[ad_1]

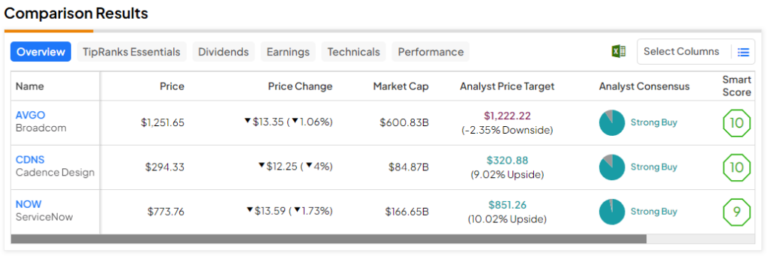

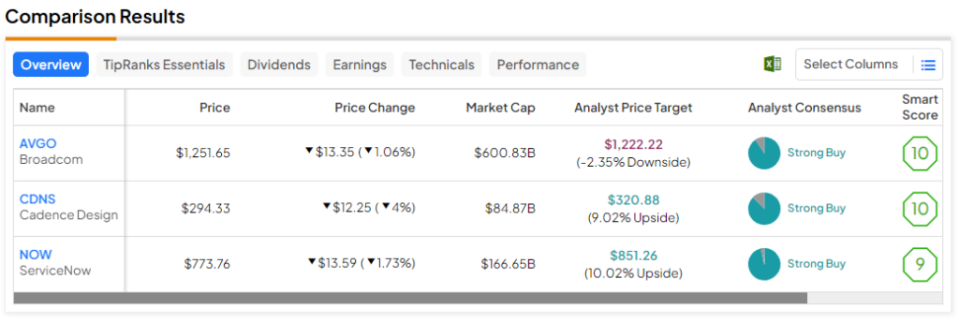

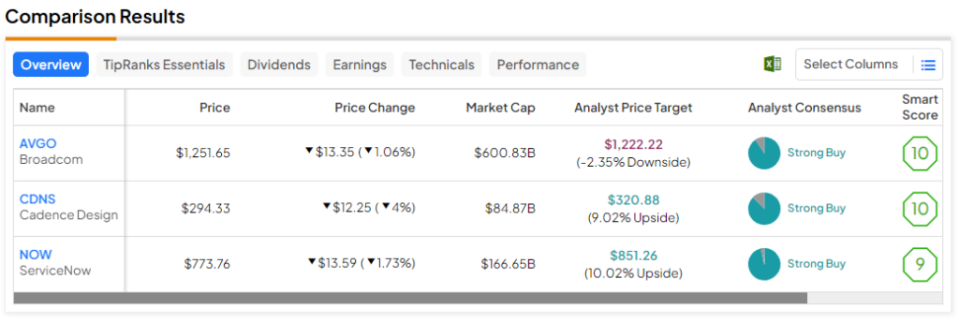

The technology sector has remained hot so far this year. While the valuation may be a bit jarring for those who haven’t bought a ticket yet, it’s reassuring that the Wall Street crowd still views many of the high flyers (AVGO, CDNS, NOW, etc.) as strong buys. Must.

Therefore, in this article, we use TipRanks’ comparison tool to check out three outstanding performers in the technology scene that could help you achieve further gains using generative artificial intelligence (AI) catalysts.

Broadcom (NASDAQ:AVGO)

Most of the semiconductor industry’s attention may be focused on the top two AI chip companies, but Broadcom, a diversified chip business, has quietly been on the rise. The $592 billion semiconductor giant may not be the rich dividend-paying company it once was, but it still stands out as one of the semiconductor industry’s high-growth companies, at least according to many on Wall Street. There is.

What’s more, I see AVGO stock at a more favorable valuation compared to many competing chips at 27.4x forward price/earnings. So while I remain bullish on the stock, I acknowledge that there could be some disruption in the short term.

It’s hard to believe that this stock once boasted a dividend yield of over 3-4%. After more than doubling (up 112% in the past year), the yield has compressed to 1.64%. In retrospect, it’s clear that Broadcom stock should not have fallen below $500 per share in the second half of 2022. Chalk it up as Mr. Market’s failure.

