[ad_1]

When you buy a stock, there’s always a 100% chance it will go down. But on the bright side, if you buy stocks in high-quality companies at the right price, you can earn well over 100%. for example, Filtronic (LON:FTC)’s share price has soared 200% in the past five years. Most people will be very happy with it. It’s also good to see that the stock price is up 44% quarter-over-quarter.

With that in mind, it’s worth checking whether a company’s underlying fundamentals are driving its long-term performance, or if there are any discrepancies.

Check out our latest analysis for Filtronic.

Given that Filtronic generated minimal revenue in the last twelve months, we’ll focus on its revenue to assess its business development. Generally speaking, such stocks would be considered alongside loss-making companies simply because the amount of profits is so small. Without revenue growth, it would be difficult to believe in a more profitable future.

Indeed, over the past five years, Filtronic’s revenue has been declining at around 2.2% per year. On the other hand, the stock price was the opposite, compounding annually he rose 25%. This shows that the market is forward-looking, and predicting the future based on past trends is not always easy. Still, this situation makes us feel a little cautious about the stock price.

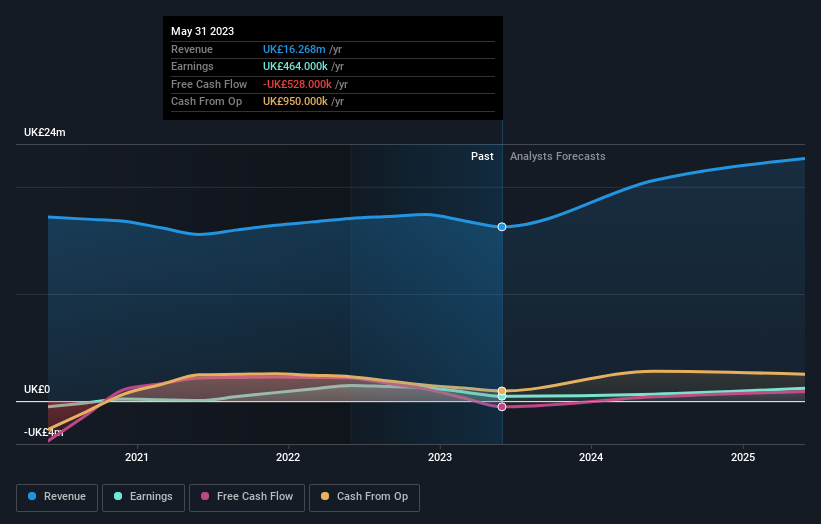

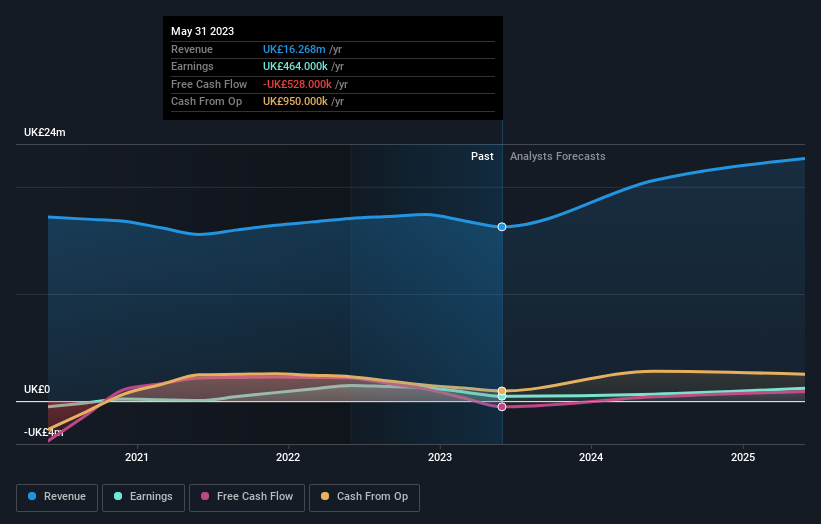

The company’s earnings and revenue (long-term) are depicted in the image below (click to see the exact numbers).

Of course, it’s great to see how Filtronic has grown its profits over the years, but the future is more important to shareholders. Check this out if you’re looking to buy or sell Filtronic stock. free Detailed report on balance sheet.

different perspective

It’s good to see that Filtronic delivered shareholder returns over the last twelve months, with a total shareholder return of 98%. The 1-year TSR is better than his 5-year TSR (the latter at 25% per annum), so it looks like the stock has performed better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock to make sure you don’t miss out. I think it’s very interesting to look at stock price over the long term as an indicator of business performance. But to really gain insight, you need to consider other information as well. For example, we discovered that 2 warning signs for Filtronic What you need to know before investing here.

of course, You may find a great investment if you look elsewhere. So take a look at this free A list of companies with expected revenue growth.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on UK exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and the articles are not intended as financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.

[ad_2]

Source link