[ad_1]

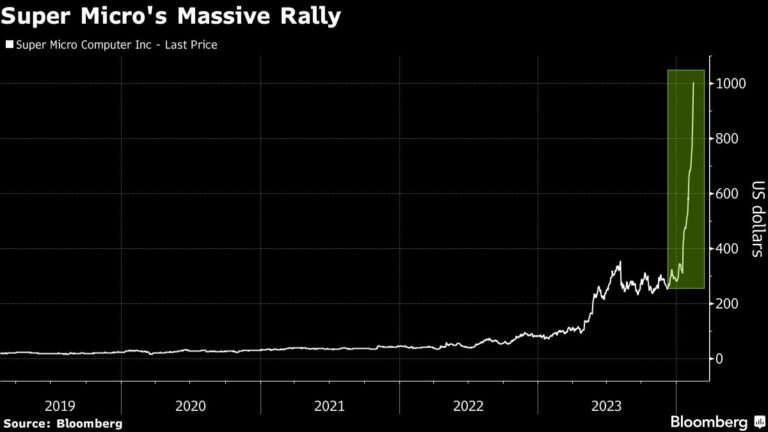

(Bloomberg) — Supermicrocomputers’ long rally came to a shuddering halt Friday, with a decline that marred what looked like the best week ever for server makers.

Most Read Articles on Bloomberg

Stocks fell 20%, the biggest single-day decline since August. The decline came on the back of nine consecutive sessions of gains, the stock’s longest streak since 2016. However, despite the day’s decline, the stock is up 8.5% for the week.

Despite Friday’s decline, the recent rally shows how Super Micro has become one of the most popular names in the field of artificial intelligence. The stock has increased in 18 of the past 21 times, and is up 183% this year. This follows a 246% increase compared to 2023.

“When things get this bad, it’s not the financial institutions that want to hold something as a long-term investment, it’s the people who are taking a shot at the momentum,” said Michael Matousek, head trader at US Global Investors. It’s the psychology of casinos.” “I’m sure some people have been run over trying to short this, and some have had success, but it really comes down to luck if you catch something like this.”

As a result of the rally, Chief Executive Officer Charles Liang’s wealth has quadrupled this year to $7.8 billion, making it the biggest jump on the Bloomberg Billionaires Index, which tracks the world’s 500 richest people.

“We provide the world’s best generative AI platform,” Liang said in an interview on Bloomberg TV on Friday, when asked if the company was being valued fairly. He added that with enough semiconductors, the company’s revenue could reach $25 billion. “There is a shortage of chips. If we get more supply from chip companies and Nvidia, we will be able to ship to more customers,” Liang said.

The company is expected to generate $7.1 billion in revenue in fiscal 2023 and $14.5 billion in revenue this fiscal year, according to data compiled by Bloomberg.

The San Jose, California-based company has become a popular company for investors seeking exposure to artificial intelligence and the infrastructure such as chips and servers that run AI applications. Bank of America began reporting on the stock earlier this week with a buy rating and a market-high price target, but the AI server market is expected to grow at an average annual growth rate of 50% over the next three years. I expect it to grow. The company said it expects Supermicro to be the main winner of that growth.

Growth expectations are so strong that Supermicro doesn’t trade at the nosebleed valuations of other investor favorites. The stock trades at about 31 times estimated earnings, compared to 87 times for Arm Holdings, a chip design company that recently issued bullish sales forecasts in part due to AI spending. Perhaps the most prominent beneficiary of his interest in AI, his Nvidia Corp. has a multiple of about 34.

Interest in the stock has increased recently after the quarterly results announced last month significantly exceeded expectations and the company subsequently raised its sales forecast.

Wall Street took notice. Analyst consensus for Supermicro’s 2025 net income has increased by 52% in the last month, while revenue expectations have increased by a similar amount, according to data compiled by Bloomberg.

Some analysts have warned about the magnitude of the stock price movement. Wells Fargo Securities initiated coverage on Friday with an equal weight rating, saying the stock is “already discounting solid upside.” Still, analyst Aaron Lakers said the company’s “fundamental AI-powered momentum, supported by engineering-first differentiation, is surprising and supports some sustainable valuation reassessment.” It should be,” he said.

The gains have pushed Supermicro’s market value to about $45 billion, making it the largest single stock in the Russell 2000 index since 1999, according to Bloomberg Intelligence.

–With assistance from Kristine Owram, Carly Wanna, and Brody Ford.

(Update on market close.)

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link