[ad_1]

apple (NASDAQ:AAPL), one of the world’s largest high-tech equipment makers, has come under intense scrutiny in recent years for failing to launch blockbuster products. The Apple Vision Pro, the company’s first virtual reality headset, is widely seen as a bright spot in what could be the company’s biggest product launch since AirPods.

Apple Vision Pro will be available for purchase in the US starting February 2nd, but the company has not yet announced an international release date. I’m starting to be optimistic about what happens with Apple this year, but I’m still neutral on his AAPL stock.

Looking beyond driving demand trends

Apple Vision Pro is available for pre-order starting January 19th, with prices starting at $3,499 for the 256 GB version. For comparison, we use Oculus Quest 3, the latest AR headset developed and sold by Meta Platforms, Inc.Nasdaq:Meta), prices start at $499 for the 128 GB version. Apple Vision Pro’s high price raised concerns when the product was announced last June, but data from the first weekend that pre-orders opened suggested initial demand was strong. ing.

According to popular Apple analyst Ming-Chi Kuo, Apple sold between 160,000 and 180,000 Vision Pro units during the first pre-order weekend. This suggests that the device was sold out in the first weekend itself as expected. As observed and reported by analysts, the expected shipping time for all Vision Pro devices was extended to 5-7 weeks immediately after pre-orders became available. This is a clear indication that Vision Pro is sold out.

However, there are major differences between the iPhone blockbuster and the Vision Pro. While iPhone shipping times typically increase steadily for at least 48 hours after pre-orders become available, Vision Pro shipping times remained stable for the first 48 hours after the initial burst. That’s a red flag, according to analyst Ming-Chi Kuo.

Apple has a cult-like following that lines up to buy a new device every time it’s released. Blockbuster products not only appeal to this powerful fan base, but they also appeal to the masses. The decline after the initial explosion in demand for the Vision Pro suggests that VR headsets have yet to capture the masses of tech consumers.

There is room for disruption in the AR/VR market

Empirical evidence shows that Apple aggressively gains market share in various consumer technology niches such as smartphones, computers, and smart watches, even though it does not enjoy first-mover advantage in any market. This indicates great success. Apple’s success stems from the company’s proven ability to develop compelling technology products based on a deep understanding of consumer preferences.

The AR/VR headset market is currently in its infancy, with IDC predicting that only 8.1 million AR/VR devices will be shipped in 2023. study of counterpoint, Meta dominated this market in the third quarter of 2023, accounting for 49% of all device shipments. Headset shipments plunged 29% year-over-year in the third quarter due to a lack of compelling headset launches, according to data from Counterpoint.

The relatively small size of the AR/VR headset market leaves plenty of room for disruption, and Apple has a reputation for successfully capitalizing on similar opportunities in other market segments.

Apple’s scale problem

Apple has grown by leaps and bounds since the launch of the original iPhone in 2007. But the company’s sheer size and scope have made it difficult for Apple to meet Wall Street’s growth expectations in recent years. By the way, total revenue for fiscal year 2023 decreased by nearly 3% year-on-year to $383 billion, and net income also decreased by 2.8%.

The problem with Apple’s massive scale is that it takes a hugely successful product to change the direction of the company in terms of financial performance. In 2024, Apple expects to sell 500,000 Vision Pro units and bring in at least $1.75 billion in revenue. While these numbers may seem encouraging on their own, Vision Pro sales seem insignificant when compared to the nearly $400 billion in revenue Apple is expected to bring in this year.

Even if Apple sells twice as many Vision Pro units in 2024 as expected, the segment will still account for less than 1% of the company’s overall sales this year. Following this understanding, it seems fair to conclude that Vision Pro will not have a significant impact on Apple’s fundamentals in the near future.

But the highly anticipated VR headset could improve market sentiment toward Apple and cement the company’s status as a leading technology innovator if sales exceed Wall Street expectations this year. .

Is Apple stock a buy, according to Wall Street analysts?

