[ad_1]

(Bloomberg) — Asian stocks are set to fall, while European stocks are expected to fall again as the risk-on mood worsened at the start of the year. The dollar mostly maintained its rise.

Most Read Articles on Bloomberg

South Korean and Australian stock benchmarks fell on Wednesday after closing at their highest since at least mid-2022 in the previous session. While Japanese markets remained closed for the holiday, Chinese tech stocks in Hong Kong fell more than 2%.

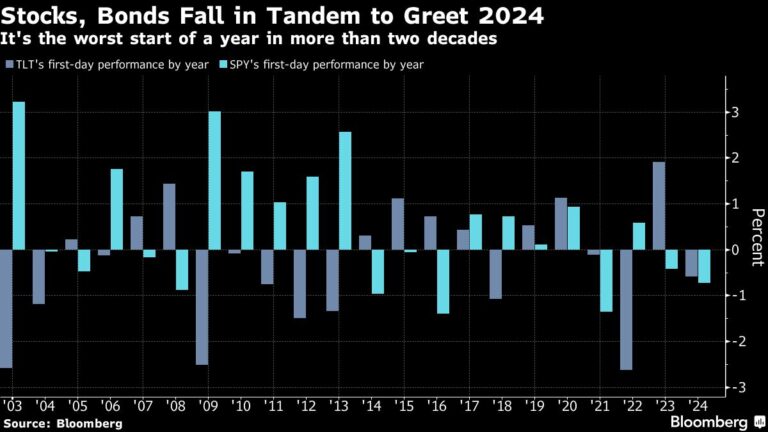

The new year started on a somber note after huge bets on the Federal Reserve’s policy shift sparked a global rally in both stocks and bonds in the fourth quarter. U.S. stock market prices fell slightly on Tuesday after the tech-heavy Nasdaq 100 fell for the first time in more than two months. Euro Stoxx50 futures fell.

U.S. Treasury futures were little changed in Asian time on Wednesday as trading in spot government bonds remained suspended due to a public holiday in Japan. Bond prices fell in U.S. trading as central banks are reluctant to abandon their fight against inflation too soon, and policy makers are unlikely to achieve the extent of monetary easing priced in by money markets. This partly reflects doubts.

The dollar traded within a narrow range against the Group of Ten (G10) nations, after posting its biggest single-day gain since March.

“2024 started with risk reduction, with a recovery in stock prices and weakness against the US dollar,” Vishnu Varasan, Mizuho Bank’s chief economist for Asia (ex-Japan), said in a note. “It’s unclear whether this is a permanent purge of over-enthusiasm or just pre-NFP profit-taking,” he said, referring to the U.S. non-farm jobs report due out later this week.

Chinese tech stocks have been in the spotlight following reports that the Chinese government has fired a senior official overseeing the domestic gaming industry, which comes after the government announced a tough new move that triggered an $80 billion collapse across the gaming industry. This suggests that the government is trying to quell opposition to such regulations. Tencent Holdings and smaller rival NetEase reversed earlier losses.

Redmond Wong said: “If this story is correct, it sends a signal that what has happened is not a change in policy direction towards further tightening of the mobile and online gaming industry, and that there is a need for stability and certainty in policy.” “It may provide some relief to investors.” Market Strategist at Saxo Capital Markets in Hong Kong. “But overall, investors remain skeptical. This news, while positive, is not big enough to move the picture.”

Focus on Fed minutes

Traders are currently awaiting the release of the latest Fed minutes on Wednesday. Ian Lingen of BMO Capital Markets said the tone is expected to be hawkish.

“Although unlikely, a dovish surprise would carry far more shock value for markets moving away from taking the Fed at face value in favor of a more skeptical approach,” the strategist said.

Wednesday’s jobs report and Friday’s nonfarm payrolls numbers will also be scrutinized for signs of labor market weakness.

“The rally in stocks and bonds is justified if Fed Chairman Jerome Powell is right that inflation can slow further without a sharp increase in unemployment,” Bloomberg Economics reported. International Monetary Fund President Kristalina Georgieva told CNN International that the U.S. economy is “definitely” headed for a soft landing thanks to the Fed’s “determination” in curbing inflation.

Bitcoin hovered around $45,000 on Tuesday, after rising above that level for the first time in nearly two years on expectations over expected U.S. approval for an exchange-traded fund (ETF) that invests directly in the largest token.

Oil continued to fall as concerns about escalating conflict in the Red Sea subdued the broader risk-off mood.

This week’s main events:

-

German unemployment rate Wednesday

-

US FOMC Minutes, ISM Manufacturing, Recruitment, Light Vehicle Sales, Wednesday

-

Richmond Fed President Tom Barkin, 2024 FOMC voter, speaks Wednesday

-

China Caixin releases PMI on Thursday

-

Eurozone S&P Global Eurozone Services PMI, Thursday

-

U.S. new jobless claims, ADP employment, Thursday

-

Eurozone CPI, PPI, Friday

-

US non-farm payrolls/unemployed, factory orders, ISM services index, Friday

-

Richmond Fed President Tom Barkin, 2024 FOMC voter, speaks on Friday

The main movements in the market are:

stock

-

S&P 500 futures were little changed as of 6:05 a.m. London time.

-

Hong Kong’s Hang Seng fell 1.2%

-

The Shanghai Composite fell 0.2%.

-

Euro Stoxx50 futures fall 0.3%

currency

-

Bloomberg Dollar Spot Index little changed

-

The euro rose 0.1% to $1.0953.

-

The Japanese yen was almost unchanged at 142.11 per dollar.

-

The offshore yuan was little changed at 7.1505 yuan to the dollar.

-

The British pound rose 0.1% to $1.2632.

cryptocurrency

-

Bitcoin rose 0.2% to $45,208.55

-

Ether rose 0.5% to $2,378.21

bond

merchandise

-

West Texas Intermediate crude oil fell 0.2% to $70.27 a barrel.

-

Spot gold rose 0.3% to $2,064.33 an ounce.

This article was produced in partnership with Bloomberg Automation.

–With assistance from Joanna Ossinger.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link