[ad_1]

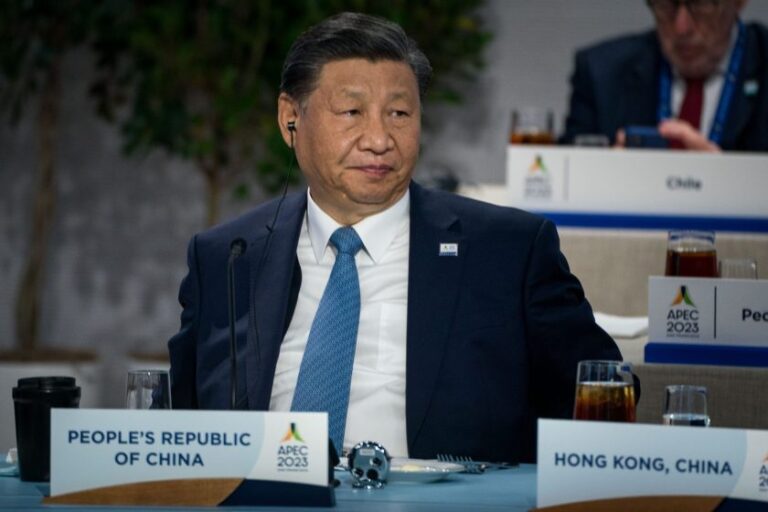

Foreign direct investment in China is decreasing. Kent Nishimura/Getty Images

Foreign companies’ direct investment in China rose last year to the lowest amount since the early 1990s, highlighting challenges for the country as Beijing seeks more foreign funding to support its economy. Ta.

China’s direct investment debt in the balance of payments last year was $33 billion, according to data released by the State Administration of Foreign Exchange on Sunday. A measure of new foreign investment into the country, which tracks the flow of funds related to foreign-owned companies in China, was 82% below 2022 levels, the lowest since 1993.

The data shows the impact of coronavirus lockdowns and the slow recovery last year. For the first time since 1998, investment fell in the third quarter of 2023, but recovered slightly in the final quarter to record growth.

Economists say the SAFE data, which measures net flows, may reflect trends in foreign companies’ profits and changes in the size of their operations in China. According to data from the National Bureau of Statistics, profits of foreign-funded enterprises in China fell by 6.7% year-on-year last year.

Previous figures released by the Commerce Department showed that new foreign direct investment into China fell to a three-year low last year. Economists say Treasury’s figures do not include reinvested profits from existing foreign companies and are less volatile than SAFE’s figures.

The government’s efforts to encourage foreign companies to return after the coronavirus pandemic is under control are insufficient, and further efforts will be needed if the Chinese government is to succeed in its objective. The continued weakness highlights how foreign companies are pulling money out of the country due to geopolitical tensions and rising interest rates in other countries.

Multinational companies have more incentive to hold cash overseas than in China, as developed countries raise interest rates even as the Chinese government lowers them to stimulate the economy. A recent survey of Japanese companies in China showed that most of them reduced or kept their investments flat last year, and the majority do not have a positive outlook for 2024. It was done.

Japanese companies added the least net new capital last year in at least a decade, with just 2.2% of Japan’s new overseas investment going to the mainland. This is less than its investment in Vietnam or India, and only about a quarter of its investment in Australia, according to Japanese government data released earlier this month.

Taiwanese companies have also become more reluctant to expand in China, with new investment last year the lowest since 2001, government figures showed last month. Taiwanese companies have traditionally been among the biggest investors in China, but since their peak in 2010 they have cut back on new capital investment in the world’s second-largest economy.

South Korean companies also cut investment in neighboring China last year, with new FDI falling by 91% in the first nine months of 2023 compared to the same period in 2022, the lowest level since 2002.

However, there are some bright spots. Direct investment by German companies in China reached a record of around 12 billion euros ($13 billion) last year, according to a report by the German Institute for Economic Research based on data from the German Bundesbank.

This shows that the European Union is keen to expand in the world’s second-largest economy, even as it has increased scrutiny of these investments due to security concerns. According to the report, the share of Germany’s total foreign direct investment in China expanded to 10.3% last year, the highest since 2014.

[ad_2]

Source link