[ad_1]

super microcomputer (NASDAQ:SMCI) The stock price fell significantly in trading on Monday. The company’s stock closed the day down 6.4%, according to data from S&P Global Market Intelligence. Notably, the pullback S&P500 The index rose about 0.8%.

Supermicro stocks were added to and replaced the S&P 500 today. swirl in the benchmark index. The move was announced on March 4, and the server specialist’s stock price soared on the news. Despite today’s pullback, Supermicro stock is still up about 11% since the company was announced to be added to the index.

Being included in the S&P 500 index is often a bullish sign for a stock. When a company joins the S&P 500, investors who buy exchange-traded funds (ETFs) that track the index are effectively buying that company’s stock. As a result, demand increases and stock prices tend to rise. Being a member of the S&P 500 is also prestigious, and can increase the appeal of a still relatively unknown company like Supermicro.

But in this case, some investors appear to have gotten overly excited about the impact that an actual addition to the index would have on short-term pricing. In fact, the stock was up as much as 7.4% in early trading on the day, but many shareholders took profits as soon as the market opened.

Is Supermicro stock still a smart buy?

Despite today’s decline, Supermicro remains one of the best-performing artificial intelligence (AI) stocks this year. The company’s stock price has soared about 252% throughout trading in 2024, thanks to AI-driven demand for high-performance rack servers.

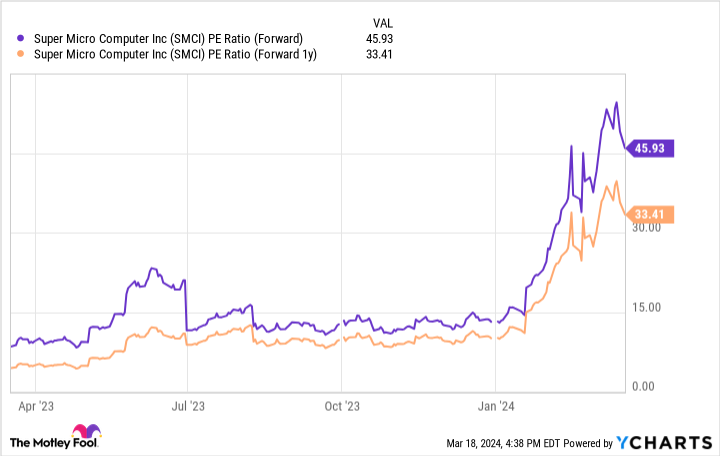

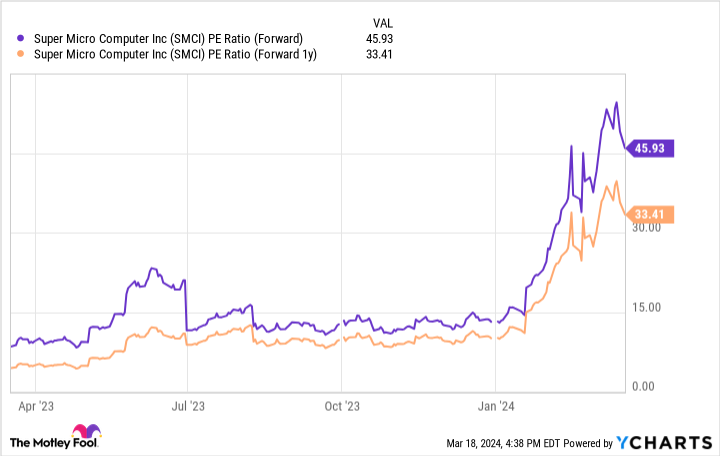

Supermicro stock currently trades at about 46 times this year’s expected earnings and just under 33.5 times next year’s expected earnings. On the other hand, the company’s forward price/earnings (PEG) multiple is approximately 0.5x, and the expected 1-year PEG is approximately 0.6x. A PEG of less than 1 is generally considered to indicate that the stock is undervalued.

Given the company’s recent sales and earnings growth and the emergence of AI-related tailwinds, it’s not unreasonable to think that Supermicro stock could still deliver strong returns over the long term. But investors need to approach stocks with the understanding that short-term performance can be volatile in the aftermath of such explosive growth. With that in mind, dollar-cost averaging appears to be a prudent strategy for bulls at this point.

Should you invest $1,000 in a super micro computer right now?

Before buying Super Micro Computer stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks Things investors could buy right now…and super micro computers weren’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 18, 2024

Keith Noonan has no position in any stocks mentioned. The Motley Fool has no position in any stocks mentioned. The Motley Fool has a disclosure policy.

Supermicrocomputers fall after being added to the S&P 500 today — Is this an opportunity to buy AI stocks? Originally published by The Motley Fool

[ad_2]

Source link