[ad_1]

(Bloomberg) — As the best hedge fund strategies of 2023 begin to attract mainstream investors, the risk models they rely on are becoming much harder to unravel.

Most Read Articles on Bloomberg

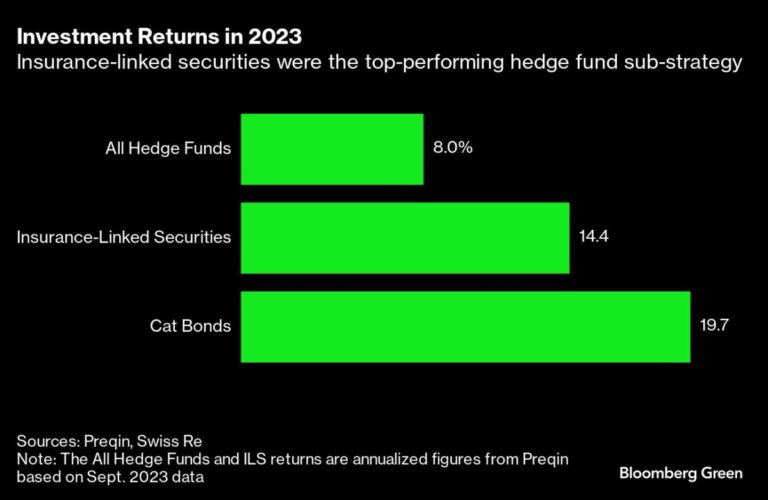

The strategy in question is tied to insurance-related securities, which are dominated by catastrophe bonds (also known as catastrophe bonds). No other asset class produced better performance for hedge funds in 2023, with companies like Fermat Capital Management and Tenax Capital posting record returns.

Cat Bonds have been around for over 25 years and are used by the insurance industry to protect against losses too large to cover. That risk is instead transferred to the investor, who stands to lose if a predefined catastrophe occurs, and potentially make huge profits otherwise.

But calculating catastrophic risk is much more complex than it used to be. This is because real estate is concentrated in areas prone to frequent storms, fires, and floods. When viewed individually, each event is less intense than a major earthquake or hurricane. But overall, such losses can be much larger, which has major implications for the growing number of investors who are now adding exposure to cat bonds.

Cat bonds have traditionally been used to protect insurance companies from losses associated with once-in-a-generation natural disasters. However, according to broker Aon, last year these major dangers accounted for only 14% of the world’s known losses. Meanwhile, the category known as secondary hazards has “substantially exceeded the cumulative costs of the 21st century.”

Fund managers monitoring developments say these secondary hazards, primarily in the form of destructive thunderstorms, are not consistently captured in models designed to measure cat bond risk. He says he hasn’t.

“What we see is that some models don’t really factor in these risks properly,” said Etienne Schwartz, head of investment management at Twelve Capital, which holds $3.7 billion in Cat bonds. . In fact, he says, “The projected losses on paper are far lower than what we actually think.”

Approximately 40% of cat bonds currently cover aggregate losses accumulated over a one-year period, and this is where investors are most likely to feel the fallout from secondary risks. The rest of the market is tied to losses from one-off disasters such as major hurricanes, according to Artemis, which tracks the ILS market.

Aon estimates that the global insurance-related securities market totaled approximately $100 billion at the end of the third quarter. According to Artemis, cat bond issuance alone reached an all-time high of more than $16 billion in 2023, including non-real estate and private transactions, and the total securities market reached $45 billion.

Cat bonds, which returned about 20% last year, are now attracting many investors who would have avoided such high-risk bets.

“Most of our clients who weren’t able to participate in 2023 now want to participate in 2024,” Schwartz said.

Meanwhile, Andre Jim, partner and portfolio manager at Man AHL, a division of Man Group, said investors who have been in the market longer are discerning and are avoiding bonds that are exposed to secondary risks. It is said that he is moving away. is the world’s largest publicly traded hedge fund manager.

“In recent years, the market has moved towards more occurrence-based trading, where the risk profile is tied to a single catastrophic event,” Rzym said. And that’s “precisely because of concerns about secondary risks,” he says.

Elementum Advisors, which has about $2 billion invested in cat bonds, also avoids bonds exposed to moderate-sized natural disasters.

“We don’t believe there is much benefit to portfolios by adding secondary risk,” said John DeCaro, co-founder and senior portfolio manager at Chicago-based Elementum. “There are a lot more variables and an element of randomness.”

Artemis estimates that the current 40% share of total loss bonds has decreased from more than 50% as of mid-2021.

Meanwhile, secondary hazards are becoming increasingly important in climate science. A paper published by the University of Cambridge’s Institute for Sustainability Leadership points out that “increasing secondary disaster losses are the canary in the coal mine when it comes to the devastating economic impacts of climate change.”

Karen Clark, who has been modeling natural disasters for more than 30 years, said her current focus is perfecting models of secondary disasters such as floods, wildfires and severe convective storms.

“Climate change has no effect on the tail, which is a once-in-100-year event, and is increasing the number of once-in-10, once-in-20, and once-in-30-year events. It’s about the same. It’s a loss,” Clark said.

At the same time, more infrastructure and housing is in the path of moderate-sized disasters, increasing the potential for loss, according to Paul Schultz, CEO of Aon Securities, a division of Aon. .

According to Swiss Re, secondary events such as severe convective storms caused insured losses of $133 billion between 2018 and 2022, an increase of 90% compared to the previous five years. Back in 2019, insurers sought to draw attention to this danger in a paper titled “Secondary Risks – Not So Secondary.”

Click here for more Swiss Re climate change analysis.

One of the challenges in modeling such weather events is the lack of historical data. Unlike models for hurricanes in Florida or earthquakes in California, built on a century and a half of data and increasingly sophisticated algorithms, loss estimates for tornadoes and wildfires are less reliable.

Risk assessments also become unstable when secondary hazards such as wildfires are combined with primary hazards such as hurricanes. That’s because the extra uncertainty caused by wildfires may not be reflected in the cat bond’s probability of loss.

According to a recent report by Tenax portfolio manager Marco Della Giacoma, “A cat bond that covers all natural catastrophes with expected losses of less than 1% and issuance spreads in the mid-double digits should ring alarm bells. It should start.” Toby Pugh is also an analyst working for a London-based hedge fund.

The bottom line is that it is unclear what changing patterns of natural disasters will mean for the cat bond market.

“There is a risk that secondary risk loss trends may prevent some new capital from entering the market,” Tenax’s Puguet and Della Giacoma said. He added that it “may cause some existing investors to re-evaluate their approach to cat bonds.”

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link