[ad_1]

The past year has been outstanding Palantir Technologies (NYSE:PLTR) investors. Shares of the company, which provides a software platform focused on data analysis to governments and businesses, soared a whopping 163%. Even better, this frenzied rally shows no signs of slowing down. Palantir stock soared 31% after the company announced its 2023 fourth-quarter financial results on February 5th.

Let’s take a look at why investors are excited and examine the catalysts that could push this high-flying tech stock even higher in the year ahead.

Palantir expects further gains in 2024

Palantir’s fourth-quarter revenue increased 20% year-over-year to $608 million, and non-GAAP earnings more than doubled to $0.08 per share. Analysts had expected Palantir to report earnings per share of $0.08 and revenue of $603 million. It’s also worth noting that the company ended the year with a generally accepted accounting principles (GAAP) profit of $210 million, making 2023 the first profitable year for Palantir since its founding in 2003. Ta.

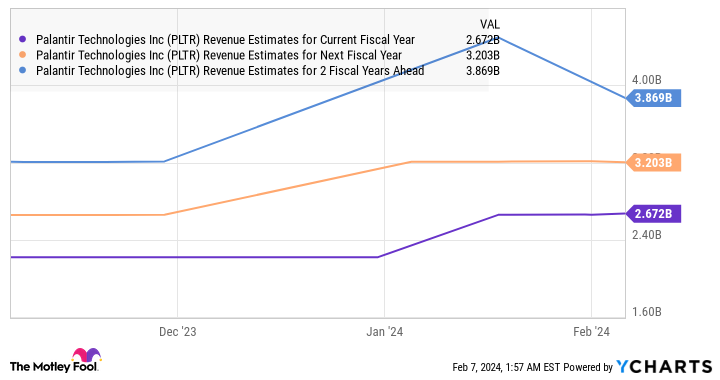

Full-year GAAP earnings exceeded analysts’ expectations of $194.5 million. Additionally, his 2024 projections from Palantir exceed consensus forecasts. The company expects full-year sales to increase 19% from a year ago to $2.66 billion. This would exceed the company’s 2023 sales growth rate of 17% to $2.23 billion. Analysts had expected revenue of $2.64 billion.

Additionally, Palantir expects adjusted operating income to be $842 million at the midpoint this year, well above the consensus estimate of $760 million. Operating profit guidance represents a significant 33% increase from 2023 levels of $633 million, indicating that Palantir has the potential to deliver strong profit growth again this year.

However, don’t be surprised if Palantir’s revenue and profits grow faster than expected in 2024, thanks to solid demand for the company’s artificial intelligence (AI) solutions.

AI can help companies achieve strong growth

Palantir has seen a significant acceleration in deal momentum recently. The company closed 103 deals valued at $1 million or more in the fourth quarter of 2023, nearly double the number from the same period last year. Of these, 21 deals were worth more than $10 million and 37 deals were worth at least $5 million.

The AI bootcamp that Palantir held last year seems to be leading to more customers. These bootcamps were organized to enable organizations to apply Palantir’s Artificial Intelligence Platform (AIP) to their operations. In its most recent earnings call, management said the company has “completed more than 560 bootcamps in 465 organizations to date,” and has “deployed AIP to conduct hundreds of real-world, tangible projects in production environments for customers.” “We are implementing use cases.”

These bootcamps are driving tangible growth for Palantir, noted Ryan Taylor, the company’s chief revenue officer and chief legal officer.

We’re already seeing evidence that bootcamps can help significantly shorten sales cycles and accelerate the rate of new customer acquisition…and the number of commercial deals in the US has more than doubled [total contract value] TCV of $1 million or more from 2022 to the fourth quarter of 2023.

Additionally, Palantir has seen a surge in customer spending. His TCV for U.S. commercial customers increased 107% year-over-year in the fourth quarter and increased 42% on a quarter-over-quarter basis. All of this explains why Palantir’s commercial revenue rose 32% year-over-year to his $284 million last quarter, outpacing overall revenue growth.

