[ad_1]

-

U.S. consumer optimism is rising rapidly and may reflect stock market outperformance, writes Paul Krugman.

-

However, stock prices are not a good indicator of future economic health and should be ignored.

-

Americans pay extraordinary attention to stocks due to their high market visibility.

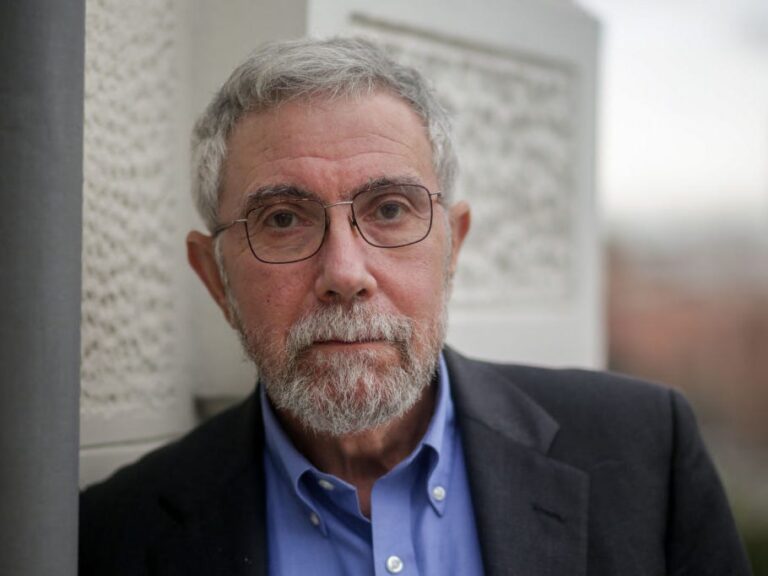

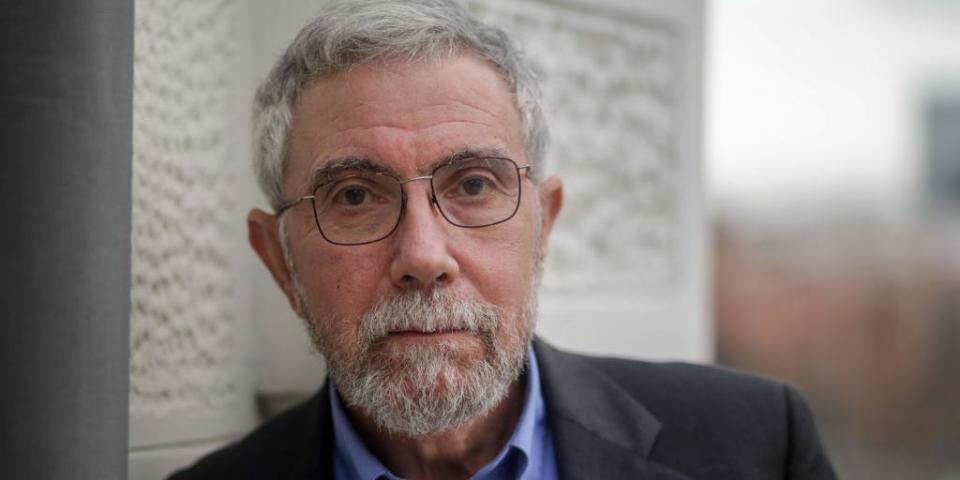

Nobel economist Paul Krugman wrote in the New York Times that consumers are becoming far more optimistic about the economy as bullish stock prices push indexes toward new highs.

But Americans are wrong to view market gains as a sign of broader good news and should ignore them as meaningful indicators of macroeconomic health.

The University of Michigan Consumer Survey for January showed a 13.1% increase from the previous month, marking the highest level since 2021. In parallel, the S&P 500 index has risen 7.2% since the beginning of December, hitting a new high last Friday.

“What to make of rising consumer sentiment? On the one hand, it makes a lot of sense given the economic realities of low unemployment and low inflation,” Krugman wrote. “On the other hand, the timing may have been driven by financial indicators that most Americans should really ignore.”

He said the stock market has historically had a poor track record of accurately predicting the future economy.

For example, previous stock market crashes were touted as signals of an impending recession, but that pessimism ended up being misguided. Examples include the 1987 recession and the 1998 bear market, Krugman wrote.

According to him, there are several reasons why stock prices are not predictive. For example, stock prices are often driven by human emotion rather than rationality, and they rise and fall without any real purpose, he said.

Despite the hawkish rhetoric of central bankers, the current bull market rests on strong expectations for a shift in monetary policy, and that may continue to be the case today.

Additionally, a deepening recession could actually push up stock prices as the Federal Reserve seeks to limit a hard landing from rate cuts. Of course, this will be offset by lower profits, which is a market headwind.

Furthermore, the majority of Americans do not have enough market exposure to justify a significant increase in consumer confidence. He said the median household owns $52,000 worth of stocks, so stock price fluctuations have limited direct impact on consumer finance.

According to Krugman, the reason consumers care so much about the market is because of its high level of recognition.

“The latest movements in stock prices are always displayed on your TV or smartphone, but not in other economic data,” he said. “So it’s kind of natural for people to judge the economy by the numbers they see all the time.”

Read the original article on Business Insider

[ad_2]

Source link