[ad_1]

Jim Cramer’s CNBC Investment Club hosts a “Morning Meeting” livestream weekdays at 10:20 a.m. ET. A recap of Friday’s key moments. 1. US stocks soared on Friday, with the S&P 500 index on track to break through its January 3, 2022 all-time high closing price of 4,796.56. The tech-heavy Nasdaq and Dow also rose on Friday after a rough start to the week. The Dow Jones Industrial Average was trading just below its Jan. 2 all-time high of $37,715.04. The Nasdaq has about 6% left to reach its all-time high closing price of 16,057.44 on November 18, 2021. The Nasdaq 100, which is even more weighted toward Big Tech stocks, rose on Friday, a day after closing at a record high of 16,982.29. The stock market is recovering from his early 2024 crash. 2. MetaPlatform stock traded above its 52-week high after CEO Mark Zuckerberg announced the company would spend billions of dollars on Nvidia’s rugged semiconductors for artificial intelligence. This is great for Meta as he looks to further his AI ambitions, and great for his Nvidia as tech companies seek powerful chips. Another club name, Eaton, could also benefit in the long run. Running Nvidia’s chips at scale requires a lot of power, and this is Eaton’s specialty. On Friday, NVIDIA stock hit another all-time high. 3. Broadcom stock hit another all-time high on Friday following a bullish upgrade from analysts. Goldman Sachs restored coverage of the chip designer to a buy rating, citing the potential for double-digit revenue growth from the VMware acquisition. We find this call particularly bullish, as Goldman analysts expect significant earnings growth from VMware-related synergies. 4. Evercore added to his Apple Tactical Outperform list. Analysts said buy-side expectations for the iPhone maker were below consensus, meaning Apple stock could rise if quarterly results go well. Additionally, pre-orders for Apple’s Vision Pro mixed reality headset began on Friday ahead of next month’s earnings announcement. Apple stock rose on Friday, but is still down about 1% in 2024 due to a lot of recent negative comments. (The Jim Cramer Charitable Trust has long been META, NVDA, ETN, AVGO, AAPL. See here for a complete list of stocks.) As a subscriber to Jim Cramer’s his CNBC Investment Club , receive trade alerts before Jim makes a trade. trade. After Jim sends a trade alert, he waits 45 minutes before buying or selling stocks in a charitable trust’s portfolio. If Jim talks about a stock on his CNBC TV, he will wait 72 hours before executing the trade after issuing a trade alert. The above investment club information is subject to our Terms of Use and Privacy Policy, along with our disclaimer. No fiduciary duties or obligations exist or arise from your receipt of information provided in connection with the Investment Club. No specific results or benefits are guaranteed.

[ad_2]

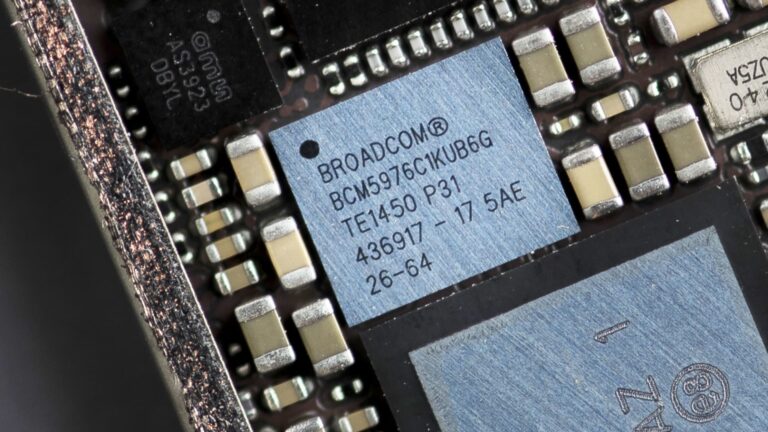

Source link