[ad_1]

Private equity giants operating in Asia are confident in their core businesses, but are turning to alternative assets such as private credit and infrastructure to generate higher returns.

Apollo Global Management, Partners Group and TPG Capital are selective about allocations as volume of deals and funding in Asia-Pacific private equity markets falls to 10-year low in 2023, senior executives say It is said that he was doing so.

“This is probably a time when quality is more important than quantity,” Ganen Sarvananthan, managing partner and head of Asia and Middle East at TPG, said Tuesday at the Milken Institute Global Investor Symposium in Hong Kong. Ta.

“I’m not going to bet on private equity. The industry will adjust to drive earnings up to and outperform the baseline that is currently being reset.”

Private equity markets around the world, including the Asia-Pacific region, plummeted last year, with deal and financing volumes falling to US$147 billion and US$100 billion, respectively, according to a Bain & Company report.

Slowing economic growth, high interest rates and volatile stock markets spooked investors and brought trading to a halt. But private equity players are still looking for acquisition opportunities that give them more control.

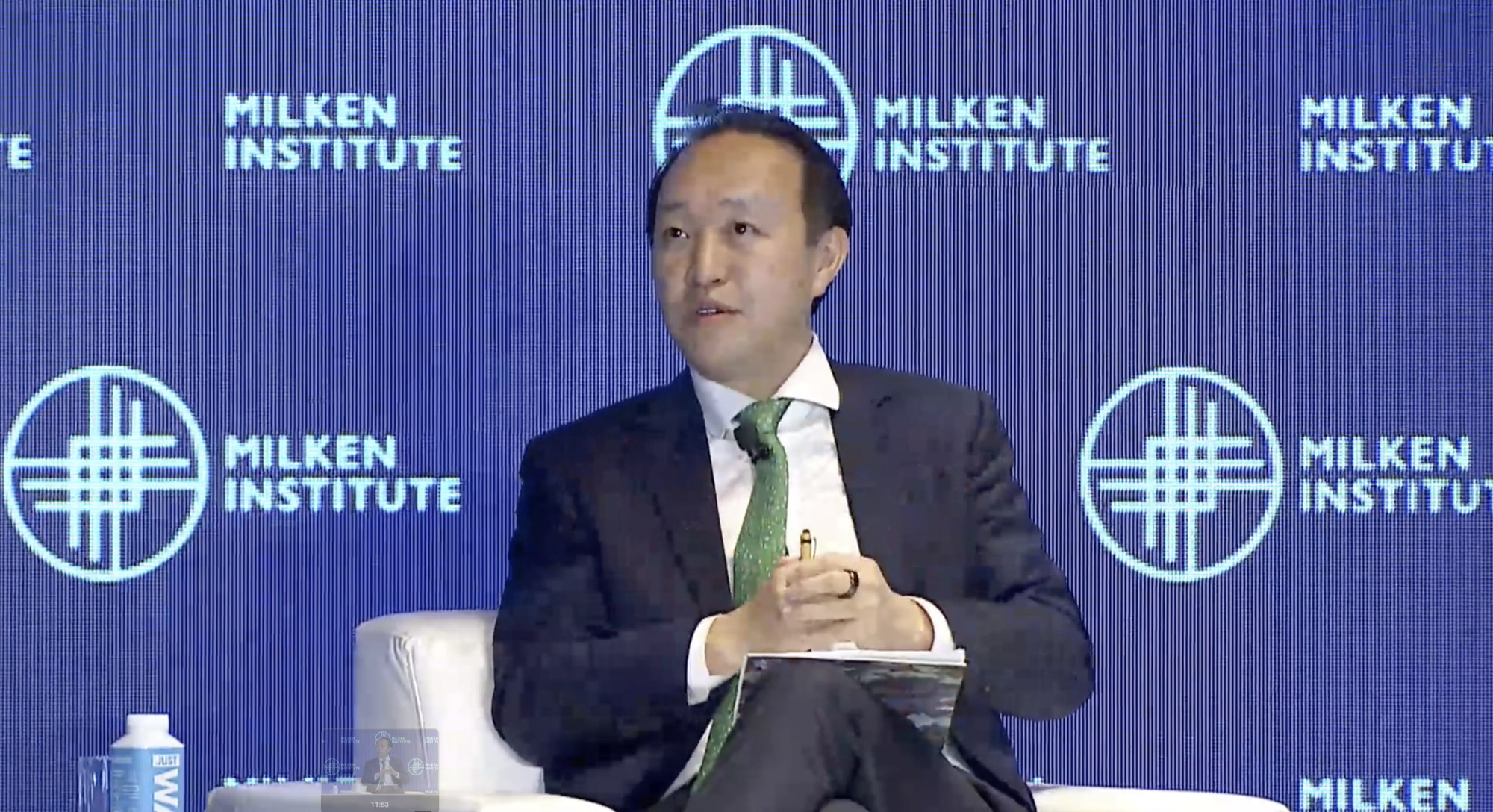

“We continue to believe in global acquisitions,” said Kevin Lu, partner and chairman of Asia at Partners Group. “In the buyout space, you still have active control ownership, which is always at a premium compared to being a passive, small owner of public stock. Management does the right thing. There’s nothing we can do except pray.”

Mr Lu said “inefficiencies” due to deglobalization and geopolitical tensions were allowing sophisticated private equity players to extract profits from assets.

Regarding China, which lost the top spot in Asia’s private equity market to Japan last year, Lu said the Chinese government is on track to resolve overlapping issues.

“I think Beijing has a toolbox,” he said. “The fact that they’re not rushing to provide stimulus or short-term solutions means they want to solve these problems in a more forceful way.”

The Swiss-based firm is selective in China’s private equity market and has invested about US$1.7 billion over the past 10 years, Lu said.

Private equity firms are increasingly leveraging alternative asset classes, such as private credit and infrastructure, apart from their core businesses, and many are betting on Asia for further growth.

“Investors are now looking for alternatives to the public markets,” said Matthew Michelini, partner and head of Asia Pacific at Apollo. “They need something that can generate alpha.”

According to data provider Preqin, the global private credit market will reach US$1.5 trillion, while the Asia-Pacific market has grown 3.5 times in the past decade and is expected to exceed US$100 billion by 2027. ing.

Michelini downplayed the idea that private credit is riskier, noting that the asset class has the potential to cater to investors with different risk appetites.

“We offer a menu of alternatives to help investors adjust their risk. [scale],” He said.

[ad_2]

Source link