[ad_1]

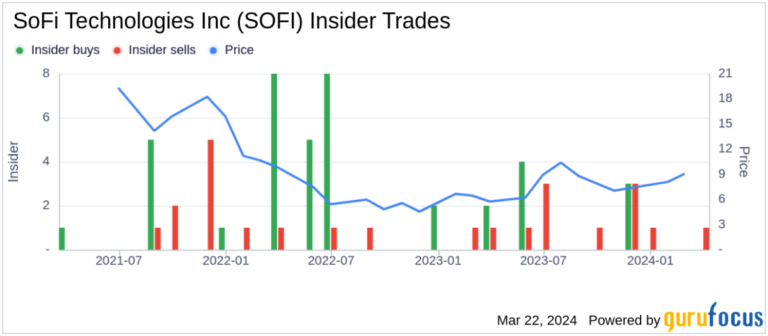

SoFi Technologies Inc (NASDAQ:SOFI), a specialist personal finance company offering products such as student and personal loans, mortgage refinancing and wealth management services, has reported an insider sale, according to a recent SEC filing. Chief Technology Officer Jeremy Richelle sold 56,273 shares of the company’s stock on March 19, 2024. The transaction was disclosed in a legal filing with the Securities and Exchange Commission, which is available at this link. Following the sale, the insider now owns a direct stake in the company. The shares were sold at an average price of $6.93, for a total transaction in the hundreds of thousands of dollars. Over the past year, insiders sold a total of 366,078 shares of SoFi Technologies Inc., but they didn’t buy any company stock. stock. This sale represents a continuation of the insider selling pattern over the period.

SoFi Technologies Inc’s insider trading history shows that insider sales have been more likely than purchases over the past year. There were 10 insider sales and 7 insider buys during this period. SoFi Technologies Inc’s stock was trading at $6.93 on the day of the sale, giving the company a market cap of $7.267 billion.

Price to GF Value ratio is 0.85, indicating that SoFi Technologies Inc is fairly valued based on GF Value of $8.18. GF Value is a proprietary intrinsic value estimate by GuruFocus that takes into account historical trading multiples, GuruFocus adjustment factors based on the company’s past performance, and Morningstar analyst forecasts of future performance.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

[ad_2]

Source link