[ad_1]

Texas, Florida and California had the highest number of borrowers who received automatic student loan forgiveness this week.

Today, the White House released data showing how many borrowers in each state are eligible for automatic loan relief under Invaluable Education Savings or Income-Driven Repayment (IDR) Savings plans.

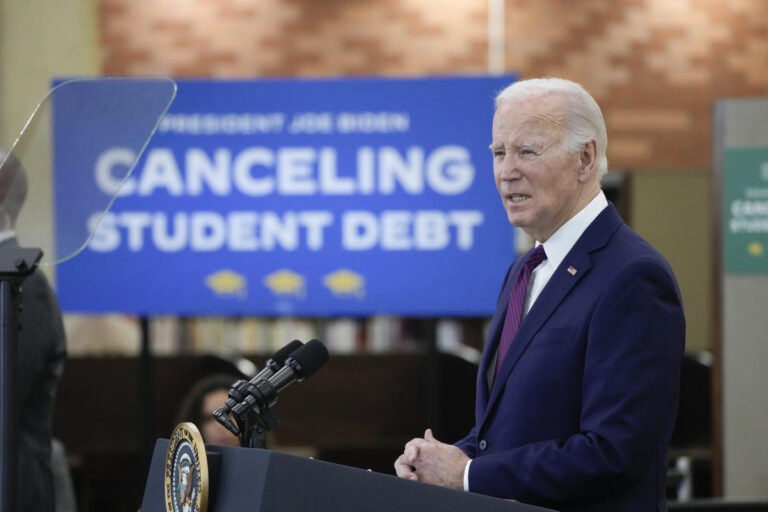

This followed this week’s announcement by the Department of Education that 153,000 students with original loan balances of $12,000 or less who had been repaying their loans over 10 years had their student loan debt forgiven, resulting in $1.2 billion being eliminated.

The forgiveness is part of debt relief for borrowers enrolled in the SAVE plan, which was expected to take effect until July but was brought forward last month.

read more: Am I eligible for student loan forgiveness?

This action resulted in the cancellation of loans for borrowers in each state. Eligible borrowers received an email from the Department of Education on Wednesday. Borrowers can also log into their StudentAid.gov account to see if they qualify.

“State-by-state SAVE Plan debt forgiveness numbers show that President Biden’s leadership is having a real impact on people’s lives in every state.” [and] It proves we will never stop fighting to make higher education more affordable and accessible to more Americans,” U.S. Secretary of Education Miguel Cardona said in a press statement.

Forgiveness will be rolled out on a rolling basis as SAVE borrowers reach the required 10 years of repayments.

Unlike one-time payment adjustments, which are available regardless of the income-driven repayment plan you are enrolled in, borrowers must enroll in SAVE to benefit from this forgiveness.

For every $1,000 borrowed over $12,000, SAVE borrowers can receive forgiveness after an additional year of payments.

Approximately 7.5 million borrowers are enrolled in SAVE plans.

Here are some key ways SAVE differs from other income-driven repayment plans:

-

Debt forgiveness for borrowers with an original loan balance of $12,000 or less and who have made payments for 10 years.

-

The maximum amount a borrower must pay for an undergraduate loan is between 10% and 5% of discretionary income.

-

Borrowers below 225% of the federal poverty level do not have to make monthly payments.

-

Borrowers aren’t charged monthly unpaid interest, so making payments won’t increase your balance, even if your monthly payment is $0 because your income is low.

Borrowers who are not yet enrolled can sign up for SAVE at StudentAid.gov/SAVE.

The Biden administration is repaying $45.6 billion to 930,500 borrowers under income-based repayment plans, which include one-time payment adjustments and SAVE repayments.

Since taking office, the Biden administration has repaid approximately $138 billion to more than 3.9 million borrowers.

Rhonda Lee is a senior personal finance reporter at Yahoo Finance and an attorney with experience in law, insurance, education, and government. Follow her on X @writesronda

Read the latest personal finance trends and news from Yahoo Finance.

[ad_2]

Source link