[ad_1]

Warren Buffett’s company berkshire hathawayare buying stocks in major oil companies. western oil (NYSE:OXY) Pass the fist. Berkshire currently owns about 28% of Occidental’s outstanding stock (and has regulatory approval to acquire up to half of the company). It accounts for 3.8% of the investment portfolio and is Berkshire’s sixth largest holding.

But while it’s clear that Buffett and his team love Occidental, that doesn’t mean it’s the best oil stock for everyone. chevron (NYSE:CVX), EnLink Midstream (NYSE:ENLC)and enterprise product partner (New York Stock Exchange: EPD) For several Fool.com contributors, it stands out as the better option in the energy sector. This is why they are preferred over Occidental.

Chevron is built to survive cycles

ruben greg brewer (Chevron): Shortly before the coronavirus pandemic, Occidental entered into a bidding war with Chevron for Anadarko Petroleum. With the help of Warren Buffett, Oxy won his trade. In the end, Chevron didn’t want to overpay, which could jeopardize its solid financial foundation.

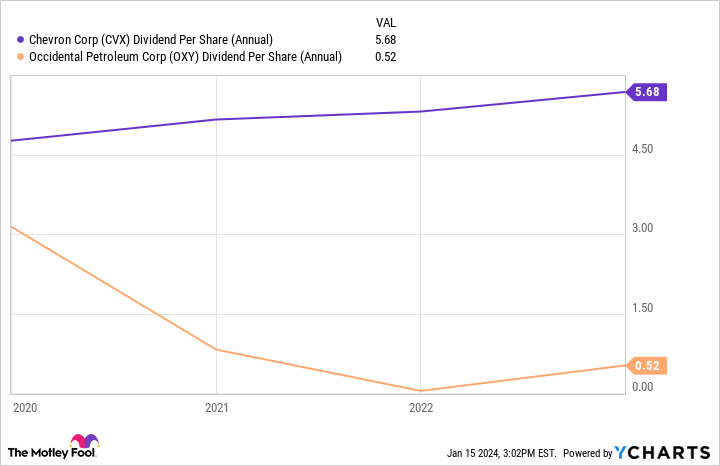

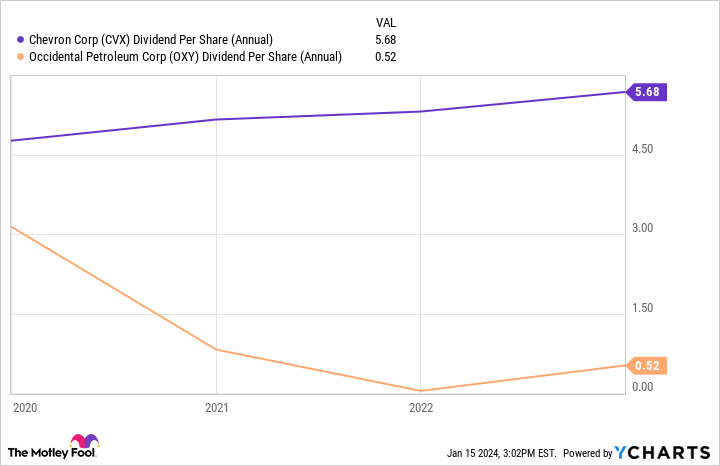

Then the pandemic hit, and low oil prices and a highly leveraged balance sheet forced Occidental to cut its dividend. Chevron continued to increase its dividend, thanks in large part to the balance sheet flexibility the company has strived to protect over the years.

Occidental’s financial situation is currently improving after the rise in oil prices. However, its debt-to-equity ratio of 0.65x is still dramatically higher than Chevron’s 0.12x. The severe oil recession of 2020, when oil prices fell below zero in the U.S. market, clearly demonstrated Chevron’s ability to weather the ups and downs inherent in the highly cyclical energy industry. Investors looking for consistency throughout the cycle have clearly seen Chevron perform better, and that’s not likely to change anytime soon.

