[ad_1]

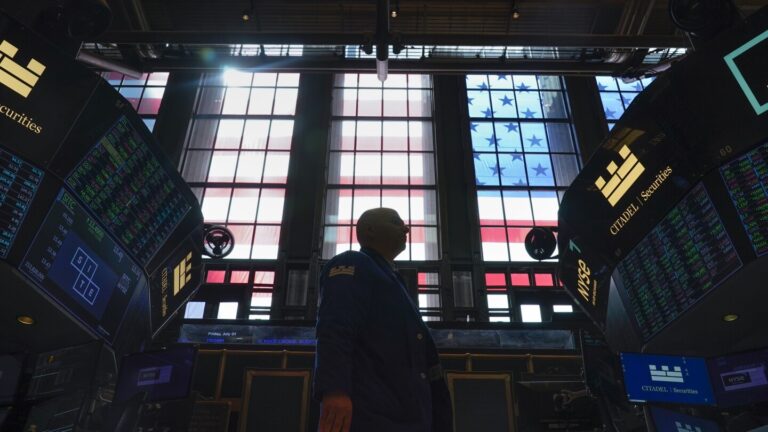

NEW YORK (AP) — Wall Street extended its record as U.S. stock indexes rose Friday.

The S&P 500 rose 0.7% in afternoon trading, after hitting a new high the previous day. As of 1:47 p.m. ET, the Dow Jones Industrial Average was up 75 points, or 0.2%, and the Nasdaq Composite was up 1.2% the previous day, surpassing its all-time high set in 2021.

In the bond market, U.S. Treasury yields fell after reports on manufacturing and U.S. consumer sentiment were weaker than economists expected. The data supported the view that the Federal Reserve could start cutting interest rates in June, especially after Thursday’s report showed. An important measure of inflation The Fed has been closely tracking whether it has behaved more or less as expected over the last month.

Dell Technologies surged 29.3%, helping to support the stock market. The company reported profit and revenue for its latest quarter that beat analysts’ expectations, highlighting demand for AI-optimized servers.

Demand for artificial intelligence technology is increasing with no end in sight, and stock prices have skyrocketed over the past year. Even Dell’s roughly 140% rise over the past 12 months pales in comparison to Nvidia’s more than 240% rise.

NetApp reported stronger-than-expected financial results and said it was seeing “good momentum in the AI space,” with its shares soaring 21%. The data firm also provided a forecast range for this quarter’s earnings that beat multiple analyst expectations.

The atmosphere in the banking industry has become even more tense. new york community bancorp It fell 24.9%. The company warned investors late Thursday that it had discovered weaknesses in its internal loan review methods due to ineffective oversight, risk assessment and monitoring activities.

The company filed a complaint worth $2.4 billion over its performance for the last three months of 2023, saying it had not submitted its annual report on time. The company’s CEO resigned with immediate effect after 27 years with the company.

After several banks failed during last year’s industry crisis, much attention has been focused on small and medium-sized regional banks. One of those banks, Signature Bank, was absorbed into NYCB, resulting in the bank facing increased scrutiny in the race for real estate loans.

While NYCB faces many unique challenges, there are concerns that banks across the industry are facing challenges from lending for real estate projects.

Interest rates have been high since the US Federal Reserve raised its key policy rate to the highest level since 2001, increasing pressure on the financial system. There was hope that the Fed would cut interest rates several times this year to relieve some of that pressure.

The Fed has indicated it may do so if inflation continues to cool decisively toward its 2% target. But a series of better-than-expected economic reports are forcing Wall Street traders to postpone their predictions for when interest rates will begin to cut. The expectation now is that the Fed could start in June after traders shelved their original March predictions.

Expectations for an interest rate cut in June to remain unchanged were heightened following reports that the U.S. manufacturing industry contracted in February for the 16th consecutive month. Manufacturing is one of the worst-performing sectors of the economy, but a resilient job market and spending by U.S. consumers are supporting the economy. The Institute for Supply Management’s report also said prices paid by manufacturers for raw materials rose again, but at a slower pace than in January.

A separate report from the University of Michigan said U.S. consumer sentiment was weaker than economists expected. February saw a decline from January, but maintained most of the gains from recent months. This is important because spending by U.S. consumers makes up a large portion of the economy.

In the bond market, US bond yields fell in response to the statistical report. The yield on the 10-year U.S. Treasury note fell to 4.19% from 4.25% late Thursday and 4.28% just before the data was released.

The two-year Treasury yield, which more accurately reflects expectations for the Fed, fell to 4.53% from 4.62%, roughly back to where it was two weeks ago. That was before several reports said that inflation last month was higher than expected at both the consumer and wholesale levels.

Economists at Deutsche Bank expect the Fed to cut its key interest rate by 1 percentage point this year to 5.50% from the current 5.25%. Like many traders, he expects the Fed to take office in June.

But Matthew Ruzzetti, the nation’s chief economist, said there are several reasons to be cautious about cuts. The biggest factor is the fact that stock prices are already rising and U.S. Treasury yields are already falling on expectations of future interest rate cuts, which could ease economic conditions and increase upward pressure on inflation. There is sex.

In overseas stock markets, Japan’s Nikkei Stock Average rose 1.9%. The unemployment rate fell to 2.4% in January, although indicators of manufacturing activity showed a contraction.

In the rest of Asia and Europe, the index rose more slowly.

___

AP writers Matt Ott and Zimo Zhong contributed.

[ad_2]

Source link