[ad_1]

As you may know recently, what is the “Magnificent Seven”? Nvidia, appleand microsoft, most of which have benefited greatly from the enthusiasm surrounding artificial intelligence (AI) efforts. But what would be the equivalent business if the same concept were applied to the healthcare sector rather than the technology sector?

At the end of the day, there are only four stocks that have the right combination of continued growth and market-beating returns. All four of these great healthcare companies have solid business models and their stock prices are on the rise, but unfortunately their valuations are a bit volatile.

But they also have a very long growth runway and a history of good execution, so there’s a good chance that their price is justified by continued strong performance. Meet the players.

Eli Lilly and Novo Nordisk

Eli Lilly (NYSE:LLY) and novo nordisk (NYSE:NVO) are two big pharma stocks that don’t need much introduction, thanks to the increasingly insane popularity of blockbuster drugs for obesity and type 2 diabetes.

Eli Lilly makes the diabetes drug Mounjaro and Zepbound, a similar treatment but prescribed for weight loss. It is the largest healthcare company by market capitalization, with a size of $729 billion.

Novo Nordisk is the second largest healthcare competitor by market capitalization, with a market capitalization of $549 billion. The company is responsible for the type 2 diabetes drug Ozempic and the obese version of the same drug, Wigoby.

The companies plan to continue the process of entering the same metabolic disease market, in addition to other markets, over the next decade and beyond. The company’s pipeline includes medium-term and It is packed with late-stage programs.

