[ad_1]

-

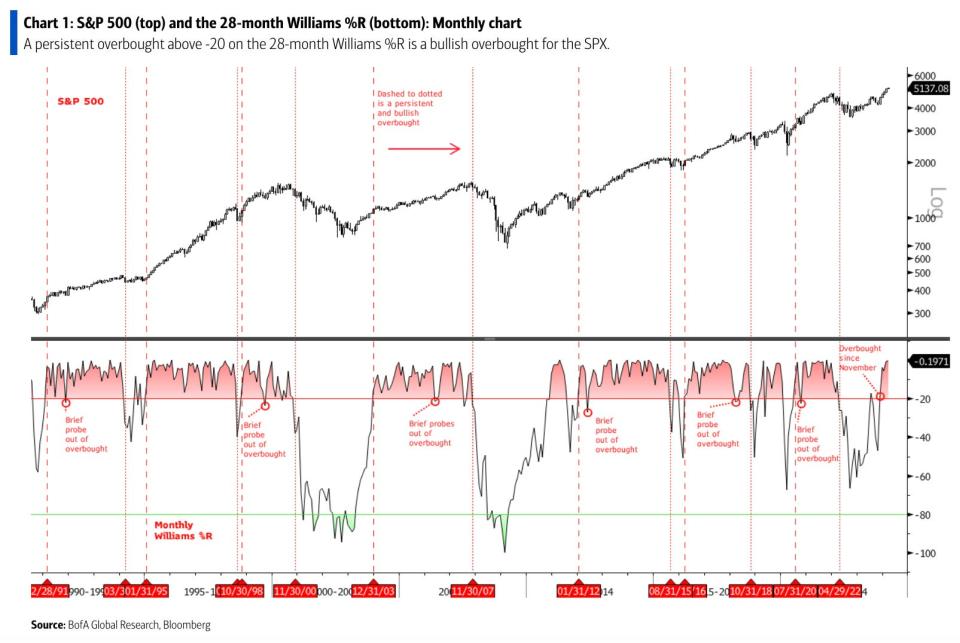

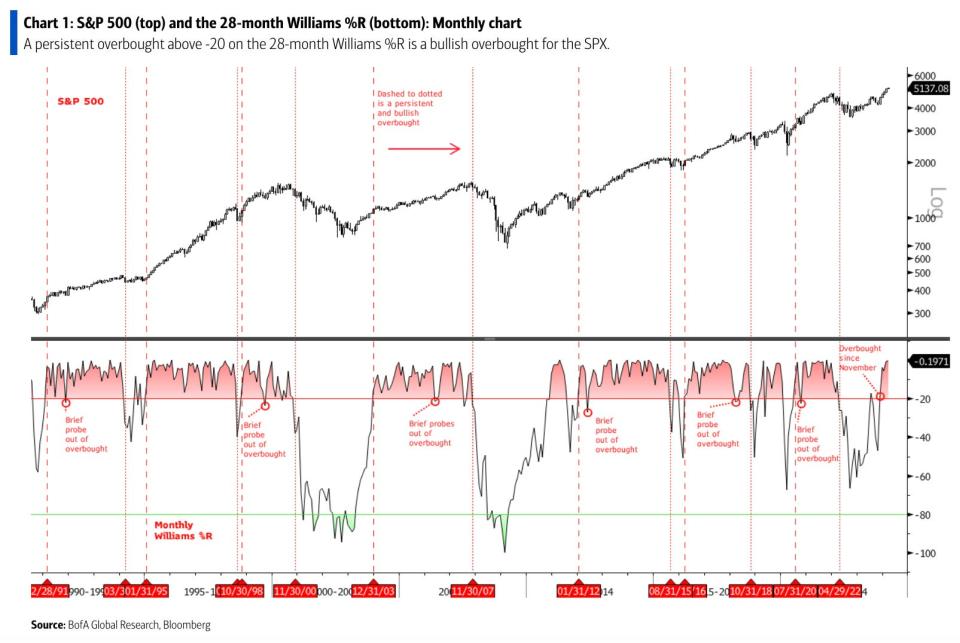

A key long-term indicator of an overbought market has been flashing since November.

-

According to Bank of America, the S&P 500 index is 100% positive over a 12-month period.

-

When the overbought level could no longer be maintained, the market became more volatile.

Three months into 2024, the stock market is off to a great start.

A string of record highs has investors clamoring to participate in the artificial intelligence-driven euphoria that is driving stock prices higher for companies like Nvidia and Microsoft.

The technical indicator (a term used by traders when a stock is trading above its fair value) indicating that stock market conditions are “overbought” has been flashing for four months, and the stock price remains unchanged until the end of the year. This could hold the key to whether or not prices can remain high. Go to Bank of America.

“An overbought 28-month Williams %R of -20 is bullishly overbought for the S&P 500 (SPX),” the strategists said in a note Tuesday. “This long-term price momentum indicator transitioned to overbought in November 2023 and remained overbought in December, January, and February.”

The bank said the S&P 500 would be 100% positive if the index remained “overbought” for the entire calendar year.

In these positive examples, the average and median returns for the S&P 500 were 19.0% and 16.8%, respectively. But at the same time, the average and median pullbacks for the year were 6.4% and 6.9%.

On the other hand, in years where the benchmark index is overbought in January but loses the index in the second half of the year on a monthly closing price basis, the market will It becomes more “unstable” and less solid. For more than 3 consecutive months.

“Maintaining overbought status will be key in 2024,” the strategists said.

Meanwhile, Bank of America’s latest fund manager survey shows investors haven’t been more bullish on stocks in the past two years as many companies rush to enter the tech industry. It was revealed.

And the recent rise in stock prices has led to whispers of a possible bubble. Market veteran John Wolfenberger took a bearish stance earlier this year. He warns that a deterioration in earnings is on the horizon, pointing to signs similar to the tech bubble of the early 2000s.

“The market is very likely to fall to new bear market lows,” Wolfenberger wrote in a January note. “Most investors don’t see this coming, fooled by the persistent strength of a small number of mega-cap tech stocks. They’ve already forgotten how much those stocks fell in 2022. We believe this will soon serve as a reminder of how overvalued tech stocks are.” We believe we could be in for a recession. ”

The S&P 500 index is up more than 7% since the beginning of the year. Just after noon Tuesday, the index was trading at 5,086.39.

Read the original article on Business Insider

[ad_2]

Source link