[ad_1]

super microcomputer (NASDAQ:SMCI) Stocks rose again on Monday. The company’s stock ended the day up 4.4%, according to data from S&P Global Market Intelligence. It had risen to 9.4% in early trading.

Before the market opened this morning, Northland Capital Markets issued a bullish update on Supermicro. In a note from analyst Nehal Chokshi, he maintained an “outperform” rating on the stock and raised his one-year price target for the company from $625 to $925 per share. Based on the server specialist company’s stock price of about $773 per share as of today’s market close, meeting Chokshi’s goal would mean an increase of about 20% over the next 12 months. Masu.

Should you buy the hottest AI stocks now?

Super Micro Computers is a provider of high-performance server and storage solutions. With the rise of artificial intelligence (AI), businesses are rapidly increasing their demand for the technology.

In the company’s second quarter of its current fiscal year, which ended Dec. 31, Supermicro sales more than doubled from the same period last year to $3.66 billion. Meanwhile, non-GAAP (adjusted) earnings came in at $5.59 per share, an increase of 71.5% year over year. Rapid growth acceleration has pushed the stock price up 759% over last year.

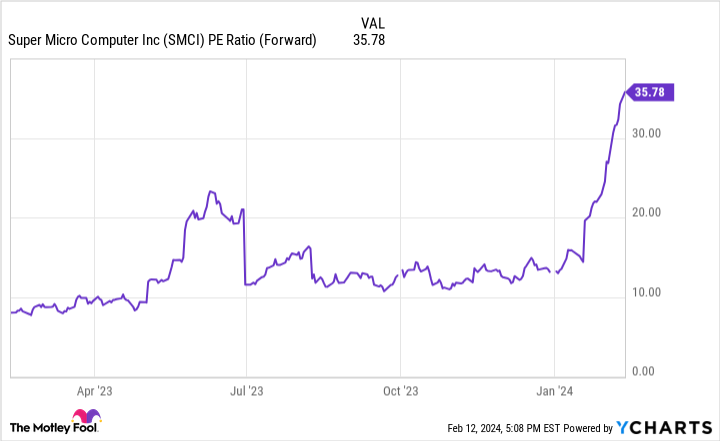

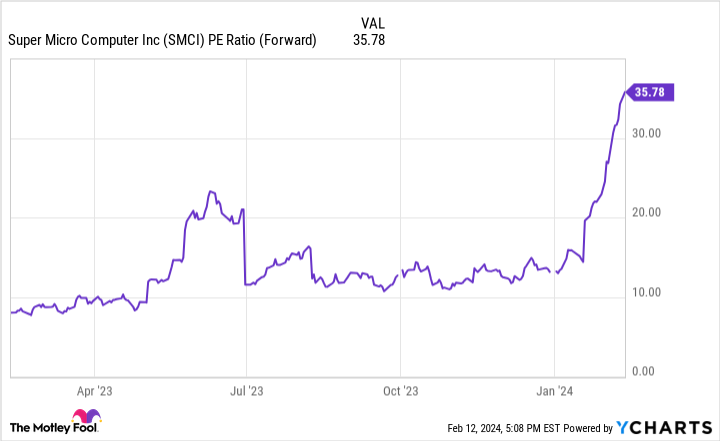

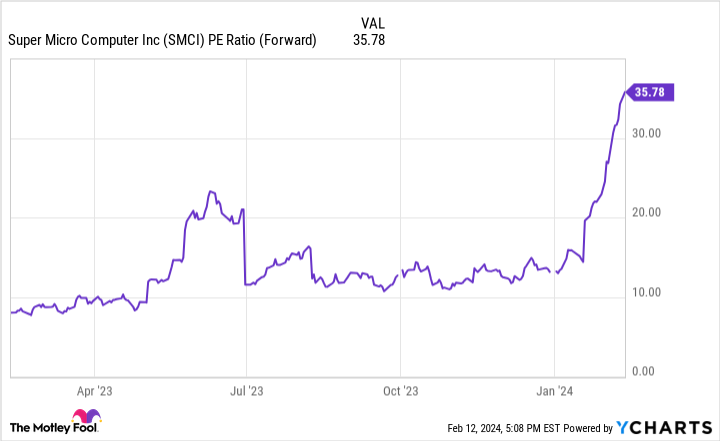

Supermicro currently trades at about 35.6 times this year’s expected earnings. Moving into the next fiscal year, the average analyst estimate is for the business to post earnings of $27 per share, giving it a forward price-to-earnings ratio of 28.6.

The company’s valuation has become much more growth-dependent as the stock has risen recently, but that’s not necessarily unreasonable. With the rise of AI, Super Micro is winning business in key technology categories.

Admittedly, it’s difficult to predict exactly what the company’s business trajectory will be long-term, but the recent surge in demand for Super Micro’s high-performance rack-scale servers is a positive sign. Although new competitors may enter the company’s turf and some key customers may shift to internally developed solutions over time, the business is undergoing major technological shifts. Currently, it seems to be rapidly gaining market share.

If you’re worried that the excitement around AI will peter out in the short term, or that emerging technology trends will soon be subject to cyclical fluctuations, then this stock isn’t for you. maybe. Similarly, if a company’s earnings multiple looks too high given the uncertainty about its long-term demand outlook, it probably makes sense to stay on the sidelines.

But for risk-tolerant investors looking for long-term growth strategies in the AI space, supermicro stocks remain promising at current levels.

Should you invest $1,000 in a super micro computer right now?

Before buying Super Micro Computer stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks Things investors could buy right now…and super micro computers weren’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of February 12, 2024

Keith Noonan has no position in any stocks mentioned. The Motley Fool recommends Super Micro Computers. The Motley Fool has a disclosure policy.

Supermicrocomputers soar again today — Is it time to buy artificial intelligence (AI) stocks? Originally published by The Motley Fool

[ad_2]

Source link