[ad_1]

Data Snapshot is a regular feature of AgFunderNews that analyzes agri-foodtech market investment data provided by our parent company, AgFunder.

Click here for more AgFunder research and sign up for our newsletter to receive alerts on new research reports.

Venture capital funding allocated directly to agri-food only accounts for about 2% of the total global investment pool, says Roberto Baiton of Valoral Advisors, who has tracked agri-food funding for more than a decade. says.

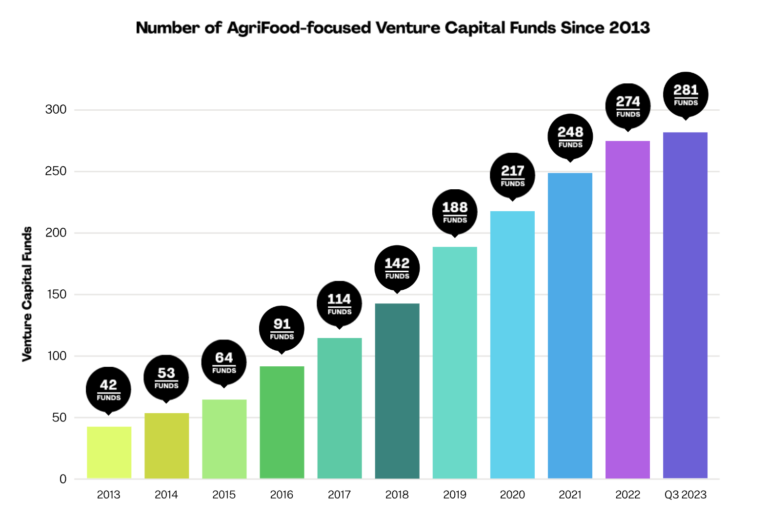

And while the number of agri-food focused VC funds has increased globally from just 42 in 2013 to more than 280 as of Q3 2023, that growth has slowed in recent years. I am.

“Growth was possible because we started from a very low level,” Byton says of the growth of agrifood funds over the past decade.

Putting this growth into context, he says: [agrifoodtech], they will tell you between zero and 2%. Or maybe 3% if forestry is included.

Like others, he also believes that 2024 will be tough again for agricultural products.

“In my opinion, this year will be the toughest year,” he says. “More companies are going to really struggle, and a lot more companies are going to go out of business. But this is going to evolve. Conversations among startup founders about merging or consolidating their businesses. I see that a lot. I think that’s what’s going to happen next.”

More efficient food production requires more capital

The number of agrifood-focused VC funds has increased every year over the past decade, according to data provided in AgFunder’s 10th Anniversary Special Report.

Byton cited four factors that drove this number.

- Supply of limited earth resources and the effects of climate change, etc.

- Demands such as population growth and changes in dietary habits

- geopolitical and economic factors such as war and inflation;

- Technology advancements across industries

“Over the past 10 or 20 years, we have been faced with the challenge of producing more food more efficiently and sustainably, facing many challenges,” says Byton. . agfunder news. “What we need to create is [food production] To become more resilient, we need to build our supply chains and deploy technology to bridge the gaps. All of that requires capital. ”

But, he added, “this growth has been possible because we started from a very low level.” “I think we’re still in the early stages today.”

He believes the reason more capital is flowing into the agricultural sector is the “attractive profit potential”. He said large asset managers, along with specialist managers and banks, are developing new strategies in this area.

2024 will be the ‘toughest’ year

In 2023, agri-food focused venture capital funds totaled $15.1 billion in assets under management (AUM), including farmland, private equity, venture capital, private debt, publicly traded equity, and commodities.

A closer look at Valoral’s 2023 data reveals that while the number of agri-food tech VC funds is up from last year, the growth rate remains at just 2.5%.

Compare this to a 32% increase in the number of funds from 2018 to 2019, or a more modest 15% increase from 2019 to 2020. In fact, since 2019, the number of funds has increased, but at a significantly slower pace.

“The last few years have been really tough for new fund managers,” Byton says. “In the long term, we are confident that we will see even more investment flows in this area.

“But when you start narrowing your focus to specific assets, strategies and geographies, a lot of funds have struggled to raise money over the past few years. If you look at who has done better, [over this timeframe], they were usually more established asset managers because they already had an LP base and a proven track record. ”

The majority of AgriFood’s assets under management come from North America ($6.5 billion) and Europe ($4.4 billion).

“Most of the capital and investors are in the US and Europe, and those two markets are more advanced in terms of innovation and talent,” says Byton. “It’s not surprising that we continue to see new funds and further investments there.”

Right now, Byton says, it’s hard to find companies in these regions that generate more than about $2 million in revenue.

“The obvious evolution is that we will be more active in Latin America, Africa and Asia-Pacific,” he added. “But it will take time.”

[ad_2]

Source link