[ad_1]

Chinese stocks (and many of their investors) have taken a huge hit in recent years, with many investors avoiding them. Even as most Chinese stocks endure seemingly endless pressure, more than a few Wall Street analysts continue to view a select few of them as interesting investments.

There is definitely a high degree of geopolitical risk involved in investing in Chinese stocks. And the lingering question is how far a broad basket of Chinese tech stocks could fall as China’s economy continues to battle headwinds.

Chinese stocks (especially tech stocks) aren’t for everyone, but if you’re looking for deep value, it’s hard not to be intrigued. There’s also talk of a Chinese stimulus package, and perhaps some hope that the economy (and hurting Chinese tech stocks) will get a much-needed boost.

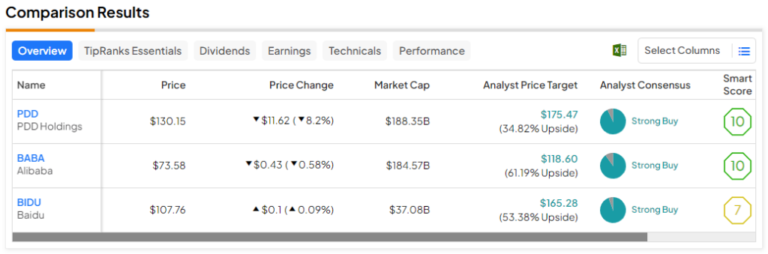

So use TipRanks’ comparison tool to check out three U.S.-listed Chinese tech stocks that Wall Street thinks could benefit in 2024.

PDD Holdings (NASDAQ:PDD)

First, there’s PDD Holdings (best known as Pinduoduo), one of the hottest Chinese stocks of the past two years. The stock has soared more than 275% since bouncing back from its lows in May 2022. While new highs are within reach after a sharp rally over the past year, new potential hurdles have emerged that could trigger a pullback.

Shares plummeted more than 8% on Monday as news of Evergrande’s liquidation sent shivers down investors’ spines. But despite the shocking headlines, I remain bullish on PDD stock. While China continues to shed more light on potential economic stimulus, shopping apps continue to grow in popularity, which could have a “significant impact”, according to former central bank officials. It’s for a reason.

Either way, it’s hard to ignore the hype behind PDD’s Temu app, and the app is quite widespread in the US. Indeed, consumer appetite for incredibly low-priced discretionary goods is likely to remain strong as inflation and macro headwinds continue to undermine our ability to spend. About useful goods. Even as consumers’ balance sheets continue to grow, it’s hard to resist the lure of cheap goods and “shopping like a millionaire,” even if your budget is a little tighter.

All things considered, PDD looks more interesting after its recent selloff, with a mix of bearish headlines (Evergrande) and bullish headlines (China Stimulus).

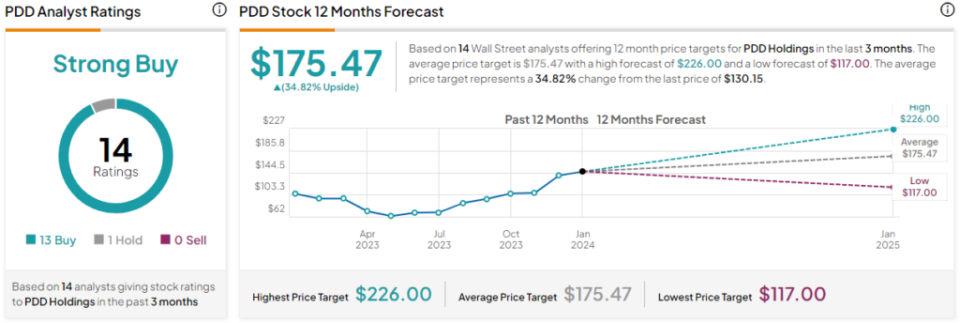

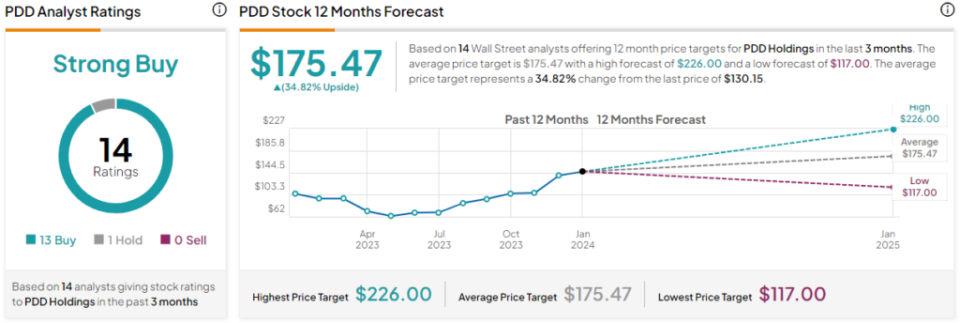

What is the target price for PDD stock?

