[ad_1]

Women + Wealth: Regions Bank launches enhanced program to support women in financial activities

BIRMINGHAM, AL – January 3, 2024 – Regions Bank announced Wednesday the launch of Women + Wealth. It is an innovative program that combines unique events and fresh insights with one-on-one coaching from a team of experts to further support and empower women on their financial journey.

The Women + Wealth program, an initiative of Regions Private Wealth Management, debuts at a time when more women across households are making investment and financial planning decisions.

“This is a program designed to listen to our clients, meet them where they are, and help them achieve their unique financial goals,” said Leslie Carter Prall, head of Regions Private Wealth Management. and provide more strategic insight.” “At Regions, we have always taken a customized approach to achieving our clients’ goals. Women + Wealth is the latest expansion of our commitment to provide more customized guidance and solutions for our advisors. is.”

Regions’ Women + Wealth program builds on the foundation established by the bank’s previous HerVision HerLegacy initiative and provides even more insight into the insights that matter to all women, regardless of their age, needs, or goals. Expanded to provide access. Women + Wealth is led by regional advisors known as Women + Wealth Champions who work one-on-one with current wealth management clients as well as the region’s commercial and consumer banking clients. , to provide you with more timely advice, guidance, and service. Resources for women to help make important financial decisions.

Resources are now available through Wealth Insights on Regions.com. There, people can access a variety of content to build, protect, and maintain wealth. Specialized content for women is also available, including articles focused on topics such as women and philanthropy, and podcast episodes covering topics such as overcoming barriers to financial confidence. Other examples of women + wealth content include:

Upcoming events and webinar on January 8th:

In the coming weeks, Women + Wealth Champions will lead gatherings of women across their regional markets to discuss:

- General finance

- The importance of actively participating in financial discussions

- And how to be proactive in preparing for your financial journey

Additionally, a special free webinar called “Women + Wealth: A Conversation with CMT’s Leslie Fram” will be held on Monday, January 8th at 4:30pm Central Time. Frum is CMT’s senior vice president of music strategy and talent. She shares about her personal challenges and triumphs in music and wealth. Additionally, Frum discusses her plans for retirement, the importance of credit, career tips for women, and more.

This webinar will be moderated by Regional Wealth Advisor Lisa Harless. You can register for the discussion using this link. Webinars are open to regional clients and non-clients alike.

“We know there is a massive wealth transfer happening across the country, and we know that women will benefit,” Carter-Prall concluded. “At Women + Wealth, our goal is to further empower and inform women as they shape their financial future and leave a legacy for themselves and their families. We are proud to announce this latest example of our dedication to meeting the needs of our customers and look forward to continuing to build on this commitment over the long term.”

About Regions Financial Corporation

Regions Financial Corporation (NYSE:RF), with $154 billion in assets, is a member of the S&P 500 Index and one of the nation’s largest full-service providers of consumer and commercial banking, wealth management, and mortgage products and services. is. Regions serves customers throughout the South, Midwest and Texas, and operates approximately 1,250 bank branches and more than 2,000 ATMs through its subsidiary, Regions Bank. Regions Bank is an Equal Housing Finance Corporation and Member FDIC. Additional information about Regions and all of its products and services can be found at www.regions.com.

Investment, insurance and pension products are not FDIC insured, bank guaranteed or deposits. It is also not guaranteed by any federal agency or a condition of any banking transaction and may lose value.

Capital Square acquires Tennessee rental townhome community for DST services

KNOXVILLE, Tenn. (January 3, 2024) – Capital Square, one of the nation’s leading sponsors of tax-advantaged real estate investments and an active developer and manager of multifamily communities, announced today that , announced the acquisition of the newly constructed 120-unit Summit Townhomes. -Built-to-Rent (BFR) housing community in Knoxville, Tennessee. The community was acquired on behalf of CS1031 Summit Place BFR Housing, DST, which aims to raise his $18 million in capital from accredited investors, with a minimum investment of his $50,000.

Capital Square will be led by experienced real estate executives Dave Platter and John Trott as managing directors and co-leads to capitalize on housing market opportunities, including a purpose-built rental strategy in the high-growth Sunbelt. We have established a private equity group that we manage as private equity investors. market. This is his fourth BFR proposal for the Section 1031/DST program with Capital Square and his seventh BFR project for the private equity group.

“Capital Square’s Private Equity Group is a talented team with top-notch executives focused on housing strategies, including BFR,” said Louis Rogers, Founder and Co-Chief Executive Officer of Capital Square. “This will be one of the largest BFR platforms in the country. Capital Square Secures First Institutional Partner for BFR Strategy and Closes Recruitment for Summit Townhomes, DST Program’s 7th BFR Community I have previously reported what happened.”

Construction on the Summit townhomes, located at 100 Lisa’s Way, was completed in 2022. A combination of three- and four-bedroom townhomes average more than 1,400 square feet and feature open floor plans, marble countertops, stainless steel appliances, full-size washers and dryers, and walk-in showers. I am. Closets, smart home integration, and additional storage space. Community amenities include a fireplace, picnic and barbecue areas, private and overflow parking, a covered gazebo, and a bark park.

The facility is located near State Route 62, and residents are close to top employers such as Oak Ridge National Laboratory, Y-12 National Security Complex, UT Battelle, Methodist Medical Center at Oak Ridge, and Oak Ridge Schools. can be easily accessed. Summit Townhomes is home to Woodland Elementary School, Robertsville Middle School, and Oak Ridge High School, all within a 2-mile radius.

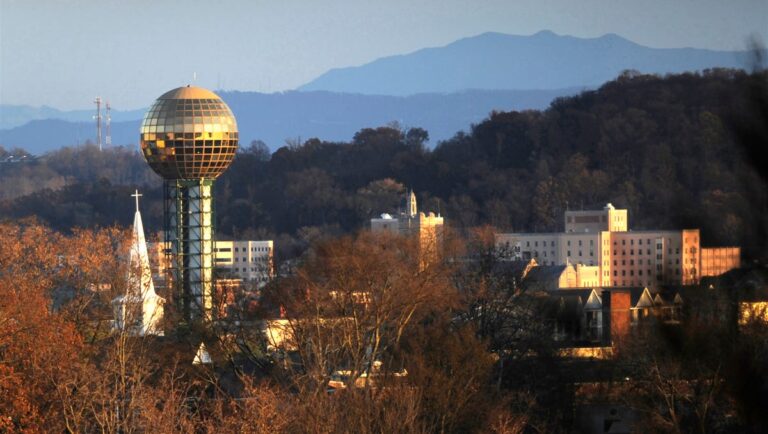

Summit Townhomes is less than a 30-minute drive from downtown Knoxville. The population of Knoxville MSA is 747,185 and is projected to grow by 3.6% over the next five years.1 The University of Tennessee plays an important role in Knoxville’s economy. With iconic landmarks like Neyland Stadium, which seats more than 100,000, university sporting events generate meaningful revenue for local businesses. Additionally, the university employs more than 11,700 employees and focuses on research, educational programs, and partnerships that contribute to economic growth across the city.

“Knoxville is an attractive and promising real estate market, combining affordability, a stable rental market with universities and government employment, stable economic growth, and favorable income tax policies,” said Co-CEO. said Whitson Huffman. “The property is already performing well, with current physical occupancy of 98% and a full lease-up in nine months.”

Since its founding in 2012, Capital Square has served more than 6,500 investors seeking quality alternative properties eligible for tax deferral under Section 1031 of the Internal Revenue Code and others seeking stable cash flow and capital growth. has acquired 170 real estate assets for investors in

[ad_2]

Source link