[ad_1]

The stock market has recently hit another all-time high, and while it’s an exciting time for those who are investing all they can, the situation can be even more frustrating for those who have cash to work with. There is a gender. As stock prices rise, it becomes a little harder for bargain hunters to find deals, but stock prices don’t all rise or fall on a synchronized schedule. Some companies always lag behind these broader market patterns.

What makes it difficult to find bargains among these laggards is that there’s usually a reason a company’s stock didn’t participate in the rally. Still, at the right price, an unpopular stock may be worth buying, even if there’s a good reason to do so.

With this in mind, three Motley Fool contributors looked for stocks left behind by the recent bull market that seem to have a bit of life ahead of them, despite Wall Street’s pessimism. What they came up with was pfizer (New York Stock Exchange: PFE), Confluence (NASDAQ:CFLT)and kinder morgan (NYSE:KMI). But only you can decide if it’s cheap enough to be worth having in your portfolio.

A powerful drug manufacturer ousted by the market

Eric Volkman (Pfizer): With rare exceptions, star power rarely lasts forever. One example of a company that has recently experienced the downside of this move is pharmaceutical giant Pfizer.

A few years ago, Pfizer gained attention for its deep involvement in the fight against COVID-19. The company was a co-developer of the hot coronavirus vaccine Comirnaty. Moreover, the company is the company behind the famous coronavirus antiviral treatment Paxrobid.

At the height of the pandemic, when hundreds of millions of people were eager to get vaccinated and demand for treatments for the disease was high, Pfizer experienced a huge jump in revenue and profitability.

Even the strongest companies would find it difficult to follow up that kind of performance with a similar second act, and Pfizer falls short in many people’s minds. After all, recently released headline numbers for the fourth quarter and full year 2023 both fell significantly as the pandemic became endemic and the public health crisis receded. Fourth-quarter and full-year revenue fell more than 40% year-over-year, and non-GAAP (adjusted) net income plummeted 91% in the quarter.

However, these fourth-quarter numbers exceeded the collective expectations of analysts, who had expected the pharmaceutical giant to post a sizable adjusted net loss. Much of the surprise of the turnaround is due to Komilnati, which continues to find its way into the pockets of those who recognize that COVID-19 remains a threat.

However, sales of several of Pfizer’s key products declined, further exacerbating the generally bearish reaction to the earnings report. For example, in the face of increased competition, sales of the cancer drug Ibrance fell nearly 13% year-on-year. The impending patent expiry of Eyebrance and other top-selling products is also worrying investors.

You really shouldn’t. Pfizer still has a solid lineup of blockbuster drugs and a strong pipeline with potential blockbuster drugs in development.

Meanwhile, the company’s valuation looks pathological, but it’s sure to improve once the market gets over the idea that the company won’t be able to fully recover from coronavirus-related revenue declines.

The company’s forward P/E ratio is just over 12x, and its price-to-sales multiple is a modest 2.3x. I don’t think that trading at such cheap levels will continue for long. One of the most stable and reliable companies in the healthcare space, the company’s dividend makes a strong case for buying. At the current share price, the yield is over 6%, which is a very high level for a blue-chip stock, both in the past and in the future.

don’t call it a comeback

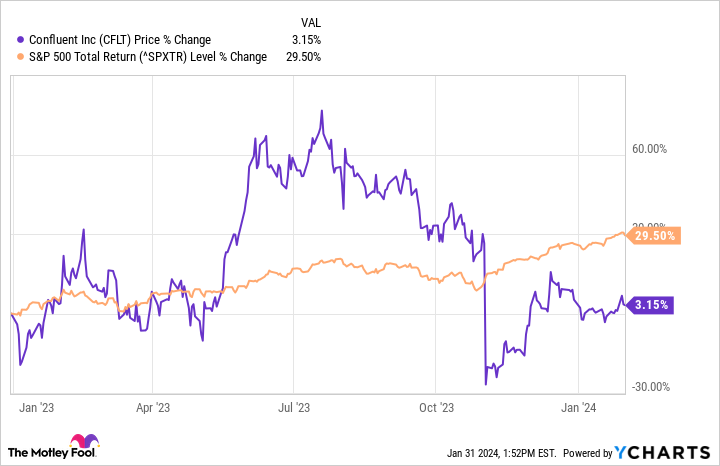

jason hall (merging): Looking at the chart below, investors might think Confluent is in trouble.

