[ad_1]

[author: Chris van Heerden]*

If you made a funding forecast in November, it may be due for an update.of wall street journalwrote on December 29th Private equity: 2024 funding outlook bleak My argument is: Key statistics from Preqin’s Q1-3 global PE funding was $509 billion with 620 closings, down 46% year-on-year, and this article’s discussion of the prospects for a secular downturn. It is the driving force.

The story here is old territory for FFF readers. Capital circulation in private markets as the Fed’s fastest rate hike cycle in history has hit financing and funding hard due to higher acquisition costs, reduced access to cheap financing, poor exit conditions, and weak distributions. slowed down dramatically in the first half of 2023. A harbinger of fundamental change in the industry.

more Current dataHowever, also from Preqin, it shows that PE funding for the full year 2023 ended with 851 funds and $669.2 billion. first This is a fairly large difference from the first quarter through third quarter data and the full year data.

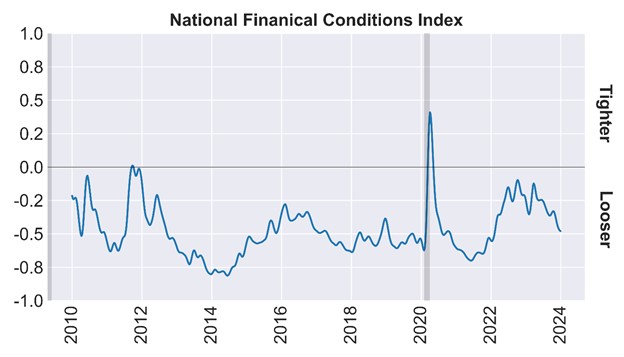

The recent easing in financial conditions probably goes a long way in explaining this gap. The Chicago Fed’s National Financial Conditions Index (NFCI) has returned to the least restrictive level since February 2022 and is on an easing trend. (NFCI compiles 105 financial condition indicators, such as credit spreads, interest rate volatility, and leverage levels, into a composite index). Credit spreads and stock prices tell the same story.

Source: Federal Reserve Bank of Chicago and Cadwalader, Wickersham & Taft LLP.

Financial conditions must be factored into the outlook for M&A volumes, deal closings, and distributions. Global M&A fell by about 20% year-on-year in 2023, based on Refinitiv data, but key variables have changed in recent weeks. Most obviously, the future trajectory of interest rates is now perceived to be less restrictive and less uncertain (the market implied probability of a 50-75bps cut in fund rates by June). (84%). The public stock is expected to record year-over-year EPS growth for the second consecutive quarter in the fourth quarter. And the disconnect between strategic buyer and seller expectations is being partially offset by higher overall valuations. If funding costs continue to fall and valuations remain high, distributions could well accelerate.

If distributions actually accelerate from here, the question arises as to what LPs will do with that cash. The LP survey data may shed some light on this point. His two recent reports suggest continued interest in maintaining or increasing private funding allocations.

- The survey found that 64% of institutional investors are bullish on private equity and 60% are bullish on private credit. 2024 Natixis Institutional Investor Survey Among 500 investors. The majority of investors have indicated plans to increase or maintain their private fund allocations.

- According to our latest research, 82% of LPs plan to invest the same amount or more in PE funds over the next 12 months. PEI Investor Survey This total has been slowly increasing after decreasing slightly in 2023. The number of investors reporting over-allocations to PE fell to the lowest since 2021.

How do all the pieces fit together? Good, beginningAs David Rosenberg likes to say, “Fall in love with your partner, not your predictions.” As the variables that drive funding prospects change, the outlook should change as well.

Number 2the upside risk to the base case due to a return to accommodative monetary policy and financial conditions cannot be ignored, and as long as these conditions continue, capital circulation in the private market should be expected to be activated.

The third, industry change is inevitable even if funding improves further, but it is due to the concentration of funds raised, not the absolute level of funding. Preqin reports that in 2023 he had 851 PE funds closed, down from 1,464 in 2022. Sponsors are expected to continue to evaluate exits, consolidation of non-core strategies, permanent capital vehicles, and increased retail participation.

finally, the downside risk is not small. These are primarily macro and geopolitical. So to take a page from the Fed’s book: The 2024 funding outlook will depend on data.

*Fund Finance Director

[ad_2]

Source link