[ad_1]

Wells Fargo (WFC) stock is up 12% since the beginning of the year, outperforming its big bank rivals and on track to hit record highs.

One big reason is that investors believe the San Francisco financial giant is slowly starting to iron out some of its past problems.

The market received a big boost last month when regulators at the Office of the Comptroller of the Currency lifted a consent order related to the 2016 fake account scandal.

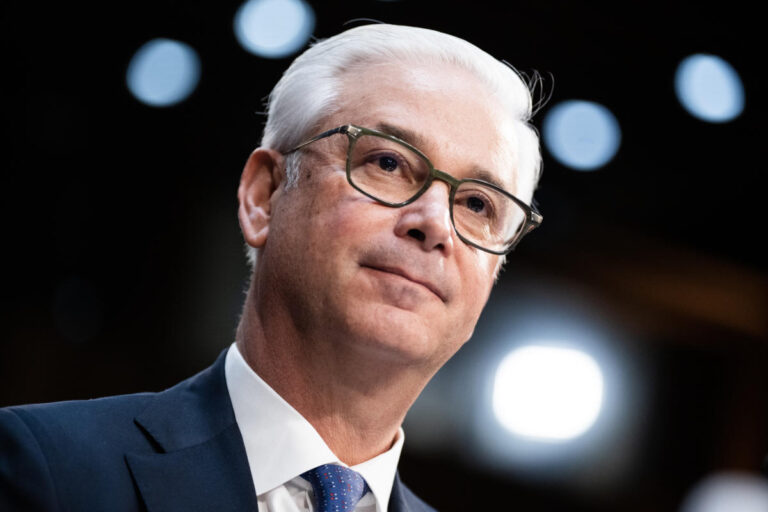

The move was a win for CEO Charles Scharf. When he took over the top job in 2019, he said his “top priority” was cleaning up the mess left by his predecessor.

Mr. Scharf is now pushing Wells Fargo into a major investment banking player and further into an ultra-competitive business that has lagged behind Wall Street giants such as Goldman Sachs (GS) and JPMorgan Chase (JPM). They are about to go on the offensive to take a step forward. , Morgan Stanley (MS).

There was another push in that direction last week when Wells Fargo announced the hiring of M&A veteran Doug Brownstein. Mr. Scharf knows Mr. Scharf and Mr. Brownstein from their time at JPMorgan, when they were vice presidents to Jamie Dimon during the turbulent period following the 2008 financial crisis. .

Brownstein knows what it’s like to be under intense scrutiny from Washington. Mr. Brownstein had to testify before senators in 2013 when he was JPMorgan’s CFO during the “London Whale” deal fiasco. At Wells Fargo, Mr. Brownstein will serve as vice chairman, reporting directly to the CEO.

“Doug is a world-class banker,” Scharf said in a press release, adding that his “expertise and business relationships reflect our continued commitment to strengthening Wells Fargo’s Wall Street division.” “I am doing it,” he pointed out.

Not a “light switch moment”

But the CEO of the nation’s fourth-largest bank is not immune to battles with regulators. Mr. Scharf has satisfied six consent orders established by regulators when he became president, but eight remain, including two added during his term.

The big problem is the cap on Wells Fargo’s size imposed by the Federal Reserve. It cannot exceed $1.95 trillion in total assets at the end of 2017 unless regulators say otherwise. The Fed imposed sweeping restrictions in 2018, citing “pervasive consumer abuse” at Wells Fargo.

Eliminating the cap will allow Wells Fargo to ramp up activity in its capital-intensive markets businesses, Chief Financial Officer Mike Santomassimo said last Monday in Florida. This was stated at the UBS conference.

“I just want to note that when it happens, it’s not going to be this switch moment, but we believe there’s some opportunity there,” Santomassimo said. For now, “our focus is really on resolving the risks and regulatory initiatives first. … We can’t abandon that.”

Analysts who follow the bank said they expect Wells Fargo to be moving in the right direction and that the Fed will eventually remove the bank from the penalty box.

“They’ve achieved tremendous results under these very unique constraints,” said Scott Schieffers, a Piper Sandler analyst who has covered the bank for about 20 years. “There is no doubt that the company will need more freedom over a period of time to reach its full potential,” he added.

Ken Usdin, an analyst at Jefferies Bank, said it remains “difficult to predict” when the Fed will lift Wells Fargo’s balance sheet restrictions.

Even after the asset cap is lifted, a second independent review will be required to assess banks’ improvements.

cross sell

The irony of Wells Fargo’s regulatory woes is that there was a time not too long ago when it was less constrained than its peers.

The company was able to avoid many of the problems that held other large banks back during the 2008 financial crisis, and in the same year it acquired Wachovia, a Charlotte-based lender weakened by the National Mortgage bankruptcy, and became a national lender. It became a giant.

The bank came out of the crisis with a reputation for being conservative, taking few risks and relying on a run-of-the-mill, old-fashioned strategy of increasing revenue by cross-selling products to existing customers.

But as employees raced to meet sales targets, that strength turned into a weakness when it was revealed late last year that the bank had opened millions of bank and credit card accounts without customers’ knowledge. It has changed.

Chief executive John Stamp, who had been with the bank for 30 years, resigned and was subsequently barred from the banking industry by regulators.

His successor, Tim Sloan, left the company in 2019. He is currently suing the bank for $34 million, alleging that the bank rescinded stock grants and used Sloan as a “scapegoat” in a sales practices scandal.

The bank stood by its decision, saying “remuneration decisions are based on performance.”

The search for a successor led to Mr. Schaaf. Mr. Scharf served as head of consumer banking at JPMorgan under Mr. Dimon, then became CEO of credit card giant Visa (V) and custodian bank Bank of New York Mellon (BK).

“We’re in a different company today.”

His own review is not without surprises, including the Consumer Financial Protection Bureau’s December 2022 spending plan to resolve allegations that the Consumer Financial Protection Bureau illegally overcharged customers on auto and mortgage loans. This includes a $3.7 billion agreement with the Financial Protection Bureau. The act in question took place in 2022.

Mr. Scharf also drastically reduced the bank’s workforce. Wells has cut about 18% of its workforce, or 50,000 employees, since its workforce peaked at 276,000 during the pandemic in 2020. The bank’s CFO said last week that Wells Fargo may also make further real estate cuts as a cost-cutting measure.

Last week also served as another reminder that the sales practices scandal is not yet completely behind banks.

The company has been sued in San Francisco federal court by customers who say lenders aren’t doing enough to help people affected by unwanted products.

The bank sent a letter asking customers to contact Wells Fargo if they had enrolled in such products, but the lawsuit claims the letter places a burden on customers to take action.

Wells Fargo is working to “avoid, reduce or delay ultimate liability and cover up years of intentional misconduct,” lawyers representing the bank’s clients said.

The bank said it was still considering legal claims. “Wells Fargo is now a separate company with new people, structures, processes, controls and culture, and is committed to correcting past customer practices,” a bank spokesperson said in a statement. “We are focusing on that,” he added.

David Hollerith is a senior reporter at Yahoo Finance, covering banking, cryptocurrencies, and other financial areas.

For the latest stock market news and in-depth analysis of price-moving events, click here.

Read the latest financial and business news from Yahoo Finance

[ad_2]

Source link