PDD stock is a “strong buy” according to analysts, with 13 buy and 1 hold assignments over the past three months. PDD’s average price target of $175.47 suggests upside potential of 34.8%.

Alibaba (NASDAQ:BABA)

While PDD stock is on the rise thanks to Tim, Alibaba continues to sink further into the abyss. As of this writing, the stock has returned to $73, with per-share volatility approaching the lows it hit in late 2022 (about $58). So far, there has been little room for patience for those hunting for the bottom in BABA stock. . But that could change quickly, as the company looks to capitalize on any stimulus while harnessing the power of generative artificial intelligence (AI).

I tend to be bullish as the stock approaches long-term support levels (mid-$60s), but I acknowledge that it takes a stomach of steel to deal with serious turbulence in the stock. But being among the bulls has become a little easier now that former Alibaba CEO Jack Ma recently netted $50 million in Hong Kong-traded stocks.

In many ways, Alibaba seems to smell like deep value, but only time will tell if Mr. Market ultimately rewards it with sustained stock price growth. For now, BABA’s stimulus-driven rally appears to have ended, with Evergrande concerns dominating the headlines. Over the next year, keep an eye out for AI announcements that could help Alibaba finally emerge from its epic selloff.

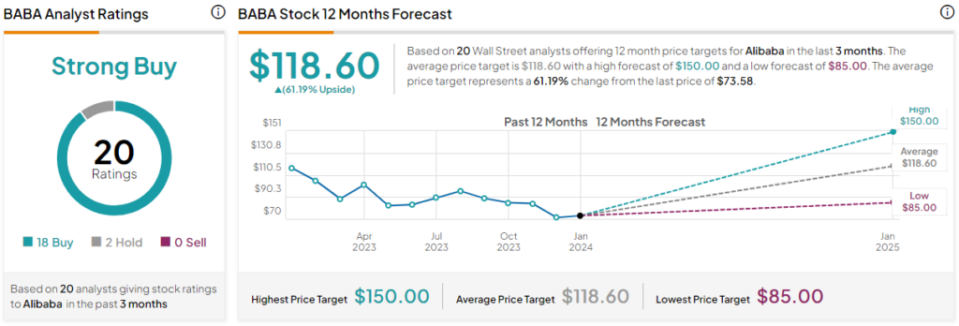

What is the target price for BABA stock?

Analysts say Alibaba stock is a “strong buy,” with 18 buys and two hold assignments over the past three months. BABA’s average price target of $118.60 implies an upside potential of 61.2%.

Baidu (NASDAQ:BIDU)

Speaking of AI, Baidu has been making waves lately with its Ernie chatbot. According to reports, this technology will be included in the latest Samsung Galaxy S24 smartphone. Given Galaxy’s enduring popularity, I would argue that a partnership with Baidu could pay off tremendously and help the stock break out of its multi-year slump. Despite the recent Evergrande liquidation news, I’m pretty bullish on the stock based on the Ernie AI news alone.

Heading into 2024, sophisticated large language models (LLMs) could change the way we look at smartphones. Indeed, smartphones and AI seem like a match made in heaven. Additionally, as Baidu looks to innovate on the AI front while staying within the guidance provided by regulators, I think the company has the potential to become one of the cheapest AI stocks on the market. I am.

Of course, if the stimulus fails to shake up China’s struggling economy, the “value” in stocks may be illusory. Additionally, geopolitical risks should always be considered before buying seemingly cheap Chinese stocks with both hands.

What is the target price for BIDU stock?

According to analysts, Baidu stock is a strong buy with 17 buy and 1 hold assignments over the past three months. BIDU’s average price target of $165.28 implies an upside potential of 53.4%.

conclusion

It’s hard to be bullish on China’s technology efforts as the country continues to experience turmoil and negative economic news over the next few quarters. Nevertheless, although it’s still too early, the following stocks could be deep value plays in the larger scheme of things. Of his three stocks rated “Strong Buy,” the analyst sees BABA (61.2%) as the one with the most potential to rise over the next 12 months.

disclosure

[ad_2]

Source link