mined 12,852 Bitcoins, an increase of 210.1% compared to 2022.

In terms of headline numbers for the fourth quarter, the company had revenue of $156.7 million, a massive 451.4% year-over-year increase and beating consensus by $11.27 million. However, adjectives. EPS -$0.02 was below expectations by $0.04.

Needham’s Todaro takes a more cautious view of Marathon’s prospects as the halving approaches, despite its strong track record on several metrics.

“Marathon has grown to become the largest Bitcoin miner in terms of hash rate over the past two years. During this period, MARA has amassed large Bitcoin balances and benefited from a historic valuation premium over its peers. “We believe this is partly due to the relatively high liquidity of the company’s balance sheet,” Todaro said. “We believe the upcoming Bitcoin halving poses a disruption risk for high-cost miners such as MARA. Given this, we believe the increased short-term risk will weigh on premium investors paying for MARA stock. Therefore, we believe there is limited upside room from now until after the halving in 2024.

Therefore, Todaro continues to maintain a wait-and-see rating with a Hold (i.e. Neutral) rating and does not have a fixed price target in mind.

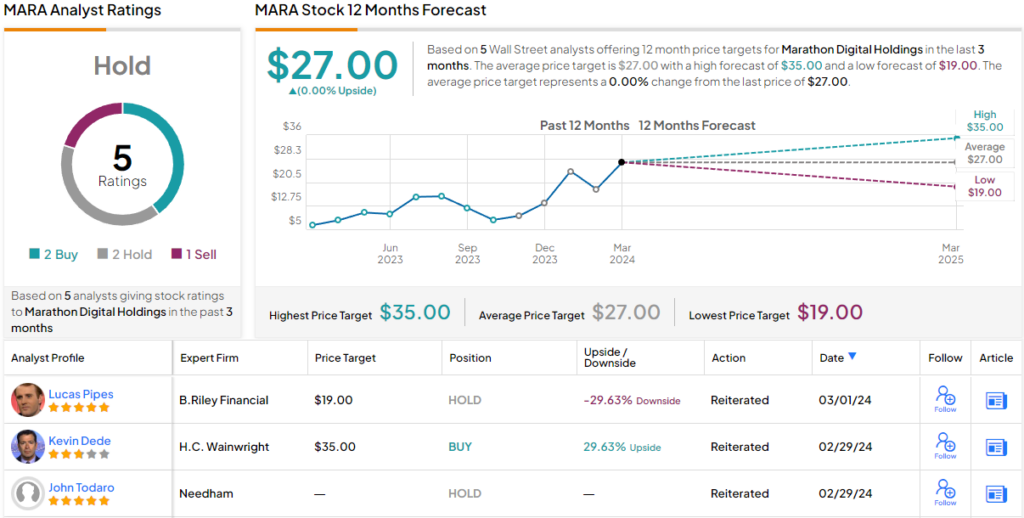

Looking at the consensus breakdown, there are two additional buys, one hold and one sell, with each stock claiming a Hold consensus rating. Analysts expect the stock to remain range-bound for now, based on an average price target of $27. (look MARA stock price prediction)

To find good ideas for trading stocks at attractive valuations, visit TipRanks’ Best Stocks to Buy, the tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. Content is for informational purposes only. It is very important to perform your own analysis before making any investment.

[ad_2]

Source link