But while Occidental acquired Anadarko, that setback didn’t stop it from acquiring Chevron.In fact, we recently signed an acquisition agreement. hess. If you want a company that doesn’t have to sacrifice dividend investors for growth, Chevron and its 4.1% yield may be a better choice, even if it doesn’t get all the deals.

Take a different path to seize this potentially huge opportunity

matt dilalo (EnLink Midstream): Although oil is Occidental’s primary fuel source these days, the company is investing heavily to capture a potentially significant future growth driver: carbon capture and storage (CCS). CEO Vicki Hollub said the company could eventually make as much money from CCS as it does from oil and gas production. The company is investing heavily in building direct air capture (DAC) projects that suck carbon dioxide out of the air and permanently sequester it underground.

Occidental isn’t the only company trying to capture the potentially huge CCS market. EnLink Midstream wants to leverage its existing services to become a leader in carbon transport. pipeline Build a network in the Gulf Coast region to move gas from capture sites to isolation hubs.

The company has signed a first-of-its-kind carbon transportation contract. exxon mobil Exxon originally secured capacity to transport 3.2 million tons of carbon dioxide on its EnLink pipeline starting early next year. Ultimately, production capacity of up to 10 million tons may be required.

EnLink is also in discussions with several other energy companies, including Occidental Petroleum, for carbon capture capabilities. The company estimates it could eventually transport around 90 million tons of carbon dioxide per year.

Carbon transportation could be a very lucrative business for Enlink. The company estimates he could generate an additional $300 million in annual adjusted profits. Earnings before interest, taxes, depreciation and amortization (EBITDA) We will be exiting this business in the next few years. This was a 25% increase from last year’s level. The company plans to primarily reuse its existing pipeline, which will require minimal capital investment over the next five years to capture revenue growth opportunities.

EnLink’s increased cash flow from carbon transportation will provide further fuel to pay the dividend. The midstream company recently increased its payments by 6%, bringing the yield above 4.5%. Dividends could accelerate further in the future as carbon cash flows begin to be captured.

Builds investor wealth slowly and steadily

Neha Chamaria (Enterprise Product Partner): Warren Buffett has always loved boring companies as long as they produce steady cash flow. He also loves dividends. Enterprise Products Partners enjoys both cash flow stability and dividend growth thanks to its midstream energy infrastructure business, which earns fees based on long-term contracts.

There’s a lot to like about Enterprise Products Partners, and many of those elements are on Buffett’s list. Enterprise Products is one of the largest midstream energy companies in the United States with over 50,000 miles of pipeline system. This allowed the company to gain a large moat within the industry. It was also the Permian Basin’s fifth-largest producer by production in the second quarter of 2023, behind Occidental Petroleum. Meanwhile, Enterprise Products also operates the world’s largest ethylene export terminal, giving it an edge over its competitors.

Enterprise Products also has one of the strongest balance sheets in the industry, with abundant liquidity, manageable debt, and one of the highest credit ratings in the midstream energy space. Over the past 10 years, the company has achieved an average return on invested capital (ROIC) of 12%, indicating that management is efficiently investing capital in high-return projects.

