[ad_1]

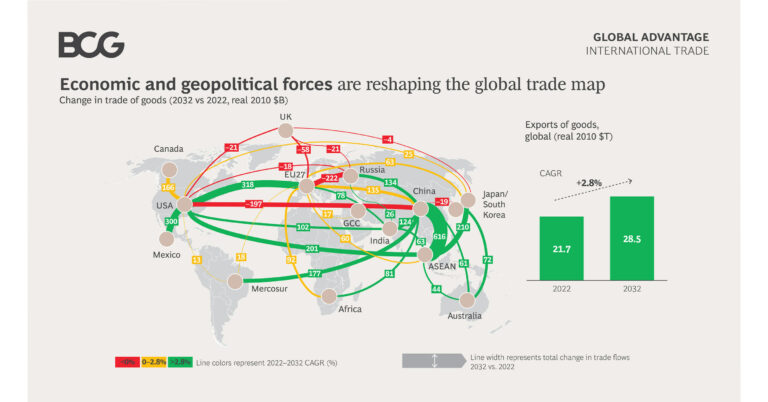

- Over the next 10 years, global merchandise trade is expected to reverse a 20-year trend and grow at a lower rate than GDP growth, according to new analysis from BCG.

- World trade forecasts are forecast to grow at 2.8% per year until 2032, while global GDP growth is estimated at 3.1% over the same period.

- 5 emerging global trade trends that will shape the next decade

- US-China trade is on the decline, and the trade amount is expected to decrease in 2032 $197 billion EU-China trade growth slows, but grows from 2022 levels

boston, January 8, 2024 /PRNewswire/ — As the global economy adapts to sustained economic and geopolitical pressures and disruptions, the familiar routes that defined the world trade map are being redrawn and regional trade lanes become more prominent in global trade. It plays a big role.

The future of jobs, national security and trade

Changes in the trade landscape indicate that overall world trade is growing at a slower pace than the global economy, a fundamental shift away from the trade-driven trend of globalism the world has enjoyed for most of the years since the end of the Cold War. It’s changing. Global trade in goods is projected to grow at an average annual rate of 2.8% through 2032, according to new analysis from Boston Consulting Group (BCG), with global GDP growth estimated at 3.1% over the same period. There is.

The emergence and increasing prominence of regional trade corridors is having the effect of dampening traditionally deep and rapidly growing trade lanes, such as China-US and China-EU.

“Global trade is changing and the familiar maps are being redrawn.” nicolaus lang, Managing Director and Senior Partner, global leader of BCG’s Global Advantage practice and co-author of the report. “We expect to see lasting changes in the flow of goods around the world as supply chains are rebalanced and neighboring countries strengthen regional trade relationships.”

This study highlights five new global trade trends that will define the world over the next decade.

- China trade dynamics. Persistent trade tensions and increased “managed trade” between the two countries China And Western countries are causing it. western china Trade slowing down. Expected decline in the US –China Trade is one of the most important developments in the latest world trade map, with trade volumes projected to decline in 2032. $197 billion From 2022 levels. Chinese Trade with the EU will continue to grow, but at a slower pace than the global average.

- fortress North America. US, Canadaand Mexico The United States will benefit from the United States-Mexico-Canada Agreement (USMCA), as trade with its neighbors is expected to increase each year. $466 billion For the next 10 years.

- Growth of ASEAN trade. Southeast Asian countries are the biggest winners in the new world trade order, and the cumulative value of ASEAN trade is projected to increase $1.2 trillion over the next decade as it emerges as an important destination for companies looking to reduce their dependence on China This is driving ASEAN’s growth as a global export platform. The ASEAN region’s own strong fundamentals are also driving increased investment and trade activity.

- India Ignition. India is emerging as a major domestic market, benefiting from a low cost structure, an increasingly talented workforce, and improved logistics. ”China + 1 inch global manufacturing destination. India It is projected to achieve an average annual trade growth rate of 6.3%, more than double the global average.

- Differences in Russian trade. many Russian Trade is shifting towards BRICs countries (Brazil, China, Indiaand South Africa).meanwhile Russian Exchange China and India will grow up to $134 billion and $26 billion Trade with the EU will decline by 2032 respectively $222 billion.

“Unit economics is one of the main drivers of these changes, but geopolitics is also a clear catalyst,” he said. mark gilbert, a managing director and senior partner at BCG and a co-author of the report. “In a year where many important global elections are coming up and almost half of the world’s population will vote, we can expect to see a continuation of industrial policy focused on national economic security, job creation and green energy. One of the consequences will be the strengthening of regional trading groups,” among others. North America, European Union, ASEAN. ”

China Although Japan is currently one of the world’s leading exporters of manufactured goods, its relative cost competitiveness is declining and its domestic economy is also slowing down.As a result, trade with China will come to a halt as non-Chinese companies re-evaluate their supply chains. China And Western countries will often relocate elsewhere.Notable people who benefited from reduced concentration China It will be ASEAN countries, India Many companies are moving manufacturing to these economies to reduce risks in global supply chains and access new markets.As a result, trade with ASEAN China achieve impressive growth $616 billion ASEAN and the US and trade between the two countries over the next decade Japan will also increase. 200 billion dollars.

“This is not sudden. These changes in trade patterns are reshaping the global economy,” he said. “Businesses must be thoughtful and decisive, otherwise they will rapidly change beyond their control.” There is a danger of being involved in this.” Michael McAdoo, is a partner and director of global trade and investment at BCG and a co-author of the report. “Companies that are ahead of the curve are already investing in making their supply chains more resilient, responding to volatility, and building appropriate risk and cybersecurity capabilities.”

Download the publication here:

https://www.bcg.com/publications/2024/jobs-national-security-and-future-of-trade

Media contact:

Eric Gregoire

+1 617 850 3783

[email protected]

About Boston Consulting Group

Boston Consulting Group partners with leaders in business and society to tackle their most important challenges and seize their greatest opportunities. BCG was a pioneer in business strategy when he founded it in 1963. Today, we work closely with our clients to take a transformative approach aimed at benefiting all stakeholders, helping organizations grow, build sustainable competitive advantage and society. We are helping you make a positive impact.

Our diverse global team brings deep industry and functional expertise and a broad range of perspectives that question the status quo and inspire change. BCG provides solutions through cutting-edge management consulting, technology and design, corporate and digital ventures. We work in a unique collaborative model across the firm and across all levels of client organizations, driven by the goal of helping our clients grow and making the world a better place.

SOURCE Boston Consulting Group (BCG)

[ad_2]

Source link