Despite the wild rise (or should I say crash) in stock prices, JP Morgan (New York Stock Exchange:JPM) Analysts have been bullish on Broadcom stock this year, even calling it the biggest AI chip market after Nvidia (NASDAQ:NVDA). This is also thanks to Broadcom’s “leadership position in AI-related products,” including high-end AI ASICs (application-specific integrated circuits), which are low-power alternatives to GPUs for AI acceleration.

In fact, when it comes to AI hardware, it’s not just GPUs. Perhaps ASICs could experience a boom of their own as more companies look to customize their hardware for specific AI applications. Of course, ASICs can be more expensive to build from scratch, but depending on the AI application, I see his ASICs deserving of a larger slice of the AI chip pie in the future. When it comes to AI chips, it’s not all about the GPU. And with Broadcom looking to go after AI accelerators, customization is the perfect vehicle to ride the trend of his chips.

What is the target price for AVGO stock?

Broadcom stock is a strong buy according to analysts, with 19 buy and 2 hold assignments over the past three months. AVGO’s average price target of $1,222.22 means it has 2.35% downside potential.

Cadence Design Systems (NASDAQ:CDNS)

Cadence Design Systems is another company in the semiconductor industry that has been getting a lot of attention lately, but not as much as Nvidia. Cadence considers the chip design side, a corner of the market that can make itself more efficient by incorporating new AI models.

Without a doubt, chip design is a highly complex field with high barriers to entry. Creating his standards-compliant AI chip requires a hardware engineer who knows his craft. Throwing AI into the equation could potentially lower the barrier significantly.

Indeed, if Cadence can get its AI chip design right (and early signs suggest it does, given the power of its Tensilica platform), its stock price could rise as it looks to expand its outer moat. I don’t know how high it will rise. Considering all long-term growth factors, I remain bullish on Cadence as I think it’s one of the most exciting areas of AI right now.

The only knock on CDNS stock is its valuation, with a price-to-earnings ratio of 76.9 times, well above the semiconductor industry average of 45.3 times, but lower than the application software industry average of 86.1 times. Assuming Cadence can outperform its rivals in chip design, I would argue that the multiple may not be as high as it seems, since the application software controls the skin in the chip game.

Nevertheless, after reporting earnings earlier this week, CDNS stock took a 4% hit as the company issued an unimpressive first-quarter outlook. In fact, the stock looked perfectly priced heading into the quarter. As stocks fall off their highs in the coming quarters, perhaps market buyers will finally have a chance to tap into a stock with very strong long-term growth drivers.

What is the target price for CDNS stock?

Cadence stock is a “strong buy” according to analysts, with three “buy” assignments in the past three months. CDNS’s average price target of $320.88 suggests 9% upside potential.

ServiceNow (NASDAQ:NOW)

ServiceNow is a SaaS (software as a service) workflow management company that bottomed out in late 2022 and has been competing ever since. The company isn’t falling apart just because its robust products are doing well again. Investors are excited about the company’s ability to capitalize on AI opportunities.

Generative AI presents a $3 trillion opportunity for software companies, according to ServiceNow’s chief operating officer. And ServiceNow wants a piece of the pie, as it looks to funnel money into AI innovations that help consumers save money and improve productivity. Considering this, I can’t remain bullish on the stock despite its extremely high P/E ratio of 91.8x.

ServiceNow CEO Bill McDermott is also optimistic about generative AI and his company’s growth prospects. Following the company’s latest quarterly profit beat, McDermott described AI as a “landmark moment.” I think he’s right. The AI boom already seems to have arrived at ServiceNow, and it’s unclear how big an impact it will have in the coming quarters.

Stocks are expensive, but there’s a reason why they’re expensive. Perhaps ServiceNow will experience an Nvidia-like collapse, so he could be one of the most prominent software winners of the AI boom.

What is the target price for NOW stock?

According to analysts, ServiceNow stock is a strong buy with 28 buy and 1 hold assignments over the past three months. NOW’s average price target of $851.26 suggests 10% upside potential.

Take-out

Technology tailwinds appear to be alive and well into February. Valuations may be high, but generative AI appears to be able to drive enough profit growth for companies to “catch up” to higher multiples than they currently do. Of the three stocks, analysts believe NOW’s stock has the best chance of appreciating (10%) next year. As McDermott and his team continue to work their magic, it seems certain that ServiceNow is the best choice right now.

disclosure

[ad_2]

Source link