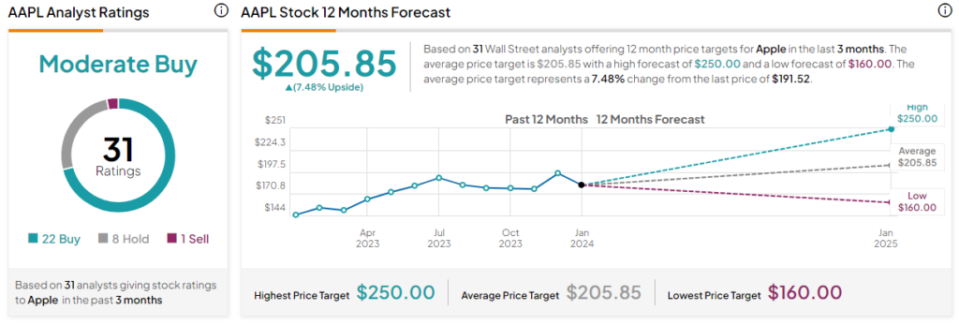

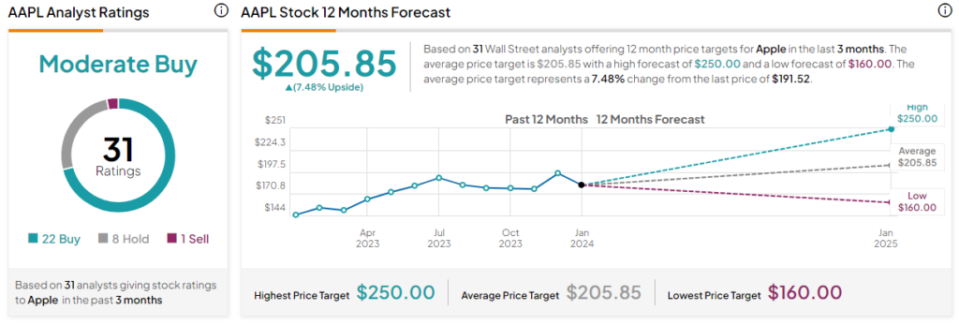

Apple is one of the most supported companies in the market. Unsurprisingly, Wall Street analysts are often divided on Apple’s prospects, but they’re generally bullish at the moment. The stock received a “Moderate Buy” consensus rating, based on his 22 buys, 8 holds, and 1 sells assigned over the past three months. Here’s what some analysts say about Apple:

On January 18, Bank of America Securities upgraded Apple and raised its price target from $208 to $225, citing bullish developments such as the company’s promising AI product roadmap and improved outlook for its services sector. I pulled it up. BofA also claimed that Vision Pro sales could eventually surpass iPad sales in the long term as VR becomes mainstream.

January 23rd, Bank of America (New York Stock Exchange:BAC) has added Apple to its US 1 list of best investment ideas.

Morgan Stanley (New York Stock Exchange:MS) ranked Apple as the top U.S. company among 56 other companies that appear well-positioned to achieve alpha returns this year in its weekly warm-up report published on January 22nd. listed as one of the high-quality growth stocks.

Last week, Piper Sandler highlighted Apple as three companies.rd Choose the most attractive brand from among the 7 Magnificent stocks and compare it to Alphabet Inc. (NASDAQ:GOOG)(NASDAQ:Google) and metaplatform.

Overall, based on ratings from 31 Wall Street analysts, Apple has an average price target of $205.85, which implies an upside of 7.5% from the current market price.

Bottom line: Vision Pro is exciting, but Apple’s review isn’t.

Exciting days ahead for Apple, with the first batch of Vision Pro units set to ship in the coming weeks. The Vision Pro may not have a big impact on Apple’s revenue this year, but if the device attracts positive reviews from tech bulls and enthusiasts, the market could reward Apple handsomely. unknown. However, Apple’s forward P/E of 29x looks expensive compared to its average of 25x over the past five years.

disclosure

[ad_2]

Source link