Confluent stock price from low to high in early 2023 doubledHowever, it has since fallen again and was well below its previous low when it released its third quarter results in November.

What caused stock prices to plummet? Frankly, there’s a certain amount of instability that is common in young, developing businesses. Confluent is a leader in data streaming, and investors are focused on its growth rate and customer expansion. The market went into a kind of turmoil when it reported that the defection of a few large customers would carry over into early 2024.

My analysis is that this was an overreaction. Confluent’s growth story remains intact.

Third-quarter revenue increased 32%, and Confluent Cloud’s revenue increased 61%. Growth has slowed, with investors expecting it to slow further by 22% and 43% in the fourth quarter. (The company is scheduled to report results for that period on Wednesday.) But Confluent Cloud (a version of Kafka built to run on AWS, Azure, etc.) is still expected to grow more than 40% annually. .

Customer growth remains in the low teens, and the number of customers spending $100,000 or more annually is growing even faster. As a result, profit margins have improved and cash flow has strengthened. The company expects to break even in free cash flow in the fourth quarter and expects to start generating positive free cash flow in 2024.

So, while the market recognizes the risk, I see companies getting stronger and more secure with each passing quarter. In the brave new world of how businesses manage and use data, now is the time to buy this startup.

This company still has decades of life left in the industry.

chuck saletta (Kinder Morgan): Oil and natural gas may not be the most attractive forms of energy these days, but they are still in strong demand around the world. In fact, according to the latest report from the U.S. Energy Information Administration, Annual energy outlookOil and natural gas use is expected to remain roughly stable from now until 2050.

Furthermore, they project beyond 2050 and estimate that even if the supply of green energy continues to increase, it will still be a long time before oil and natural gas are completely eliminated from the global energy mix. It’s not that unreasonable either. After all, we can’t eliminate our approximately 20 million barrels of oil per day and 30 trillion cubic feet of natural gas per year to zero overnight.

Furthermore, even when accounting for declines in oil and natural gas usage over time, pipeline companies like Kinder Morgan are likely to be among the industry’s longest-lasting companies. Although pipelines have high initial costs, they have the advantage of relatively low costs per barrel of oil or cubic foot of natural gas to transport energy.

As a result, as long as oil and natural gas are needed and need to move from where they are produced to where they are processed and consumed, pipelines will still be needed to move them. Other modes of transportation, such as trucks and trains, are likely to decline in use for transporting oil and natural gas before pipelines.

Despite these decent prospects for the next few decades, Kinder Morgan stock has essentially not appreciated in more than five years, even as the dividend continues to recover. The company has a market capitalization of approximately $38 billion and generated approximately $5.6 billion in cash from operations in the past 12 months. At this valuation (less than 7 times its cash-generating capacity), the market has effectively given up on the company, even though it is likely to perform well for decades to come.

Kinder Morgan may not be the fastest growing company on the planet, but given its prospects, its stock certainly looks cheap enough to be worth considering right now.

Get started now

While rising markets can sometimes leave solid companies behind, true bargains rarely remain bargains for long. So now is the time to take a look at yourself and decide whether the stocks of these companies are worth picking up at their current prices. Even if the market doesn’t end up bidding you big up, you might be able to pick up a stock in a quality company that you’ll be happy to hold for years to come.

Should you invest $1,000 in Pfizer right now?

Before purchasing Pfizer stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors should be buying now…and Pfizer wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of January 29, 2024

Chuck Saletta has positions in Kinder Morgan and Pfizer, including a long January 2026 $25 call on Pfizer, a short January 2026 $25 put on Pfizer, and a 2024 March 2024 call on Pfizer. The options are to short the month’s $22.50 put and short the March 2024 $27.50 call on Pfizer. Eric Volkman has no position in any stocks mentioned. Jason Hall has a position at Confluent. The Motley Fool has positions in and recommends Confluent, Kinder Morgan, and Pfizer. The Motley Fool has a disclosure policy.

“The bull market left these 3 stocks behind, but now they’re buys” was originally published by The Motley Fool

[ad_2]

Source link