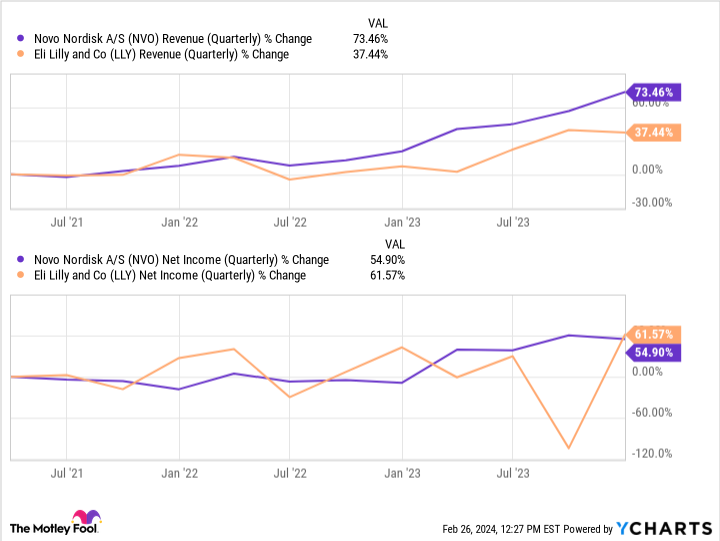

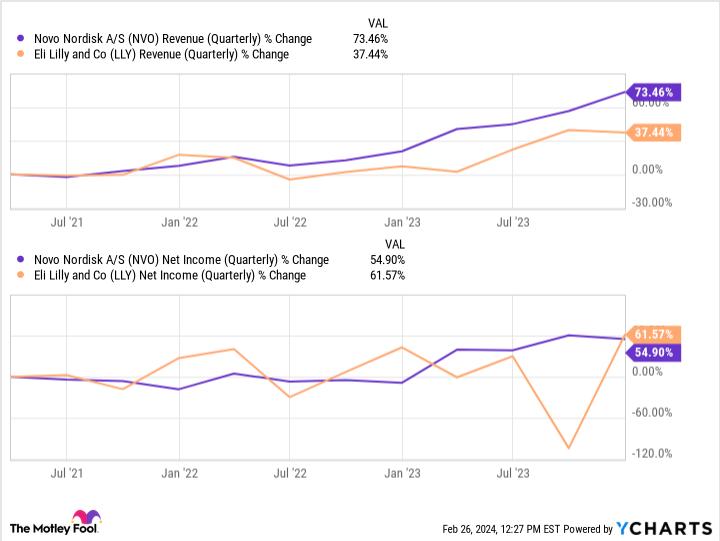

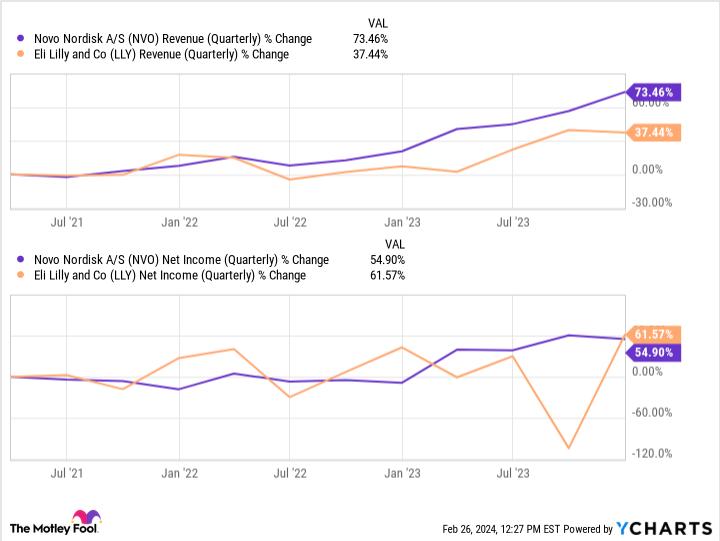

Additionally, neither company expects to have any major problems competing for market share, as the markets they are interested in are very deep and expected to continue to grow. Not sure if their trajectory is consistent with greatness? Consider the diagram below. As you can see, the stock is rising rapidly and is worth buying if you don’t care about valuation.

vertex pharmaceuticals

vertex pharmaceuticals (NASDAQ:VRTX) is a drug developer focused on rare diseases such as cystic fibrosis (CF). We recently commercialized a new gene therapy called Kasugebi for both sickle cell disease (SCD) and beta-thalassemia. CRISPR Therapeutics. Its market capitalization is $111 billion. And, in spectacular fashion, the company’s stock price has risen by 45% over the past 12 months.

One of the key factors driving Vertex’s stock price higher and higher is that its cystic fibrosis drugs are constantly undergoing a lot of manufacturing and testing, and are deeply entrenched in the market. In fact, of his 92,000 CF patients known in the Western world, Vertex currently treats all but 20,000 of his eligible patients.

Moreover, there are no direct competitors vying for its huge market share. Patients then need to continue taking the drug for the rest of their lives to control symptoms.

Because the company has a secure revenue base from sales of CF drugs, it can afford to invest in research and development (R&D) targeting larger and more competitive markets, such as acute pain treatment. This means you can afford to take a lot of ambitious shots on goal without stretching too far. And that’s a big reason why the company’s trailing 12-month net income has increased 68% over the past five years to $3.6 billion. As more programs are approved for sale, that number will rise further and so will the stock price.

intuitive surgery

Last but not least, we are a robotic surgery company. intuitive surgery (NASDAQ:ISRG)has a market capitalization of $136.9 billion and a top line of $7.1 billion in 2023.

In the company’s line of business, hospital customers first purchase da Vinci-branded robotic surgical units. It then pays Intuitive for maintenance contracts, spare parts, new surgical tool heads, and surgeon training programs, generating a long tail of recurring revenue over many years.

As customers perform more surgeries with the da Vinci unit, revenues will increase and the device will become a mainstay in bariatric, urology, and general surgery operating rooms.

And so far there is no competition. So it’s no wonder Intuitive’s margin is as wide as 25%. Given that demand for surgery isn’t slowing down anytime soon, it’s surprising that the company isn’t yet included in the existing Magnificent Seven stocks.

Should I invest $1,000 in Eli Lilly right now?

Before buying Eli Lilly stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks Investors can buy now…and Eli Lilly wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of February 26, 2024

Alex Carchidi has held positions at Apple and Microsoft. The Motley Fool has positions in and recommends Apple, CRISPR Therapeutics, Intuitive Surgical, Microsoft, Nvidia, and Vertex Pharmaceuticals. The Motley Fool recommends Novo Nordisk and recommends the following options: A long January 2026 $395 call on Microsoft and a short January 2026 $405 call on Microsoft. The Motley Fool has a disclosure policy.

These four stocks are the “Magnificent Seven” of healthcare. The original article was published by The Motley Fool.

[ad_2]

Source link