[ad_1]

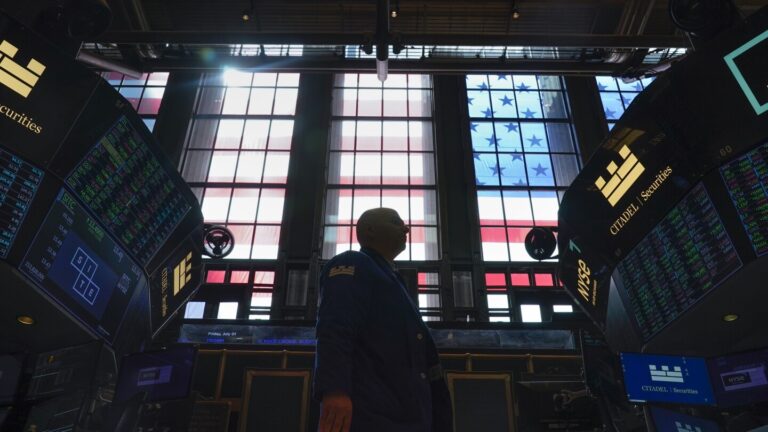

NEW YORK (AP) — Wall Street ended its worst week since Halloween on a languid Friday after reports that workers are getting big raises, but key parts of the economy remain overheated. It doesn’t look like that.

The S&P 500 rose 8.56 points, or 0.2%, to 4,697.24 after bouncing between modest gains and losses throughout the day. After surging in 2024 on expectations that inflation and the broader economy have cooled enough for the Federal Reserve to cut interest rates sharply by the end of the year, the index ended its first week of decline in a decade. Ta.

The Dow Jones Industrial Average rose $25.77, or 0.1%, to $37.466.11, inching closer to the record set earlier this week. The Nasdaq Composite rose 13.77 (0.1%) to 14,524.07.

U.S. Treasury yields soared in the bond market following the economic report. It initially rose after the latest monthly jobs report showed. US employers unexpectedly accelerated hiring last month. Average hourly wages for workers also rose, even though economists had predicted a decline.

These strong numbers are good news for workers and should keep the economy in good shape. This is positive for corporate profits, which is one of the main factors determining stock prices.

But what worries Wall Street is that strong data could persuade them. federal reserve Upward pressure on inflation remains. This could mean the Fed will keep interest rates high for longer than expected. Interest rates affect another major factor in determining stock prices, and high interest rates have a negative impact on financial markets.

The jobs report temporarily boosted traders’ expectations for when the Fed will start cutting interest rates. However, a report this morning showed that growth in financial, real estate and other U.S. service industry companies was slower than economists expected last month.

The report quickly raised traders’ expectations that the Fed would begin lowering interest rates in March. According to CME Group data, they currently predict that the probability is almost two-thirds, similar to the day before.

Overall, the data could strengthen Wall Street’s hopes for a perfect landing for the economy, one that slows enough to quell high inflation with high interest rates, but not enough to cause a recession.

The 10-year Treasury yield rose to 4.09% immediately after the jobs report, but fell to 3.96% after a weaker-than-expected report on the services industry. It was 4.00% as of late Thursday, but it eventually returned to 4.04%.

On Wall Street, Constellation Brands rose 2.1% after the U.S. maker of Corona and Modelo beers reported better-than-analyst-expected profits for its latest quarter.

Travel-related companies also performed well, recovering more of their losses from the start of the week. Carnival rose 2.8% and American Airlines rose 3.9%.

Apple was among the losers, with Friday’s 0.4% drop taking its weekly decline to 5.9%, its worst level since September. That’s a complete change from last year, when the market’s most influential stocks soared more than 48%.

This week’s sharp decline in stock prices came as no surprise to many on Wall Street, who had argued that the biggest gains since the fall were overdone. Critics say the six rate cuts that traders are betting on in 2024 are unlikely to materialize unless a recession occurs. The Fed itself has indicated in its latest Summary of Economic Projections (SEP) that three rate cuts are more likely.

“Many people who thought the Fed needed to act more quickly and aggressively than the SEP outlook and recent statements showed were hit hard this week,” said Rick Rieder, BlackRock’s chief investment officer for global fixed income. There is a high possibility that it was.” “Things are cooling, but as with recent weather, the trend is milder than historically. Some areas are experiencing rapid cooling, but generally people are not panicking. There is no need to actively evacuate.”

In overseas stock markets, indexes mostly fell in Europe after data showed inflation. rose to 2.9% in December. The rebound after seven straight months of declines has fueled debate over how quickly the European Central Bank can lower interest rates on its own.

The index also fell in much of Asia. Japan’s Nikkei Stock Average was an exception, rising 0.3%.

Japanese exporters are betting on tailwinds from the yen’s fall in value against other currencies. The yen has been weakening in recent days amid speculation that the Bank of Japan will gradually change its ultra-aggressive interest rate policy from the day after Monday. A major earthquake occurred in the Chubu region.

___

AP Business writers Yuri Kageyama and Matt Ott contributed.

[ad_2]

Source link