[ad_1]

Part of the loss seen by insiders who bought US$182,000 worth of shares Schiller Resources Limited (ASX:SYR) share price has rebounded over the past year after rising 16% over the past week. But the deal is proving to be a high-stakes gamble, with insiders still having to overcome losses since the time of the acquisition, now amounting to $57,000.

While we never say investors should base their decisions solely on the actions of a company’s directors, we believe it would be foolish to ignore insider trading entirely.

Check out our latest analysis on Schiller Resources.

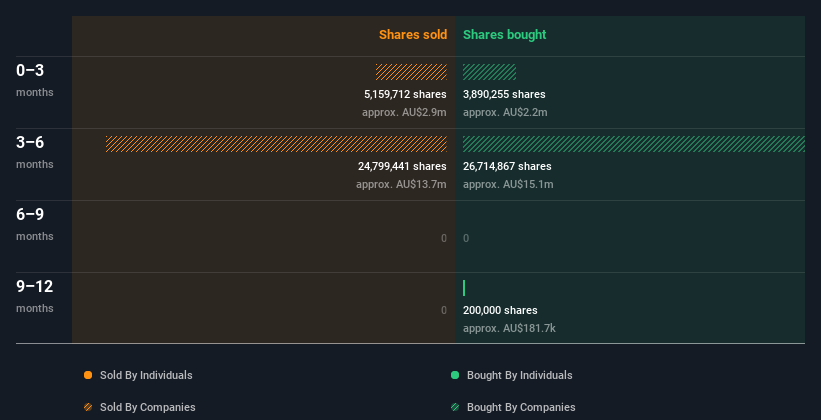

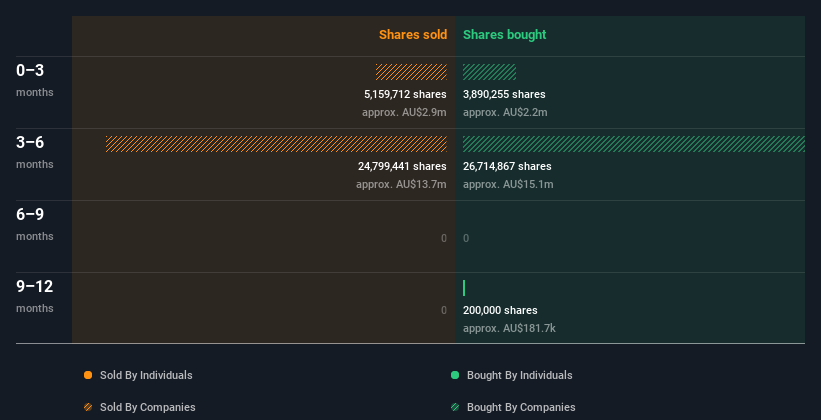

Syrah Resources insider transactions over the past year

The biggest acquisition by an insider in the last twelve months was when the Independent Chairman, James Askew, bought AU$182k worth of shares at a price of AU$0.91 per share. This means that an insider was willing to buy shares above his current price of AU$0.63. Their views may have changed after the acquisition, but this at least suggests they were confident in the company’s future. For us, it’s very important to consider the price insiders pay for shares. It’s encouraging to see that insiders paid more than the current share price. This suggests that they valued higher standards. James Askew was the only individual insider to buy shares in the last 12 months.

You can see a visual representation of the insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, click on the graph below.

Shiller Resources isn’t the only stock that insiders are buying.So take a look at this free A list of growing companies with insider buying.

Insider ownership

Another way to test the alignment between a company’s leaders and other shareholders is to look at the number of shares they own. Typically, the higher the insider ownership, the more likely it is that insiders are incentivized to build the company for the long term. It appears that Shiller Resources insiders own 6.3% of the company’s shares, worth about AU$27m. This level of insider ownership is good, but far from particularly noticeable. That certainly suggests a reasonable degree of consistency.

What can we tell from Syrah Resources’ insider transactions?

It doesn’t make much sense to see that not a single insider traded in Shiller Resources stock in the last quarter. On a brighter note, last year’s trading was encouraging. Insiders own shares in Shiller Resources, and their transactions don’t cause us concern. We like to know what’s going on with insider ownership and transactions, but we also always consider what risks a stock faces before making any investment decisions.Case in point: we discovered 2 warning signs for Syrah Resources Note that one of them is important.

of course Shiller Resources may not be the best stock to buy.So you might want to see this free There are many high-quality companies here.

For the purposes of this article, insiders are individuals who report their transactions to the relevant regulatory body. The Company currently only accounts for open market transactions and private dispositions of direct profits, and does not account for derivative transactions or indirect profits.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and the articles are not intended as financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.

[ad_2]

Source link