Unsurprisingly, Palantir is focused on “accelerating the velocity of its bootcamps with current and future customers,” which will ultimately help the company maintain impressive commercial revenue growth over the next year and beyond. may be useful. This explains why analysts have significantly raised their revenue growth estimates from Palantir.

How much upside can investors expect over the next year?

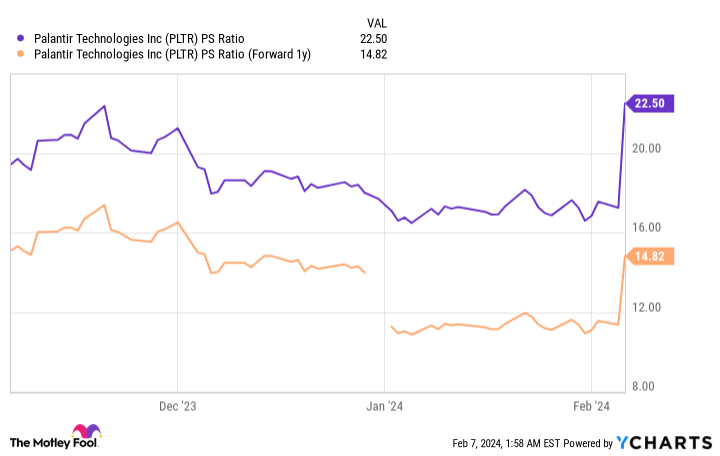

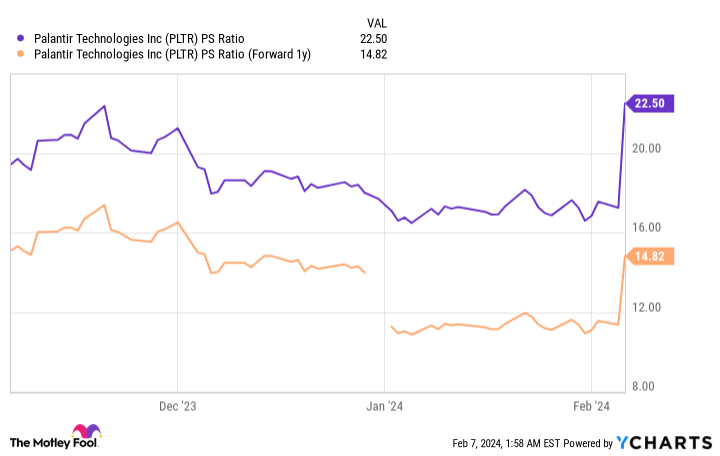

Palantir stock is trading at a multiple of 22.5 times. Investors may be wondering whether Palantir is worth buying at this valuation, especially given the significant post-earnings share price increase. However, the company can justify the sales multiple as it has seen impressive trading momentum and could ultimately outperform expectations. Also, as the following chart shows, Palantir’s future sales multiples are at a much lower level thanks to its expected growth.

Additionally, the large difference between Palantir’s year-end profit margin and future profit margin indicates that the company’s profits will steadily increase.

As such, investors should ignore Palantir’s valuation. Especially considering that the market could reward premium valuations thanks to strong growth-accelerating AI opportunities. After all, the introduction of Palantir’s AIP led to a healthy 56% year-over-year increase in billings to his $605 million last quarter. Remaining performance obligations, which refer to the total amount of contracts to be fulfilled in the future, increased 28% from the same period last year to $1.24 billion.

All of this indicates that Palantir could end 2024 with more revenue than currently expected. Assuming Palantir achieves his 25% revenue growth in 2024, its sales could reach nearly $2.8 billion. If improved growth drives the market to a 25x price-to-sales ratio a year from now, Palantir’s market cap could reach $70 billion in a year.

That’s a 47% upside from current levels, so investors looking to buy AI stock now should consider buying Palantir before the stock price skyrockets.

Should you invest $1,000 in Palantir Technologies right now?

Before buying Palantir Technologies stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Palantir Technologies wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of February 5, 2024

Harsh Chauhan has no position in any stocks mentioned. The Motley Fool owns a position in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.

What will Palantir Technologies’ stock price be in a year? Originally published by The Motley Fool

[ad_2]

Source link