[ad_1]

Insights on Value Guru Tom Russo’s Investment Trends for Q4 2023 (Trades, Portfolio)

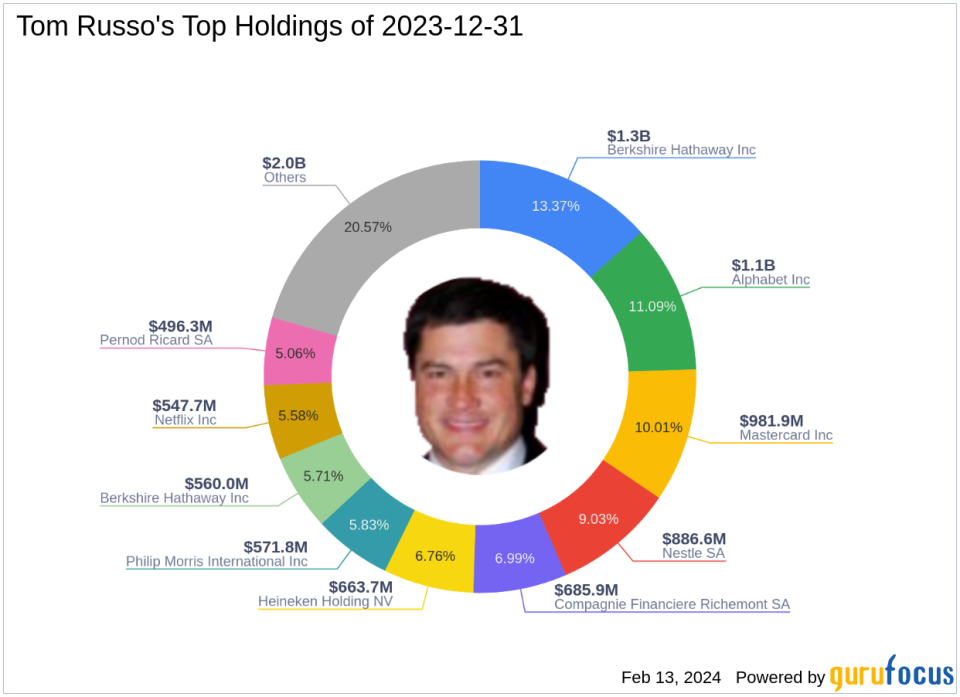

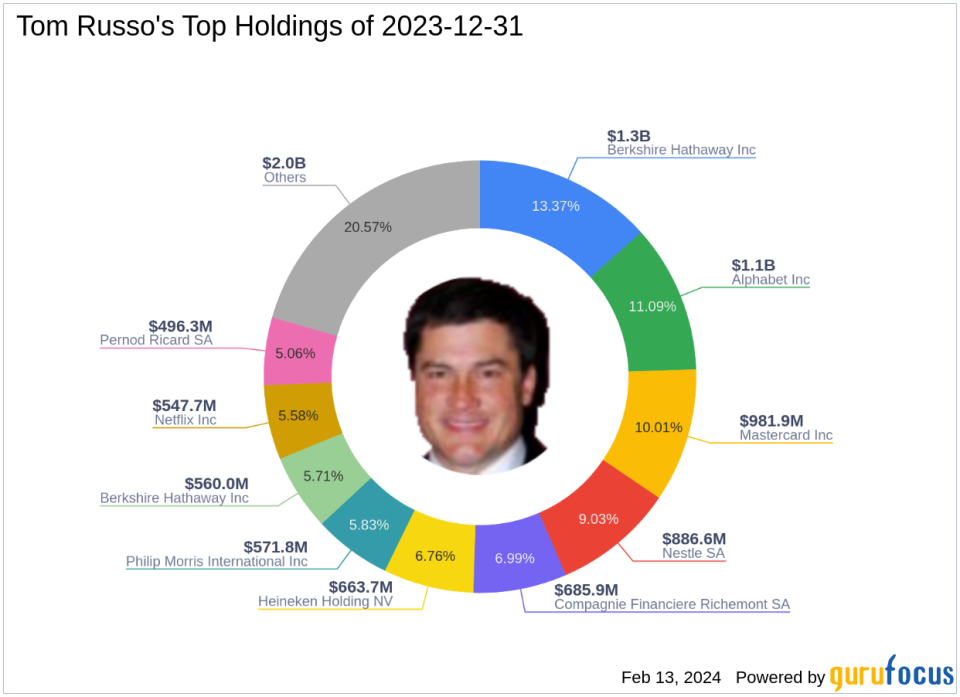

Tom Russo (Trades, Portfolios), an experienced value investor and managing member of Gardner, Russo & Quinn LLC, has disclosed his investment decisions for Q4 2023 through his latest 13F filing. . With a portfolio of over $8 billion, Mr. Russo’s strategy focuses on companies with strong cash flow characteristics and high returns on invested capital. His longtime equity-only partnership, Semper Vick Partners, reflects his commitment to value and price in stock selection.

Summary of new purchases

Tom Russo’s (Trades, Portfolios) portfolio welcomed a new entrant in the fourth quarter.

-

Uber Technologies Inc (NYSE:UBER) emerged as a significant addition with 3,081,363 shares representing 1.93% of the portfolio or a total value of $189.72 million.

Key position rises

Mr. Russo’s strategy also included strengthening positions in existing holdings.

-

Microsoft Corporation (NASDAQ:MSFT) acquired an additional 3,086 shares for a total of 5,218 shares. This 144.75% increase in the number of shares affected his current portfolio by 0.01%, giving him a total of $1,962,180.

-

Alphabet Inc (NASDAQ:GOOGL) increased its capital by 200 shares, for a total of 22,530 shares. This 0.9% increase in his shares totaled $3,147,220.

Overview of sold out positions

Tom Russo (Trade, Portfolio) liquidated shares in several companies.

-

JCDecaux SE (JCDXF): All 10,500 shares were sold, resulting in a 0% portfolio impact.

Reduction of key positions

Several holdings have seen Russo write down their stakes.

-

Alphabet Inc (NASDAQ:GOOG) was reduced by 372,525 shares, decreasing the stock by 4.6% and impacting the portfolio by 0.54%. The average price for the quarter was $135.69, with a return of 9.79% over the past three months and 4.12% year-to-date.

-

Berkshire Hathaway (NYSE:BRK.A) was reduced by 65 shares, resulting in a 2.62% decrease in shares and a 0.38% portfolio impact. The average trading price for the quarter was $533,852, with a return of 11.73% over the past three months and 9.39% year-to-date.

Portfolio overview

At the end of the fourth quarter of 2023, Tom Russo (Trade, Portfolio)’s portfolio consisted of 82 stocks. The top holdings are Berkshire Hathaway (NYSE:BRK.A) with 13.37%, Alphabet (NASDAQ:GOOG) with 11.09%, Mastercard (NYSE:MA) with 10.01%, Nestlé SA (NSRGY) with 9.03%, and Company. and 6.99% for Financière Richemont SA (CFRHF). Investments span a wide range of industries, with a particular focus on financial services, consumer defense, communications services, consumer cycles, basic materials, industrials, technology, energy, healthcare, and real estate.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

[ad_2]

Source link