[ad_1]

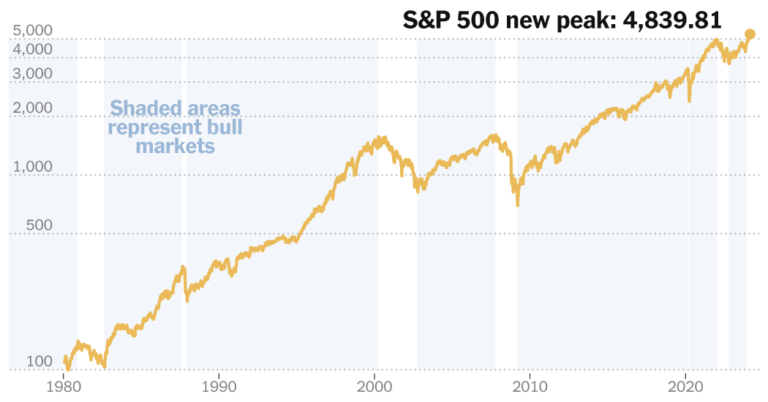

The stock market hit new highs on Friday, with the S&P 500 index finally hitting its all-time high after weeks of hitting record highs.

The index, one of Wall Street’s most widely followed benchmarks and the basis of many portfolios, rose 1.2. % is expected to close above the high recorded in January 2022.

The record marks a stunning rally in the final months of 2023 as investors seized on signs of slowing inflation and signals from the Federal Reserve that it could start lifting the brakes on the economy by cutting interest rates. This is due to what I did. But after coming just short of the highs reached in late December, some inflation indicators remained elevated and key Middle East shipping routes came under attack, raising concerns that the market may have risen too fast. remained strong, and the market lost some momentum. .

The rally that ultimately pushed stock prices over the edge was rooted in gains in influential tech stocks like Apple, Microsoft, Meta, and Nvidia, but the ferocious gains that drove up the valuations of these companies last year By 2024, it will be even more complex. Closely tracked consumer surveys have shown a significant rise in economic confidence, along with a slowdown in inflation expectations, increasing expectations for the economy.

Tom Logue, a strategist at Commonwealth Financial Network, said even with market highs, worries about a potential recession and the risk that interest rates will remain higher than investors currently expect have eased. He said that it would not be possible. But it will help maintain some optimism on Wall Street, he said.

“This is a positive thing for both the everyday investor and the individual investor,” Logue said. “Psychologically, when prices reach all-time highs, it affects people’s minds.”

It took about two years for the index to recover from its initial decline due to concerns that an outbreak of inflation would prompt the Federal Reserve to rein in rising prices and the economy. The decline ended after 10 months, as fears of an impending recession began to give way to hope for economic resilience. With inflation slowing in recent months, investors are starting to expect a change in direction from Fed policymakers.

The S&P 500 has recently been buoyed by expectations that interest rates will fall in 2024, rising about 35% from its October 2022 low. Friday’s record also helped confirm the arrival of a new bull market, a Wall Street term for an exuberant period that pushes stock prices further into new territory.

The S&P 500’s record is a psychological indicator for investors, in part because the companies in the index account for more than three-quarters of the value of the U.S. stock market, according to S&P Dow Jones Indices. This means that it occupies a large number of people. About $11.4 trillion in funds and other assets benchmark the S&P 500, and its ups and downs are a concern for nearly every investment manager.

Investors enjoyed nearly 15 years of gains through the index’s last bull market, which ended in early January 2022. Inflation soared to 40% in the latter stages, fueled in part by pandemic stimulus and low interest rates. It hit a yearly high and prompted action from Fed policymakers.

The Fed’s rapid interest rate hikes starting in March 2022 shocked financial markets, with more than a decade of rock-bottom interest rates making borrowing cheap and encouraging investors to raise rates before a new round of higher borrowing costs. was forced to make a sudden adjustment to a world of Taking on more risk in pursuit of higher returns.

Despite a series of large interest rate hikes, stubborn inflation has raised concerns that the Fed will crush the economy while trying to keep prices in check. This caused stock prices to fall, sending the S&P 500 index into a bear market in 2022, wiping out more than 20% of its value from January to October.

But stocks began to rise again as companies and the economy showed far more resilience than most investors expected. Consumers continued to spend, spurring economic growth and allowing businesses to continue aggressively raising prices, boosting profits.

Further tailwinds are advances in artificial intelligence, and we’re betting on the technology’s ability to generate significant returns well into the future. Chipmaker Nvidia is one of the biggest beneficiaries of this trend. The company’s stock has risen more than 400 percent since the S&P 500’s low, making it one of the few companies with a market capitalization of more than $1 trillion.

The company joins Alphabet, Amazon, Apple, Meta, Microsoft, and Tesla as one of the “Magnificent Seven” stocks, and because of its size, it has a large impact on the S&P 500’s performance.

The S&P 500 is weighted by market capitalization, meaning that the movements of the largest companies contribute significantly to the index’s performance. When the index is adjusted to give equal weight to all companies, the S&P 500 is about 5% below its all-time high, highlighting the outsized contribution of this small number of stocks.

As inflation declines and confidence in the economic outlook increases, this dynamic is starting to shift, with a wider range of companies contributing to the market recovery.

The Russell 2000 index, which tracks small and medium-sized companies that tend to be more sensitive to changes in the U.S. economy than the multinationals in the S&P 500, has also risen over the past few months. However, this is still only about 20% of the record achieved at the end of 2021.

Some analysts believe that slowing inflation could breathe new life into the market, giving the market more room to continue. Traders in futures markets are now betting that the Fed could begin cutting interest rates as early as March. If that view changes significantly due to warnings from central banks or economic indicators that undermine the outlook, stock prices could become unstable.

The S&P 500’s rise over the past 15 months has been periodically derailed by moments of setbacks such as setbacks on the path to lower inflation, poor performance at major companies, and economic threats stemming from the Ukraine war and the escalating conflict in the Middle East. Ta. east.

There are other reasons to be cautious, with many economists predicting the economy will slow in 2024, at the same time that consumers begin to succumb to the weight of high credit card debt and other debt.

[ad_2]

Source link