[ad_1]

Energy companies are very cyclical. Their profits expand during economic expansions, but rapidly contract during recessions. After posting record profits in 2022, energy stocks saw their valuations plummet last year due to a combination of the global clean energy transition and macro headwinds. However, the dividend yields of some energy stocks are currently rising. For example, chevron (New York Stock Exchange:CVX) stock is currently trading 21% below its all-time high, offering shareholders a dividend yield of 4.2%.

This makes CVX stock an attractive choice for dividend investors, so let’s take a look at whether you should buy Chevron stock based solely on its relatively high dividend yield.

Investors need to understand that not all dividend stocks are good investments. It’s essential to analyze a company’s fundamentals, such as its dividend payout ratio, balance sheet debt, pricing power, and cash flow, to see if it can maintain and grow these dividends over time. Despite this, I remain bullish on Chevron. This is because of its wide competitive moat, predictable cash flow stream, and sustainable dividend payout ratio.

Chevron Overview

Chevron is engaged in integrated energy and chemical businesses in the United States and other international markets. The company has two major business segments:

- Upstream: Exploration, development, production, and transportation of crude oil and natural gas.

- Downstream: Refining crude oil into petroleum products and selling crude oil, refined products, and lubricating oil.

Chevron has extensive operations in some of the world’s most important oil and gas regions. The company’s upstream portfolio is underpinned by key assets including oil in Kazakhstan, LNG in Australia, shale in the United States and Argentina, deepwater assets in the Americas, and natural gas in the Eastern Mediterranean region.

Chevron is a global energy giant with a market capitalization of $274 billion and an enterprise value of approximately $290 billion.

How did Chevron perform in Q3 2023?

In the third quarter of 2023, Chevron reported adjusted earnings of $5.7 billion, or $3.05 per share, compared to earnings of $10.8 billion, or $5.56 per share, in the year-ago period. Lower oil prices resulted in lower Chevron upstream realizations and lower margins on refined products sales in the September quarter.

Chevron’s third-quarter sales were $51.9 billion, down from $63.5 billion a year earlier due to lower commodity prices.

Despite a difficult and uncertain macro environment, Chevron increased capital spending by more than 50% to $4.7 billion in the third quarter. This includes the $400 million the company spent to acquire a majority stake in ACES Delta.

Chevron acquires Hess for $53 billion

Late last year, Chevron announced plans to acquire Hess (New York Stock Exchange: HE) It was a whopping $53 billion. Hess is a leading exploration and production company that owns long-life growth assets in Guyana.

Chevron expects the transaction to be accretive to cash flow per share in 2025 following the achievement of synergies and the launch of its fourth FPSO (floating production, storage and offloading) vessel in Guyana are doing.

According to Chevron, Guyana’s Stabroek field has more than 11 billion BOE (barrels of oil equivalent) of recoverable resources discovered. Hess’s net production in this basin is approximately 110,000 barrels per day from just two Hess FPSOs. Hess is developing three more FPSOs, which should double his production capacity.

Chevron has identified $1 billion in run-rate cost synergies related to Hess, which it emphasized should be realized within one year of closing. Additionally, the acquisition should improve production and free cash flow growth over the next five years, fueling dividend increases and share buybacks.

These low-premium deals have diversified Chevron’s upstream business. Considering free cash flow from investments in TCO, Permian and Gulf of Mexico, the company expects its free cash flow to more than double by 2027.

Armed with a strong portfolio of cash-producing assets, Chevron emphasized that it will generate $10 billion to $15 billion in asset sales by 2028.

dividend aristocrat

Chevron has raised its dividend for 36 consecutive years, demonstrating cash flow resilience and earning the title of “Dividend Aristocrat.” During this period, Chevron’s dividend grew by 6.6% per year, significantly increasing its effective yield.

In the third quarter of 2023, Chevron reported free cash flow of $5 billion, which is lower than the cash flow of more than $12 billion for the same period in 2022. Considering that it paid out $2.9 billion in shareholder dividends, the company’s payout ratio is below 50%. Chevron has the flexibility to reduce balance sheet debt and target expansionary acquisitions.

Chevron expects to raise its quarterly dividend to $1.63 per share in 2024, an 8% increase from a year ago. The company also plans to allocate $20 billion for share buybacks, which will reduce its total number of shares by 7% and increase its earnings per share in the process.

Is CVX stock a buy, according to analysts?

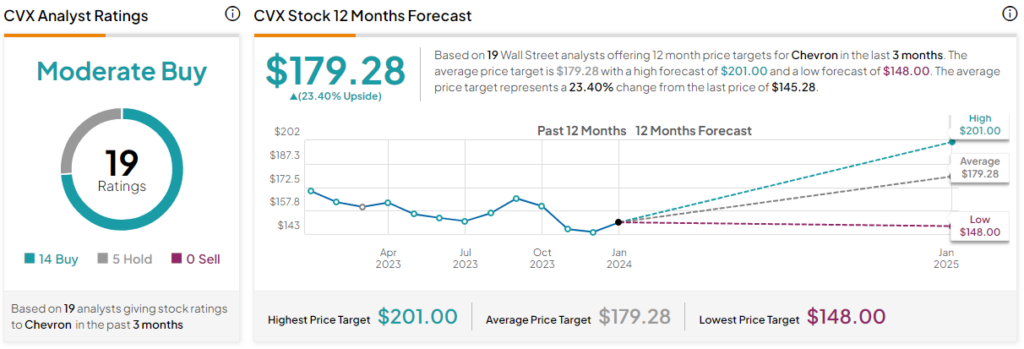

Of the 19 analysts covering CVX stock, 14 recommend a buy, 5 recommend a hold, and none recommend a sell, giving the consensus rating a medium buy. ing. CVX’s average price target is $179.28, 23.4% above the current price.

CVX stock trades at a forward P/E of 10.8x, which isn’t too expensive given its tasty dividend yield and potential for consistent dividend increases. The median forward price/earnings ratio for peer companies is approximately 10x.

Important points

Chevron is a blue-chip energy stock that has weathered multiple economic downturns and maintained its dividend yield. The company says that even if oil prices were to fall 35% from current levels ($50 per barrel of Brent crude), it would still cover capital expenditures and dividend payments, with a significant margin of error.

In addition, with less than $15 billion in adjusted debt (total debt less cash, cash equivalents, and securities), Chevron will be able to easily raise funds to advance its acquisition of Hess, providing regular This makes it an attractive investment option for companies seeking dividend income.

disclosure

[ad_2]

Source link