[ad_1]

super microcomputer (NASDAQ:SMCI) The stock rose again in Wednesday trading. The company’s stock closed the day up 11.3%, according to data from S&P Global Market Intelligence.

on tuesday, barclays Analysts have released notes on Super Micro (commonly known as Super Micro) stock. The company’s analysts raised their one-year price target from $691 to $961 per share, citing signs that artificial intelligence (AI) will continue to drive strong demand for Supermicro’s rack servers. . Based on today’s closing price, a new target from Barclays analysts suggests the stock could rise another 9%.

Furthermore, super micro stocks are Nvidia Susquehanna inventory released today. In a Susquehanna note, analyst Christopher Rolland said he expects Nvidia to post fourth-quarter revenue that exceeds current market expectations, thanks to AI-driven demand. Supermicro is also benefiting from his surge in AI-related demand, and the good news for Nvidia could bode well for the server and storage company’s own prospects.

Is supermicrocomputer stock still a buy?

Supermicro’s stock price has fallen unbelievably. The company’s stock is already up about 210% through trading in 2024, and has soared 872% in the last year.

To its credit, the company has had some impressive results that support its share price growth. At the end of January, Super Micro announced its financial results for the second quarter of its current fiscal year (ended at the end of December last year). In addition to the current period’s sales and earnings performance being better than the significantly improved guidance issued just prior to the report’s publication, forward guidance also beat Wall Street’s targets.

The company expects to record revenue of $14.3 billion to $14.7 billion this fiscal year, suggesting it would more than double the previous fiscal year’s revenue of $7.12 billion. AI is driving a significant increase in demand for Supermicro’s high-performance rack servers, and this trend is likely to continue for some time.

Supermicro’s earnings outlook is promising, but investors should also keep in mind the stock’s significant rise.

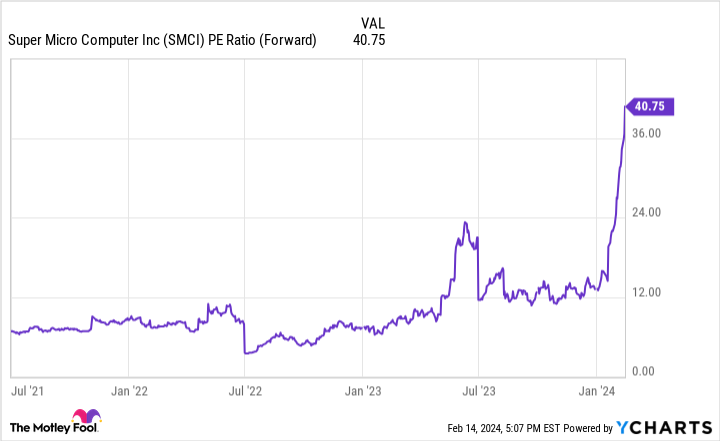

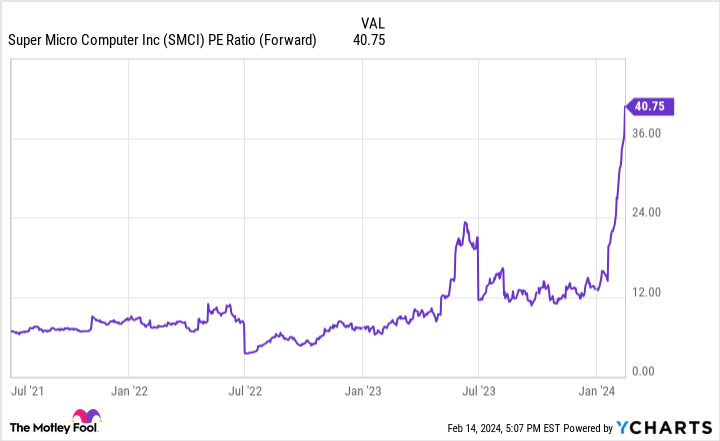

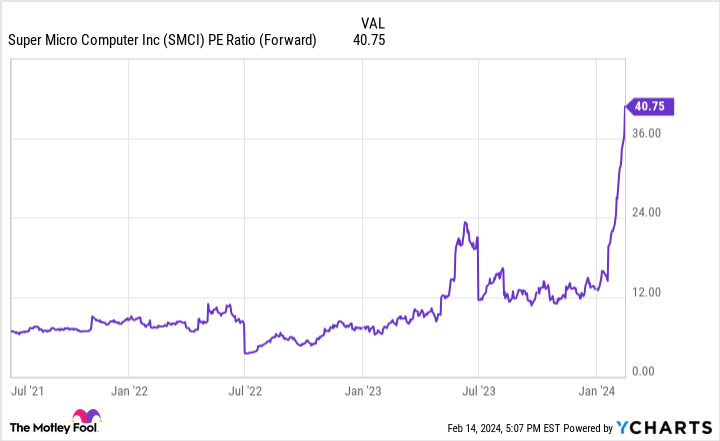

Supermicro stocks, which trade at about 41 times this year’s expected earnings, have become riskier after that impressive rally. Looking ahead, the company’s valuation is approximately 31 times next year’s expected earnings. Given the speculation and uncertainty involved in charting the tech expert’s business trajectory, Supermicro’s current valuation is probably too high for investors without a high level of risk tolerance.

However, the company may still be in the early stages of benefiting from strong long-term demand tailwinds from AI. Supermicro is valued at about $49 billion, and the stock could still have significant upside potential if artificial intelligence continues to drive rapid sales and profit growth. The stock could be riskier and more volatile, but the company may have the talent in place to continue beating expectations.

Should you invest $1,000 in a super micro computer right now?

Before buying Super Micro Computer stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks Things investors could buy right now…and super micro computers weren’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of February 12, 2024

Keith Noonan has no position in any stocks mentioned. The Motley Fool has a position in and recommends Nvidia. The Motley Fool recommends Barclays Plc and Super Micro Computer. The Motley Fool has a disclosure policy.

Supermicrocomputers soar today — Is it too late to buy hot artificial intelligence (AI) growth stocks? Originally published by The Motley Fool

[ad_2]

Source link