[ad_1]

Share of Plug Power (Nasdaq: Plug) and Powell Industries (NASDAQ:POWL) closed up 19.3% and 45.3% on Wednesday, January 31st. Additionally, both of these stocks rose after hours. The surge in PLUG stock followed the rating upgrade. At the same time, POWL stock rose due to strong first quarter results, expanding margins, and increasing dividends.

Plug Power is developing hydrogen fuel cell systems. Powell Industries, on the other hand, offers custom-engineered solutions designed for the management, control, and distribution of electrical energy.

Analysts expect Plug stock to double

Roth MKM analyst Craig Irwin upgraded Plug Power stock to Buy from Hold on January 31st. He expects Plug Power stock to double in value from current levels. As a result, Irwin raised his price target to $9 from $4.50.

Analysts cited a recent tour of PLUG’s Georgia green hydrogen plant as positive, citing a smooth start-up of the facility and successful resolution of key technical issues, as well as visibility into backlog and margins. I see this as pushing away concerns about the issue.

Plug Power announced last month that it had begun producing liquid green hydrogen at its Georgia plant, its largest production facility in the U.S. market.

Is Plug Power a buy or sell?

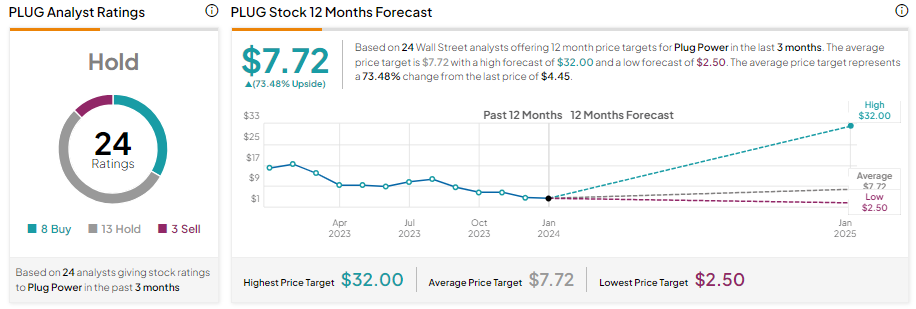

Plug stock has a Hold consensus rating, reflecting 8 Buy recommendations, 13 Hold recommendations, and 3 Sell recommendations. While the start of production at the Georgia facility is a positive development, continued cash burn and capital needs remain a drag.

Plug inventory has decreased by about 75% in one year. Considering the significant decline, analysts’ average price target of $7.72 implies a potential upside of 73.5% from current levels.

Powell witnesses stellar demand in the first quarter

Powell Industries is seeing strong demand across its core industrial end markets, which boosted the company’s sales and profits in the first quarter. Sales increased 53% year over year. Additionally, the company reported earnings per share of $1.98 (compared to $0.10 in the same period last year).

It’s worth noting that the company’s order backlog doubled to $1.3 billion in the first quarter. Additionally, new orders and healthy market activity are likely to support top and bottom line growth in the coming quarters.

POWL has increased its quarterly dividend for the second consecutive year due to its strong financial position. The annual dividend is currently between $1.05 and $1.06 per share.

What is the stock price forecast for Powell Industries?

Powell Industries stock has risen more than 170% in one year. Additionally, POWL stock has an Outperform Smart Score of 9.

disclosure

[ad_2]

Source link