[ad_1]

The opinions expressed by Entrepreneur contributors are their own.

You are reading Entrepreneur India, an international franchise of Entrepreneur Media.

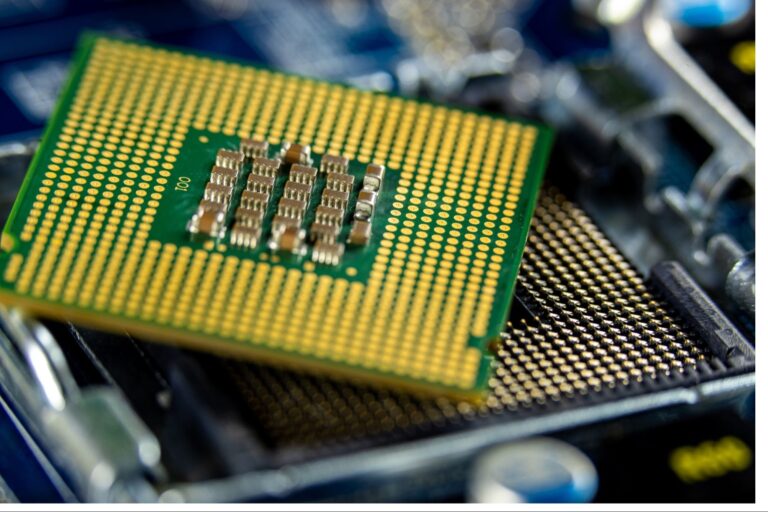

In a significant step towards building India’s indigenous semiconductor ecosystem, the Center is partnering with Powerchip Semiconductor Manufacturing Corporation (PSMC) to set up a semiconductor factory at Tata Electronics Private Limited (Tata Electronics Private Limited).・Approved the proposal of a wholly owned subsidiary of Sands Corporation. ,Taiwan. The plant will be built in Dholera, Gujarat at an investment of Rs 91,000 crore. PSMC is known for its expertise in the logic and memory foundry segment and has six semiconductor foundries in Taiwan. The manufacturing capacity of this facility will be 50,000 wafer starts per month (WSPM). This investment will create over 20,000 skilled jobs directly and indirectly in the region. With this announcement, Tata Electronics enters the global semiconductor industry.

Tata Sons Chairman N. Chandrasekaran announced the Tata Group’s decision to build a semiconductor factory in Dholera at the 20th Vibrant Gujarat Summit in January 2024. “The Tata Group has a tradition of pioneering many sectors in this country, and we are confident of our entry.” “This legacy in semiconductor manufacturing will continue to grow. Every aspect of human existence Semiconductors will become the most important building blocks in the AI-driven digitalization. By 2030, the global semiconductor industry is expected to grow to USD 1 trillion, and India’s demand for semiconductors will be Our entry into semiconductor manufacturing will significantly reduce risks in the global supply chain and make India a very important player in the global semiconductor industry,” the Chairman said.

Semiconductor fab manufacturing is important for India for two main reasons: ecosystem development and supply chain resilience. However, semiconductor factory manufacturing is highly capital-intensive and requires long lead times. Setting up a wafer fabrication (front-end fab) requires an investment of up to $10 billion, while an ATMP facility requires an investment in the range of $2-3 billion.

The Center also approved a proposal by Tata Electronics to build a state-of-the-art greenfield semiconductor assembly and testing facility at Jagiroad in Assam. The facility will be built at an investment of Rs 27,000 crore and is expected to generate over 27,000 direct and indirect jobs in the region. The facility will focus on his three major platform technologies: wirebond, flip-chip, and a differentiated product called Integrated System Packaging (ISP), with future expansion into advanced packaging technologies. We plan to expand our roadmap. These technologies are critical for key applications in India, including automotive (particularly electric vehicles), communications, and network infrastructure. Tata Electronics has already invested heavily in developing proprietary technology for all these platforms. The proposed facility will meet growing global demand across key market segments such as AI, industrial electronics and consumer electronics.

Construction of the facility will begin this year and the first phase of the facility is expected to be operational by mid-2025, giving a major boost to the industrialization of northeast India. The project is conceptualized based on the Semiconductor Policy of the Government of India as promoted by the Indian Semiconductor Mission and the Electronics Policy of the Government of Assam.

Semiconductor assembly and testing is a critical part of the semiconductor value chain, where wafers produced in semiconductor factories are assembled or packaged and tested before they are ultimately used in the intended product. Innovations in semiconductor assembly and test are driving improved performance, smaller form factors, and lower costs for semiconductor chips.

The semiconductor industry consists of companies that design, manufacture, assemble, test, and supply semiconductors suitable for a variety of applications. India has strengths in design, but will also make strides in fab manufacturing. In December 2021, the Government of India allocated Rs 230,000 crore to position India as a global hub for electronics manufacturing with semiconductors as the basic building blocks. An outlay of Rs 76,000 crore has been earmarked for the development of semiconductor and display manufacturing ecosystem in India.

The government’s PLI scheme is expected to attract large-scale investments in the semiconductor manufacturing value chain and significantly increase India’s semiconductor manufacturing capacity in the coming years.

[ad_2]

Source link