[ad_1]

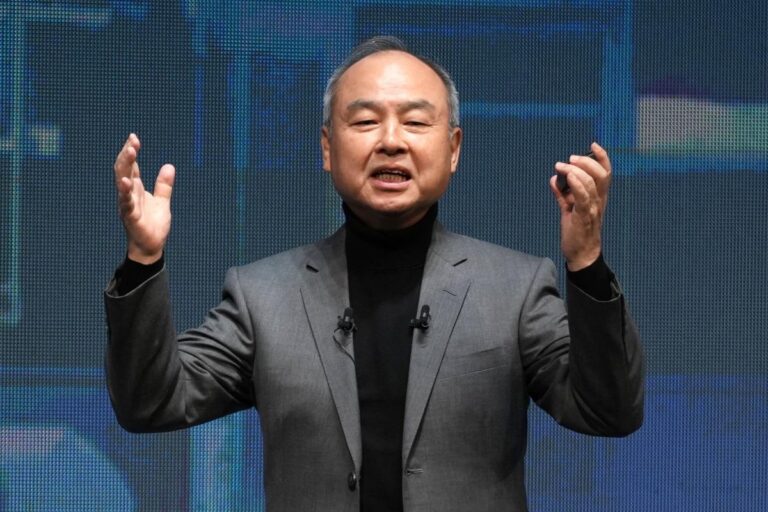

(Bloomberg) – SoftBank Group Corp. shares rose as founder Masayoshi Son is considering creating a $100 billion chip venture that would supply AI-enabled semiconductors.

Most Read Articles on Bloomberg

The Tokyo-based technology investor’s shares soared as much as 3.2% after Bloomberg News reported that the 66-year-old billionaire is seeking funding for a foray into AI chips to compete with Nvidia Inc. Rose. The project, code-named “Izanagi,” aimed to build an AI chip venture to complement chip design company Arm Holdings, in which SoftBank holds a majority stake.

Read more: Masayoshi Son aims to build $100 billion AI chip venture

One of the scenarios Son is considering could see SoftBank provide $30 billion, with $70 billion of that coming from Middle Eastern institutions, one of the people said.

If he succeeds, the chip project will not only dwarf Microsoft’s OpenAI bet, but will also account for about a fifth of the global semiconductor market. Named after the Japanese god of creation and life, the project reflects Son’s unfettered enthusiasm for the advent of artificial general intelligence. He often says that he would be happier in a world filled with smart machines rather than humans.

After experiencing a series of setbacks investing in startups, the Japanese entrepreneur has seen Arm achieve solid success. Softbank stock has risen about 30% in the past 10 business days, and Arm stock has also risen more than 80%.

Mr. Son sees a chance to build a company that rivals the Magnificent Seven’s in the AI space, the people said.

Thanks to the recovery in global stock markets, SoftBank had 6.2 trillion yen ($41 billion) in cash and cash equivalents as of Dec. 31. The company’s balance sheet was boosted by a windfall of about $8 billion worth of T-Mobile US Inc. stock and the company’s 90% stake in Arm.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link