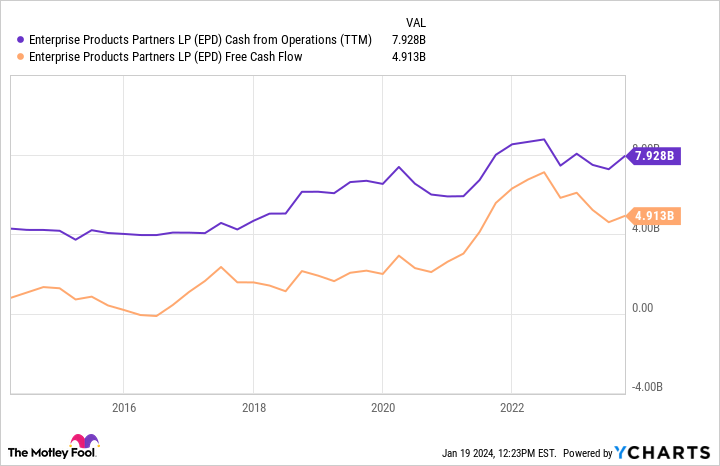

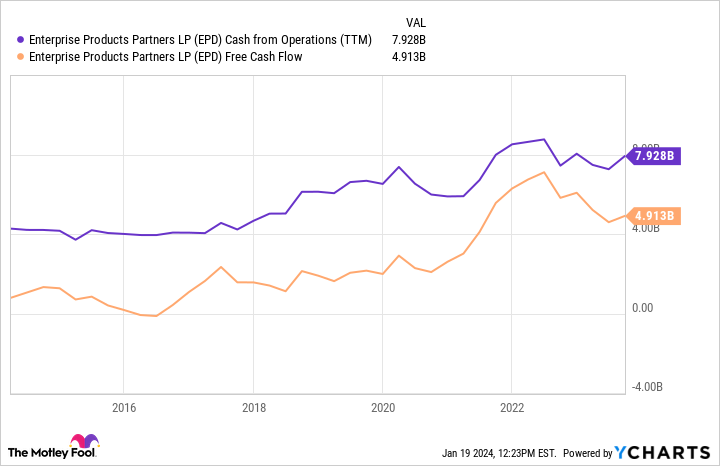

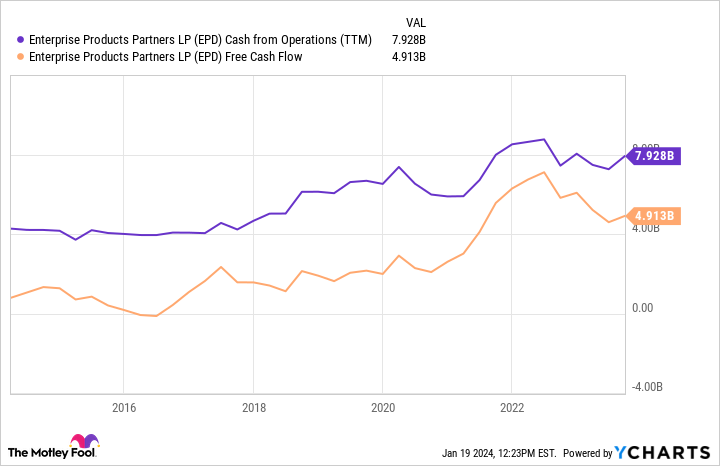

For further evidence of efficient capital allocation, consider that Enterprise Products’ cash flow has steadily increased over the past decade. In 2023, the company increased its dividend for the 25th consecutive year.

All of this has combined to generate strong returns for Enterprise Products shareholders over the years, with dividends playing the biggest role in that return. Therefore, with dividend reinvestment, Enterprise Products stock has given shareholders a return of nearly 42% over the past five years.

Meanwhile, Occidental stock lost about 6% of its value during the period, eroding investors’ money. Enterprise Products remains the top energy stock to own with his 7.5% yield.

Should you invest $1,000 in Chevron right now?

Before buying Chevron stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks Investors can buy now…and Chevron wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of January 16, 2024

Matthew DiLallo holds positions at Berkshire Hathaway, Chevron, and Enterprise Products Partners. Neha Chamaria has no position in any stocks mentioned. Reuben Greg Brewer has no position in any stocks mentioned. The Motley Fool has a position in and recommends Berkshire Hathaway. The Motley Fool recommends Chevron, Enterprise Products Partners, and Occidental Petroleum. The Motley Fool has a disclosure policy.

Warren Buffett owns Occidental, but you should consider these three energy stocks instead.

[ad_2]

Source link